Bear Market? I See a Bull Market for the Next 15-20 Years

Here’s what a long view of the direction of markets shows us.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The first week of 2016 started with a big move down in equity prices as a result of geopolitical events in emerging markets and fears of slowing economies worldwide. However, there are larger trends influencing markets today.

Understanding today’s market moves requires the study of market history and secular trends that dominate market direction. Most investors are unaware of secular bull and bear markets that control long-term direction of markets for significant periods of time.

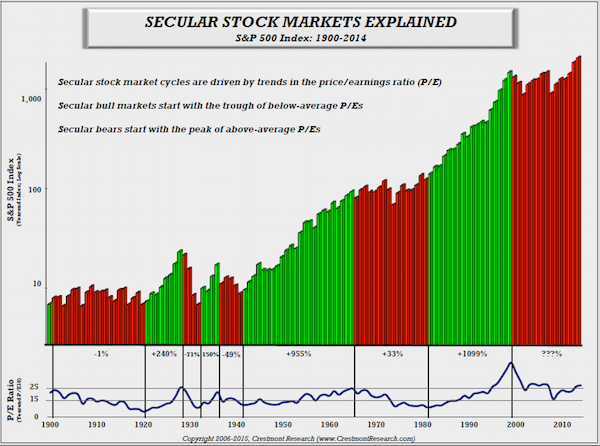

Let’s review the last century of stock market cycles. Classifying bull markets and bear markets is necessary to understand their impact on short-term trends. I define secular bull markets as extended periods or years when the stock market achieves higher highs and higher lows, and bear markets retreat to lower highs and even lower lows. These extended bear and bull markets can last for eight to 20 years for either market. Take a look at this illustration of the S&P 500 for 114 years, with bull markets in green and bear markets in red:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It is important to remember that the stock market is an auction system made up of millions of investors interacting electronically to achieve the best results for their efforts. People are emotional by nature, often influenced by both the fear of losing wealth and the greed of not attaining enough wealth; as a result, overbidding for desired stocks will push markets to much higher highs years before ending bull markets and beginning the bear markets that follow. There are, of course, other contributing factors, but most secular market trends are driven by the basic human emotions of fear and greed.

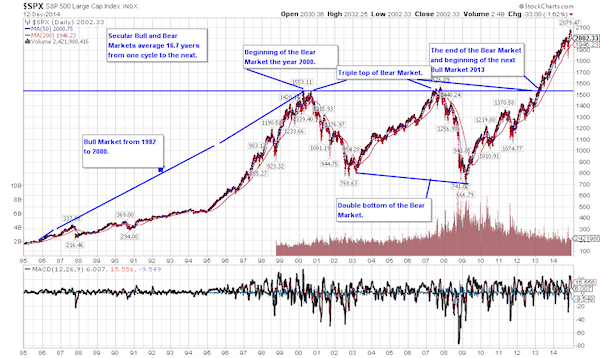

If you accept the existence of secular market trends, then the question is: where are we in 2016? To understand the answer to this question, let’s review the bear market that began in the year 2000. The bear market began in March 2000 after one of the greatest bull markets in history (1982-2000), giving investors a 1099% return if they invested in the S&P 500 for that period of time.

The bear market of 2000 began with the busting of the dot-com bubble and the S&P 500 falling in value until October 2002, with the final low reached in March 2003 before rising in value for the next four-and-a-half years until October 2007. The market fell again until March 2009 before starting its rise to current levels with the market highs reached in May 2015.

The S&P 500 did one extraordinary thing that did not happen during the prior 14 years of the secular bear market. In May 2013, it reached the highs achieved in the years 2000 and 2007, but, this time, it broke through the ceiling and has continued to rise to current (2016) levels. We at Geasphere believe that the breakout in 2013 was the end of the 14-year secular bear market and the beginning of the next secular bull market. (See illustration and explanation below of the 2000 secular bear market.)

The chart shows the beginning and the end of the secular bear market by illustrating the price action of the S&P 500 over the 14-year period. More importantly, it demonstrates the basic principal of economics: if you have more sellers than buyers in the market, markets will go down; the reverse is true that if you have more buyers than sellers in the market, it will go up. We believe the market has begun the next secular bull market that will last another 15 to 20 years.

We live in a time of the 24-hour news cycle, in which information that used to be interesting only to professionals is now packaged and highlighted with great graphics and music to investors with sensational entertainment values-- and yes, this might make good television, but it does not make good investors.

Enjoy the ride, because it’s going to be a long one.

Eduard Hamamjian, an accredited Asset Management Specialist, has been in the industry since 1992. With years of experience in investment research, portfolio construction and even business ownership, he has developed a suite of services specific to business owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As an Accredited Asset Management Specialist, Eduard has developed his investment approach through a unique diversification method, and proprietary stock valuation and various other strategies for research, construction and management of portfolios. Eduard's innovative strategies allow him to provide distinct value for GeaSphere clients looking for growth without excessive risk. He oversees the construction, research and management of client portfolios. In recent years, he has combined his investment approach with practical planning tools and cash flow solutions, so that he can deliver comprehensive services for business owners. He also partners with accounting firms for a simpler, more tax-efficient process for each client.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.