The Folly of Market Timing

If you want to make money in the stock market, you have to be in—all the time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Market timing for fun and profit! Now that sounds good, right? Who wouldn’t want to have fun while making a profit? In the investment world, that’s the siren song of the market timer. They ask the obvious question, “Why would you want to invest in the market when it’s going down?” Of course no one would.

As a consequence, there is an overwhelming temptation to follow the guru who promises to help you avoid bear markets by trying to ride market updrafts and avoid drops. That approach of beating the market is an overwhelming temptation for many investors.

A simple analysis of market history would show that if you called the market correctly every year you’d be rich. If you were correct in calling the market even half the time, your return wouldn’t be too bad, either. Given those odds, why wouldn’t you give market timing a shot?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The problem is that, as in many cases, simple statistics can be very misleading—like the stories of the man who drowned in a lake with an average depth of 3 feet, or the man who thought he’d be comfortable with his head in an oven and his rear in the refrigerator.

Assuming returns based on the concept of flipping a coin can be very misleading. What matters is the actual annual sequence of returns. Remember, a market timer has to be right twice – when to get out AND when to get back in. Consider the following example:

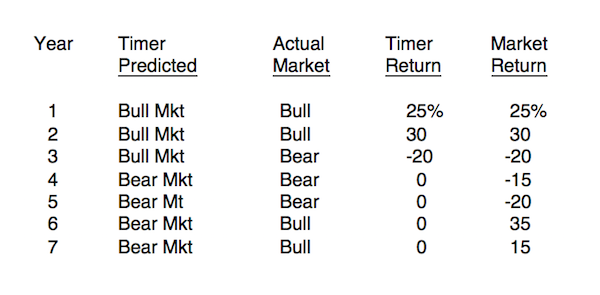

The timer correctly called the bull markets in years 1 and 2 but missed the first bad market in year 3. He then redeemed himself by calling the serious bear markets in years 4 and 5, avoiding a 35% loss. Unfortunately, while waiting for confirmation that the market had turned, he missed the dramatic bull markets in years 6 and 7 (remember, you have to decide when to get back in as well as when to get out). The result: Patient investor, 4.6% annual return; Timer, 3.9%.

How likely is it that this will happen to a market timer? Over time, it’s just about guaranteed. Consider the grand recession. From November ‘07 to March ‘09, the market fell 46.7%. The subsequent one-year return was 53.6%!

Still not convinced? If I asked you to name the top 10 artists of all time or the top 10 baseball players or the top 10 presidents, we’d all have our own list and happily debate our choices. Now, let me ask you, name the top 10 market timers of all time? Having trouble? How about the top 5? Still stuck? How about the top 1? I’m sure you’re still having trouble.

My point is, if anyone had successfully timed the market over an extended period of time we would know his or her name as they would be one of the richest people in the world. The fact that we don’t know any names should be a warning sign not to chase the illusion of market timing.

Research has shown that when you factor in transaction costs you would have to be correct almost 70% of the time. And that assumes instantaneous switching from stock to cash and back. The real world doesn't work that way. If you factor in a time delay for switching to look for a market “confirmation,” you would have to be correct almost all of the time to beat the buy-and-manage alternative.

The moral? If you want to make money in the market, you have to be in the market – all of the time.

Harold Evensky, CFP is Chairman of Evensky & Katz, a fee-only wealth management firm and Professor of Practice at Texas Tech University. He holds degrees from Cornell University. Evensky served on the national IAFP Board, Chair of the TIAA-CREF Institute Advisor Board, Chair of the CFP Board of Governors and the International CFP Council. Evensky is author of The New Wealth Management and co-editor of The Investment Think Tank and Retirement Income Redesigned.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Harold Evensky, CFP® is Chairman of Evensky & Katz, a fee-only investment advisory firm and Professor of Practice in the Personal Financial Planning Department at Texas Tech University. Evensky served as Chair of the TIAA-CREF Institute Advisor Board, Chair of the CFP Board of Governors and the International CFP Council. He is on the advisory board of the Journal of Retirement Planning and is the Research Columnist for Journal of Financial Planning. Evensky is co-author of The New Wealth Management and co-editor of The Investment Think Tank and Retirement Income Redesigned. Mr. Evensky has received numerous awards over the years. The most recent is Investment Advisor Magazine, 2015 IA 35 for 35 recognizing the advisor advocates, investors, politicians and thought leaders have stood out over the past 35 years and will influence financial services for decades to come. Don Phillips of Morningstar called Mr. Evensky the dean of financial planning in America.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.