What Should Your Adviser Do in Times of Market Volatility?

Positioning your investments—and educating you—to cope with all market environments should be Job One.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The headline above poses a trick question. The short answer is: nothing that he or she shouldn’t be doing already to help you prepare for the future and be well positioned for the present.

Market volatility tests everyone’s nerves. It’s a recurring phenomenon, a symptom of larger concerns making themselves felt in the markets. The proverbial “wall of worry” includes the current unease with the state of the global economy and today’s turbulent geopolitics. Historically, volatile periods in the markets eventually sort themselves out.

In building a portfolio to meet your goals and needs, your adviser should have taken potential episodes of volatility into account. The point is to support your ability to live your life in ways that are satisfying and rewarding—without undue worry about the market’s short-term gyrations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So what risk-control techniques should your adviser have in place to achieve all this? What should be your attitude toward market volatility?

Philosophy and Strategy

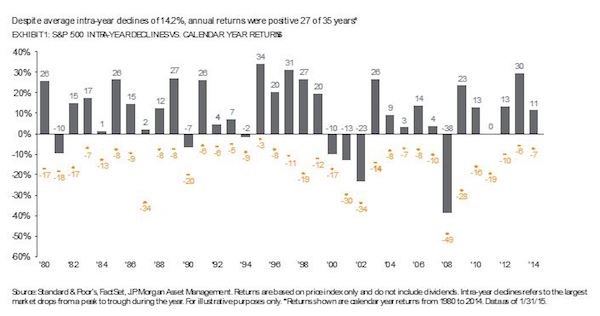

First, please consider the graphic below. Many people have short-term memories for market volatility, often erroneously recollecting recent rides as relatively smooth. Think again: Since 1980, in the majority of years in which the U.S. stock market has turned in positive returns, there have been significant interim downdrafts.

I can’t emphasize enough that, over the long term, market participants earn more, on average, than those who sit apprehensively on the sidelines in cash or other low-risk instruments. During recent months in the equity markets, stocks have been lunging fairly dramatically between highs and lows. How do you manage volatility risk when volatility increases? This must engage both philosophy and strategy:

Philosophy: One of the most meaningful aspects of your adviser’s role should be in educating and preparing you for times like these. Your responsibility as a client is to choose an adviser whose investment philosophy you understand and find consistent with your own beliefs. Your adviser is responsible for understanding your goals and attitude toward risk, implementing a strategy consistent with these, and communicating this so you both understand it and feel comfortable with it.

Working with the right adviser isn’t meant to guarantee that you’ll feel great when the markets take a precipitous turn. But if you’re well diversified and plan to remain invested for the long term, you should have the confidence in your adviser’s strategy to be able to say, “It’s going to be okay.”

Strategy: Your adviser’s strategy, in helping to shore up your economic ability to bear volatility risk, plays a huge role in why “It’s going to be okay.” The first step is helping you ascertain how much you need in reserves to support your cash flow for the next three years. Your adviser should have allocated that money in instruments that are more defensive during periods of volatility. So that if, for whatever reason, you need cash in the near term, you won’t pay a heavy price: No need for forced sales at the bottom.

Goal Matching

Obviously, selling when the markets are down can be damaging to a portfolio’s long-term performance. For those who need to sell holdings to fund immediate financial needs, this may be unavoidable. The traditional way of dampening volatility—holding long-dated, high-quality bonds—not only depresses earnings, but also presents a different risk: exposure to bubble pricing in bonds.

At Halbert Hargrove, we address these risks through clients’ direct ownership of bonds, so that maturing issues, invested in a “ladder” sequence, can provide cash flow if needed. This tactic can help market volatility to have a reduced effect on both personal cash flow and portfolio performance. Depending on a client’s life situation, the proceeds from maturing bonds can be reinvested. If interest rates rise, you can then reinvest at higher rates. But the funds are there if needed.

Diversification

But what about investing for longer-term goals? Diversification is key. When you’re diversified, you’re holding different types of assets with separate and distinct return patterns that reflect different potential states of the world—including volatility. Investment characteristics such as value, small cap, momentum, and low beta, as well as the diversification effects of, say, managed futures, do work over time, but not at all times.

I like to say that diversification means always having to say you’re sorry. Holding a truly diversified portfolio with risk characteristics appropriate for both your risk appetite and your needs for investment returns means that some elements will not be working at any given time. The objective is a harmonious whole that will meet your investment goals over a long time horizon.

Patience and Perspective

There are many other volatility-addressing tactics in a skilled planner’s toolbox. Rebalancing, for example, is the process of bringing portfolio allocations back to target weights, thus buying low and selling high as asset returns revert to their average relationships. This should be executed with added consideration for taxes, trading costs, and the effect of volatility on relative valuations.

Another important discipline you and your adviser should be participating in together is the regular review of your values, long-term goals and risk tolerance. This should serve you well during the tough periods, providing perspective, and reinforcing all those important reasons why, in the long run, you’re remaining on the right track.

Trying to predict or react to volatility just doesn’t carry good odds for success. Disciplined investing on the other hand—particularly diversification—has historically helped those long-term investors who remain invested to capture good performance when it (unpredictably) occurs. This requires both patience and perspective, as we hold on during those exasperatingly rough rides until the markets find their bearings once again.

Russ Hill CFP®, AIFA® is CEO and Chairman of Halbert Hargrove, based in Long Beach, CA. Russ specializes in investing, financial planning and longevity-awareness solutions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Russ Hill CFP®, AIFA® is CEO and Chairman of Halbert Hargrove Global Advisors LLC, an independent registered advisory firm based in Long Beach, CA. He has led the firm for more than 40 years, specializing in investing, financial planning and longevity-awareness solutions. Russ is heavily involved with Stanford University's Center on Longevity, and has helped to launch the Center's symposiums and Design Challenges on aging-related challenges.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.