Skill Versus Luck in Investing

Having a disciplined investment strategy in place can help increase your odds of success.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Have you ever looked through a kaleidoscope? You know, one of those tube-shaped objects with mirrors and colored glass that make beautiful patterns when you rotate it? I'm going to ask you to try looking at your world differently, and consider the various roles that luck and skill play in almost every outcome. We're going to use a new tool, a "skilleidoscope," that will help us identify where skill is actually present.

In his book, The Success Equation, Michael J. Mauboussin explains how events are affected by both luck and skill, and how to determine the impact of each on an activity or outcome. I highly recommend it to anyone with a curious mind and suggest adding it to your list of mental models. The examples the book cites are delineated by life, business, sports and investing. As a financial planner, I am primarily interested in how Mr. Mauboussin's conclusions apply to the world of investing.

Over the last few decades, theories in finance have focused on identifying factors that are predictable and can help us decide which particular investments give us a better chance at succeeding. Succeeding in investment management usually means getting a return commensurate with the risk we bear or a better return than what is expected by comparing to a reliable benchmark.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The biggest controversy these days is the "active versus passive" debate. Passive is defined as low-cost, highly liquid investments such as index mutual funds and low-activity exchange traded funds (ETFs). These funds generally require little day-to-day management and generally just try to match a published index. Therefore, their management fees are very low.

Active funds involve managers and teams attempting to do better than their benchmarks through different strategies, such as using sector weighting, focused portfolios, segments of the market, style investing, global investing, etc. They tend to have relatively high management fees. The argument is that if you are paying those higher fees, you should expect better results. Otherwise, why spend the money paying for active management? And that is a common sense position, particularly when you realize that over periods of time, very few actively-managed funds outperform their benchmarks.

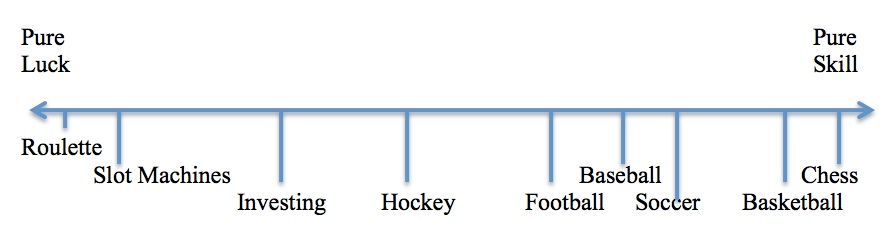

The Success Equation attempts to break out the element of skill from luck in investing. The author has developed what he calls the "luck versus skill continuum," as shown below, based on extensive statistical analysis.

You can readily see where investing fits on this scale—unfortunately near the "pure luck" endeavors (as is the world of business, where he makes the case that a CEO experiencing success at one firm is hardly assured of success at his or her next venture).

Some of the factors that influence our perception of success in investing include the following:

- Time frame: Someone with a lousy process can end up winning in the short run due to pure luck. Our tendency is then to project this lucky outcome into the future, and the probability of failure is the same as it was prior to the last "success."

- Bad luck overcoming skill: An accomplished money manager with a thorough and informed process can fail in the short run due to events outside of his or her control (i.e. dividend stocks gain favor at the expense of non-dividend payers; interest rates affect the market; investors run the technology sector through the roof at the expense of more solid companies; market sentiment shifts to small companies; etc.).

- Limitations of good luck: A manager possessing a high skill level and is the beneficiary of good luck is suddenly faced with the eventuality of that luck running out. His or her returns are bound to revert to the mean or average.

- Confusing compensation with skill: Incentives and rewards can reinforce a bad process. Think of the manager who is compensated for return and associates the return with skill when it is really the result of a lucky stretch for his or her style of investing (i.e. internet stocks in the late '90s and the proponents of "new and better" valuation metrics).

Added to the fact that we have largely efficient markets, we also have an increasingly growing pool of highly-skilled talent in the investment business. It is therefore becoming extremely difficult for any one manager to outperform his or her benchmark on a consistent basis.

At a meeting in Chicago last year, I had an opportunity to ask Dr. Eugene Fama, the father of the efficient market hypothesis, how we can explain those few standouts, such as Warren Buffet, if the markets are truly efficient and remove any potential for outperformance (amongst all participants combined). He answered that there are those few who have the requisite talent and skill to add value over time, but the problem is that we don't know who they are in advance, nor how long their advantage will last, so trying to select them is an exercise in futility.

So where does this leave us? Is there any hope in finding outstanding managers and investment opportunities? I would answer that there is, but you have to have a repeatable and disciplined process in place, and not deviate from it. Mr. Mauboussin also recommends that you use checklists to stay consistent in your approach.

In conclusion, I highly recommend reading this book and starting to apply its concepts in your everyday life as soon as possible. It will make a profound difference in how you see the world.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm based in Dayton, Ohio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Doug Kinsey is a partner in Artifex Financial Group, a fee-only financial planning and investment management firm in Dayton, Ohio. Doug has over 25 years experience in financial services, and has been a CFP® certificant since 1999. Additionally, he holds the Accredited Investment Fiduciary (AIF®) certification as well as Certified Investment Management Analyst. He received his undergraduate degree from The Ohio State University and his Master's in Management from Harvard University.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.