What Investors Can Learn from the 2016 Presidential Election

Beyond the candidates, we're seeing a spotlight on globalization and demographics — two forces sure to steer the economy for years to come.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Ask any political junkie, and they'll tell you that the 2016 presidential campaign has been one of the strangest they've ever experienced. The rise of billionaire/reality TV star Donald Trump and Vermont Senator Bernie Sanders, the wild and woolly TV debates, and how wrong the pundits have been at predicting anything has been unprecedented.

But if we set aside the drama, we may discover that the most important thing we can learn from this election has nothing to do with the candidates. Instead, the most important takeaways are how the two mega-forces of globalization and demographics have changed our country and the influence they will have for years to come. Investors would be wise to pay attention.

We're living in a global village

First let's look at globalization. We've heard a lot of talk about trade, trade agreements and jobs from the candidates, but unless you've been personally affected, much of it seems more abstract than real. So let's make it real.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There's no question that we have reaped the economic benefits of globalization. Trade liberalization alone increases our annual output by $300 billion to $500 billion, according to the Peterson Institute. Trade creates new jobs as well as destroying old ones. In 1992, 14.5 million or 10.4% of all jobs were tied to trade. By 2014, that number had grown to 41 million or 21.7% of all jobs, according to Business Roundtable.

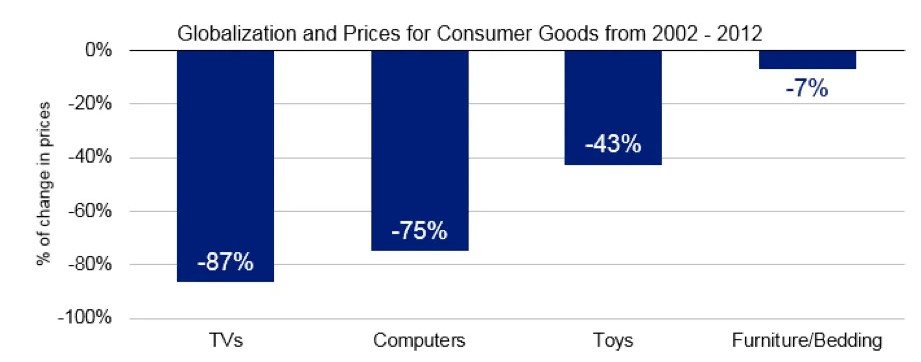

But many of us missed the fact that globalization also gave us the benefit of lower prices on personal goods. The following chart gives you an idea of what happened to the prices of some commonly purchased goods between 2002 and 2012.

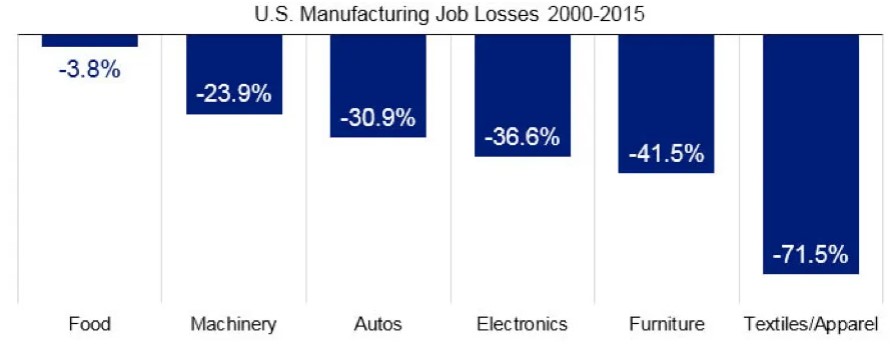

Yes, there have been downsides to these consumer benefits. The first trade-off of globalization has been domestic jobs. You can't miss that on the campaign trail. But it's important to understand that while not all of the job losses are a result of globalization, many are. The chart below shows manufacturing job losses by sector between 2000 and 2015. As you can see, while a number of sectors have been hit, a few have been decimated.

When you see that 31% of all automobile workers have lost their jobs since 2000, it's easy to understand why voters in Michigan and Ohio are frustrated and angry. And when you see that 71% of all textile and apparel jobs have been lost, it's easy to relate to concerns expressed by voters in the Carolinas.

