Don't Expect the Fed to Protect Your Portfolio

Near-zero interest rates, high market valuations and monetary policy could make for an explosive brew. I'm counseling my clients to be prepared.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you have read my previous articles, you know that I'm worried about what lies ahead for the markets. In my opinion, the Federal Reserve is following a failed strategy that results in a boom-bust cycle. The tech bubble collapsed under former Fed chairman Alan Greenspan; the housing bubble collapsed under Ben Bernanke; and the Bernanke/Janet Yellen bond bubble is teetering.

Worse is the mountain of debt the Fed helps create to stimulate the economy after each bust. This mountain of debt has had diminishing economic returns, meaning it takes more debt to create less economic activity. A combination of record-low yields, extreme market overvaluation and a Fed whose policies are ineffective should worry wise investors.

It's hard to say how President-elect Trump might play into the story. Since he is so unpredictable, we really have no idea what he will do. However, his past statements might indicate that he is in favor of low rates. So, if the Fed were to start raising rates, and the economy began to slip even a little, I would expect Trump to bring a ton of pressure on the Fed to keep stimulating the economy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So be prepared. There are a number of strategies that can be deployed to take advantage of these Fed bubbles. Here are a few ways to protect your portfolio:

- Shorten bond durations and increase quality.

- Raise cash.

- Avoid interest rate sensitive issues like preferred stocks, banks and bonds.

- Review your equity portfolio and reduce your risks.

- Lower the average price-earnings ratio on your holdings. That stock in your portfolio with a 32 P/E and earnings growth of only 5% might be a good candidate to sell.

- Utilize various bear market strategies and securities.

The Fed's policies have resulted in diminishing economic returns. With interest rates near all-time lows and the stock market near all-time highs, how can this be happening? First, let's review what the Fed does and how it impacts the economy.

The Federal Reserve guides the economy through recessions and recoveries with interest rates. To speed up the economy, the central bankers lower interest rates. To slow the economy down, they raise rates. The raising and lowering of rates also has an impact on debt.

As rates rise, debt becomes more expensive, so its growth slows. When rates are lower, debt is cheaper, and so the amount of debt increases. To achieve these goals, the Fed raises and lowers the money supply. The more money in the system, the lower rates go. When the Fed pulls money out of the system, rates rise.

To see if such use of monetary policy is actually effective, let's look at its impact on the economy.

Debt is often referred to as "leverage" because it can give you an economic return much greater than what you put in, the same way a lever is able to multiply the strength of the user to move heavy objects.

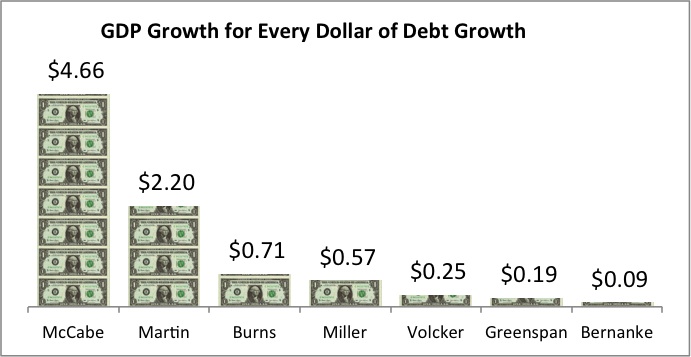

If the Fed's monetary policy is working, we should see increases in economic growth that exceeds the growth of debt. That hasn't happened, however, since the 1970s. Take a look at this chart tracking economic growth under seven Fed chairs up through Ben Bernanke to see what I'm talking about. The data is from the Federal Reserve of St. Louis:

Fed chairs Thomas B. McCabe and William McChesney Martin Jr. understood the idea of leverage. For every dollar of debt expansion under their tenures, the gross domestic product grew $4.66 and $2.20 respectively. Quite impressive.

With Fed chair Arthur Burns, the Fed's impact starts to nosedive. Burns was only able to get 71 cents of GDP growth for every dollar of debt expansion. By the time we get to Alan Greenspan, who was heralded as a genius, he was able to eke out 19 cents of economic growth for every dollar of debt growth.

Bernanke outdid his predecessor by squeezing only 9 cents of GDP gain for every dollar of debt growth. Granted, he was also the Fed chairman to preside over the worst economic collapse since the Great Depression, so he gets some points for keeping things from getting worse. Of course he could have recognized the housing bubble happening and prevented the collapse in the first place, but let's not quibble about who saw a bubble and who didn't.

Yellen's tenure is too short to know how things will work out. But the trend is pretty clear, in my opinion—less and less economic growth requiring more and more fiscal stimulus and debt.

For investors, do not expect the Federal Reserve to notify you that they have created a bubble. Greenspan famously said you can't see bubbles until after they pop. Bernanke assured investors that the housing market was solid just months before its collapse. And today, not a word of warning from the Fed about a potential bond bubble.

And this is my concern. Near-zero interest rates, record-high stock market valuation and a Fed that continues to follow a failed monetary policy adds up to another bubble, in my view. And its impact could be much more widespread than previous bubbles that popped.

There are strategies and investments that can be deployed that are actually designed to gain as the markets fall. By raising cash and utilizing some of these strategies, you could have the money to buy good investments when they become cheap.

As for the Fed, their policies are not helping long-term investors. Boom-and-bust cycles are not a good environment in which to invest. Investors need to be wary of both sides of the cycle and understand they won't hear a warning from the Fed about a bubble about to burst.

John Riley, registered Research Analyst and the Chief Investment Strategist at CIS, has been defending his clients from the surprises Wall Street misses since 1999.

Disclosure: Third party posts do not reflect the views of Cantella & Co Inc. or Cornerstone Investment Services, LLC. Any links to third party sites are believed to be reliable but have not been independently reviewed by Cantella & Co. Inc or Cornerstone Investment Services, LLC. Securities offered through Cantella & Co., Inc., Member FINRA/SIPC. Advisory Services offered through Cornerstone Investment Services, LLC's RIA. Please refer to my website for states in which I am registered.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In 1999, John Riley established Cornerstone Investment Services to offer investors an alternative to Wall Street. He is unique among financial advisers for having passed the Series 86 and 87 exams to become a registered Research Analyst. Since breaking free of the crowd, John has been able to manage clients' money in a way that prepares them for the trends he sees in the markets and the surprises Wall Street misses.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.