How Emotions Can Hurt Your Investment Portfolio

You need a logical investment strategy to help manage how you're bound to react to the ups and downs of the market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"I love it!"

"I hate it!"

Both are emotional comments about almost anything, and they certainly carry over when it comes to investing. After all, we're only human.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

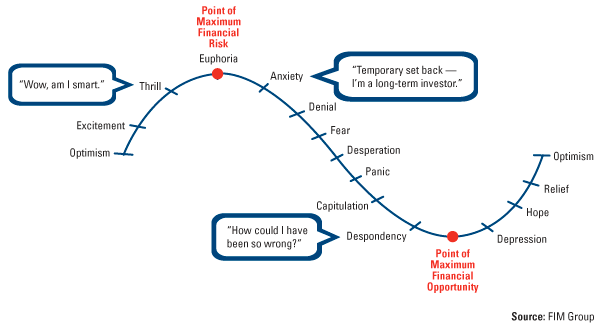

Why might this be a good time to have a discussion about this topic? The first two months of 2016 have been interesting, to say the least when it comes to investing. And 2015 wasn't so great. So, how should you deal with this current uncertainty? Before we arrive at an answer to this, it would be helpful to look at how we humans emotionally react to the up and down movements of the investment markets. As a believer that a picture is worth a thousand words, I offer the picture below for us to examine:

As the markets move up, even though it's never in a straight line, we go from optimism to euphoria, where the maximum potential risk level is reached. We now truly believe we are geniuses! What could possibly go wrong when we're so smart?

As the markets move down, as they all do at some point, our emotional state changes and we try to justify why we couldn't possibly be wrong. And as the slide continues, our emotions get stronger and stronger with fear kicking in more and more. And more often than not, we're more concerned about being wrong than the value we might be losing. How could we suddenly have gone from being so smart to being so dumb?

Invariably at the bottom of the market, our emotions have become so overwhelming that we convince ourselves that we really don't know anything, and now it's time to get out. Or we might think this whole investment process is rigged against us since it couldn't be possibly our faults. This happens at precisely the most opportune time to be in the market.

But before we can muster the emotional fortitude to jump back in, our depression needs to wane and hope, relief, and optimism need to take over again so we can decide to invest now.

Understanding how this cycle repeats itself could make you a better investor, but there are no guarantees of that. You also need to learn to not let emotions have much of any part of the investing process. How can you accomplish this?

You need a plan. A logical plan based on fact, not emotion. You need to think like Mr. Spock in Star Trek.

I'm not an advocate of simply buying the whole market and holding on forever. Yes, over a long time the markets inevitably go up, but your timeline may not be that long. I have never bought any investment for a client that we expected to hold forever. Nothing works forever.

There have been multitudes of successful investors over the years that have lived by the mandate that you have to be willing to buy when everyone else is selling and sell when everyone else is buying. If this feels emotionally difficult to do, that is exactly why we need a logical plan of what to buy, when to buy it, when to sell it, how much of it to buy and what are the key factors to go into determining all of these things. (This is a subject intended for a future article, so stay tuned.)

Hopefully, this discussion helps to explain why we, as humans, react the way we do, and how that natural reaction can be a negative when it comes to investing. It's negative in the sense that we may be buying high and selling low because our emotions tell us to do it that way, but also negative in the overall emotional turmoil it can cause.

Do yourself a favor. Understand what's going on in your heart and your head and have a plan to let logic rule the day, especially when it comes to investing.

Charles C. Scott, Accredited Investment Fiduciary®, has more than 30 years of experience in the financial services industry. "Our mission is to help our clients discover, design and live the life that they want to live by matching their finances with their visions, values and goals."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles C. Scott, Accredited Investment Fiduciary®, has more than 30 years of experience in the financial services industry. He developed and managed an institutional sales department for Washington Mutual, and then served as the Northwest Regional Manager for MFS, America's oldest mutual fund company. Since 1993, he has been an independent adviser, focusing on providing his clients with objective, unbiased planning and investment advice. He has written for the Wall Street Journal, CFO Magazine and other publications.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.