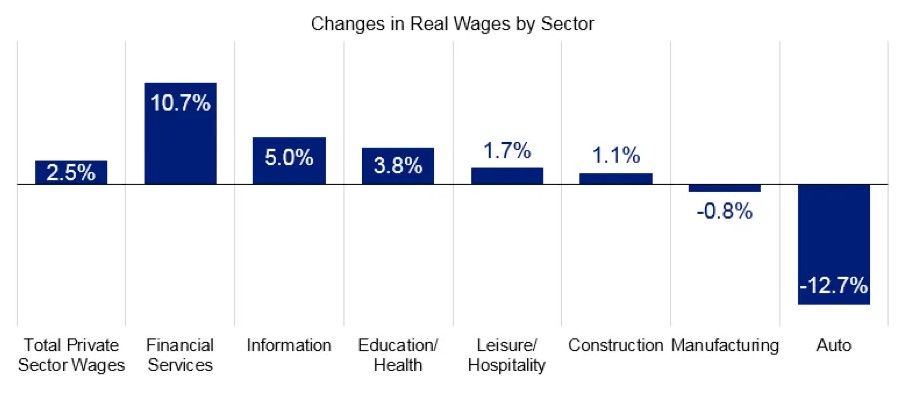

The second trade-off has been lower wages. The next chart shows the change in real wages by sector between January 2009 and December 2015. While wages haven't grown dramatically for any sector (except financial services), it's clear that individuals in the services sectors (financial services, information, education/health and leisure/hospitality) have fared much better than individuals in the construction, manufacturing and auto sectors.

So we've learned that globalization is a double-edged sword. Many individual companies and investors have benefitted from rising stock prices tied to increased corporate sales and profits. But it has been devastating for a number of U.S. cities, workers and their families. During this election cycle, we've heard the voices of many of those affected individuals.

Changing demographics

For the first time, the Millennial generation (individuals between 18 and 43) will match up with the Baby Boomers (born between 1946 and 1964) in population size. And as the Baby Boomer population decreases, the Millennials will take their place in history as the largest generation of Americans. What many don't understand is that we're just beginning to see what happens when the Millennials flex their cultural and political muscles.

Looking back, it's easy to see how the Baby Boomer generation dramatically affected our country and the economy. According to a 2008 McKinsey and Company study, Baby Boomers broke all of the previous generations' records for attaining the highest levels of education. During their working years, they have seen their incomes rise to the highest level of all generations.

As consumers, Baby Boomers have been the dominant spenders for two decades, and they have spent more at every age than prior generations. They have driven the growth of industries such as personal electronics, recreation and health care.

As investors, Baby Boomers have prospered from unprecedented increases in the stock and real estate markets. As the value of their assets rose, their spending increased, and the generation's saving rate fell to all-time lows. Now, as they look ahead to the end of their careers and retirement, they will change the face of retirement in America.

Like Baby Boomers, the Millennial generation will make its mark on the country by influencing our culture and the economy. Millennials have been particularly visible in their support for Democrat Sanders and his message. In the Michigan primary in early March, exit polling found that 81% of Democratic voters age 18 to 29 cast their ballots for Senator Sanders. In New Hampshire, 83% of Democratic voters chose Senator Sanders.

According to a 2014 Pew Research Center study, they also look different than the generations that preceded them. For example, Millennials:

- Are more ethnically diverse with 43% of them being nonwhite compared with 28% of Baby Boomers

- Are less religious with 35% having no religious affiliation compared with 17% of Baby Boomers

- Marry later with just 26% of the Millennials between 18 and 33 years old being married versus 48% of individuals the same age in 1980

These results shouldn't be surprising. This generation was shaped by the shock of 9/11. Yet, they are more supportive on issues such as gay marriage and are more open to different ways of life than previous generations.

This election, the Millennial generation is making itself heard, and this is just the beginning. While we don't know where they will take us, we do know that they will be a social and economic force for many years to come.

Globalization and demographics, two mega-forces and hot topics this election, will continue to influence the markets in the future. The best advice to investors: Keep your eyes and ears open to sectors and companies that develop the best ways to capitalize upon these forces, and invest accordingly.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jan Blakeley Holman is director of advisor education at Thornburg Investment Management. She is responsible for identifying and creating advisor education programs that support financial advisors as they work with their clients and prospects. Jan has spent more than four decades in the financial services industry. Over the course of her career, she’s served as a financial advisor, an advisor to financial advisors and a financial services corporate executive. Visit Thornburg’s website to enjoy more of Jan’s articles and podcasts.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.