Why Investments Outperform Investors

Those in the market don't want to see their decisions as market timing. But too often they are.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I would like to think of myself as a boating enthusiast. Yet, if it were a crime to be a "boating enthusiast," the evidence to convict me would be weak and circumstantial at best. Boating enthusiasts are out on their vessels regularly. I, on the other hand, find reasons (read: excuses) to not go out on a particular day. For example, it may be too windy or not windy enough. Or it might rain. Yet, the reality is that most days would be just fine and present a wonderful opportunity to be on the water—and I'd wish I'd have gone out.

So what does this have to do with investing? Some investors find themselves in a similar pattern of behavior when it comes to making investment decisions. The conditions are seldom, if ever, perfect for investing. The stock markets are overvalued, the trend for the stock markets has been negative or too positive, interest rates are too high or too low, the Fed is tightening or is too loose: These are just some of the hurdles that people put in the way of making decisions to invest.

But wait a minute! Isn't not choosing to invest really an investment decision? In reality, it is. The funds are always somewhere, whether in cash, money market accounts or other investments. While an investor may protest and say their non-decision is only to protect capital, the reality is that the facts simply don't support that view.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

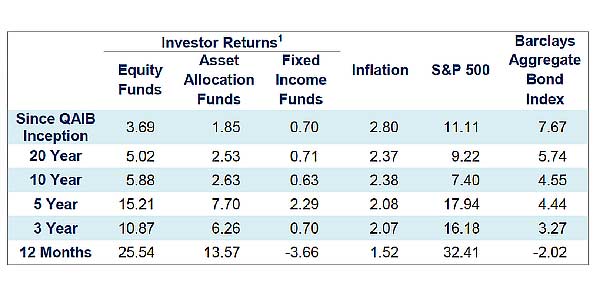

Dalbar, a leading research firm in financial services, has conducted an extensive study for the last 20 years, examining the impact of investor decisions on their results. In the table below, note the large discrepancy between investor results and investment results. The message is: Investments perform better than investors. Yes, investments perform better than investors! Why? When people only invest when they feel good about current market conditions, they endure a large negative impact on their results.

The evidence against market timing as a successful strategy is overwhelming. Investors often don't look at their decisions as market timing, but too often they are. Too often they become mono-focused on the stock market as if it were the only investment choice available when in fact contemporary portfolio design will incorporate in a portfolio several non-market selections that exhibit low to negative correlation with the market. Adding non-traditional investments, such as managed futures, absolute return strategies, etc., to reduce volatility and deliver reasonable returns helps your portfolio meet your goals and dreams.

In my professional tenure, I have had the opportunity to work with many clients and have seen the impact their financial decisions have had on meeting and achieving their needs, goals and dreams. Those who thought of their investment decisions through a matrix of risk and reward over the long term and acted on those decisions through a well thought out, intelligently diversified portfolio were able to get where they were headed with a high probability of success. Those who became frozen in place, also with a high probability, ended up disappointed and frustrated by not being able to meet the goals and dreams they envisioned.

Getting back to my boating analogy, I'm sure it occurred to many of you that there are times when weather conditions are so severe that taking the boat out would be silly. I agree! Yet, most of the time, when the potential for less-than-favorable conditions exists, it doesn't come to fruition. Even if it does, with the proper plan and equipment, the true boating enthusiast has nothing to fear.

When it comes to investing, market storms come and go, but with a well-designed strategy—using a broad base of asset classes and accounting for many likely yet unpredictable scenarios—you can weather them quite well.

Bob Klosterman, CFP, is the Chief Executive Officer and Chief Investment Officer of White Oaks Investment Management, Inc., and author of the book, The Four Horsemen of the Investor’s Apocalypse.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Robert Klosterman, CFP® is the CEO and Chief Investment Officer of White Oaks Investment Management, Inc., a fee-only investment management and wealth advisory firm. Bob is the author of the book, "The Four Horsemen of the Investor's Apocalypse. White Oaks has been recognized by CNBC.com as one of the "Top 100 Fee-Only Wealth Management firms in the country.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.