Smart Investors Ignore the Noise

You should focus on the long term and investing in relatively cheap assets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

People don't have a good intuitive sense of how to weigh new information in light of what they already know. They tend to overate it. - Nate Silver, "The Signal and the Noise: Why So Many Predictions Fail- But Some Don't"

As investors, we hunger for an inside scoop on what the market will do based on an event, real or imagined, that is being considered (for example, Brexit, the Orlando shooting, the U.S. presidential election, etc.). This hunger is being fed by the emergence of a 24/7 news culture that seeks to identify, examine and report each and every possibility of what the outcome will (might) be. This explosion of information too often gets interpreted as knowledge or wisdom but most often, in reality, it is just a piece of data that can be placed with other pieces of data to be considered in arriving at knowledge or wisdom.

The phrase "signal versus the noise" originated with radio operators. In the early years of radio technology, there was always a lot of static on the receiving end. It was vital to differentiate between the signal and the noise. What was valuable (the signal), and what was simply noise? The reason some predictions fail is that the focus possibly is too much on the noise and not on the signal.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A reasonable question is what should investors focus on? What are reliable signals to pay attention to at the expense of the noise?

Asset class valuations on a relative basis have been the most reliable indicator of future returns. When an asset class is expensive it will likely underperform an asset class that is relatively cheap. To some, this may seem like a "blazing grasp of the obvious." But do we as investors really pay attention to how our assets are valued? Or, as Nate Silver remarked in the opening quote of this article, do we pay an inordinate amount of attention to the new data we are being presented with?

Of course, valuations matter in the long-term. In the short term, markets get tossed about by the news of the day. This short-term news cycle phenomenon unfortunately causes too many investors to react and wreak significant damage to their wealth.

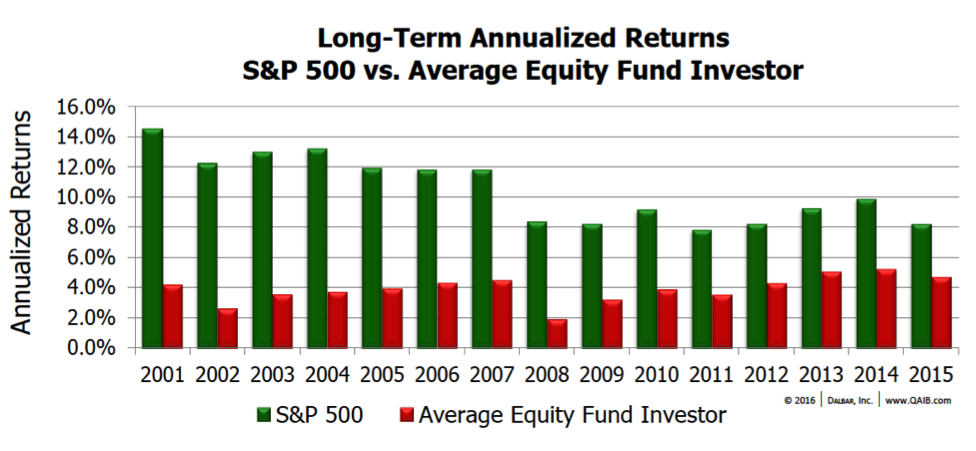

The evidence is in the 22nd release of the "Quantified Analysis of Investor Behavior" (QAIB) by Dalbar. Each year, Dalbar conducts a research project comparing the results of investors, driven by their inputs and withdrawal decisions, with the results of the market. Clearly this work is cumulative and not individual, but the consistent message over 22 years of the study is that the emotional part of investing, likely based on the noise present in the marketplace, has an impact on investors' ability to build financial security for themselves and their loved ones.

Of course, election years bring up the decibel level of the noise greatly. Data is often presented by pundits on which party or candidate will benefit investors the most. The reality is that the data points are actually incredibly small, and the number of observations is not statistically significant. For example, since 1872, we have had a whopping 25 presidents serve 36 terms. Franklin D. Roosevelt had four terms, or 11.1% of the observations. One could easily throw out an "outlier," and change the results dramatically.

An interesting statistic is that when an incumbent party has lost, the market has performed the worst. Why? Most likely it's because, when the economy has not performed well, voters have desired change. However, the market doesn't appreciate change so much.

Clearly, short-term news has a knee-jerk impact on the markets, and for speculators whose focus in on the short term, the news (noise) can have an impact. Yet, as seen above, timing the market most often has a disastrous impact on building and preserving wealth. Probabilities of success are much higher when the focus is on the signal. Valuations and sound portfolio construction of a well-diversified portfolio with multiple asset classes will serve investors much better than being distracted by all the noise.

Bob Klosterman, CFP, is the Chief Executive Officer and Chief Investment Officer of White Oaks Investment Management, Inc., and author of the book, The Four Horsemen of the Investor’s Apocalypse.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Robert Klosterman, CFP® is the CEO and Chief Investment Officer of White Oaks Investment Management, Inc., a fee-only investment management and wealth advisory firm. Bob is the author of the book, "The Four Horsemen of the Investor's Apocalypse. White Oaks has been recognized by CNBC.com as one of the "Top 100 Fee-Only Wealth Management firms in the country.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.