Bridging the Return Gap with Enhanced Equities

June 2015By PIMCO Investments

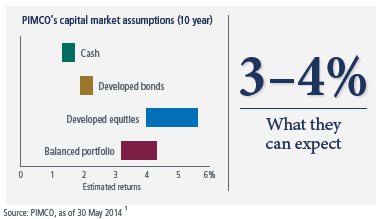

Low interest rates, full valuations and muted prospects for global growth imply a more moderate long-term return environment for traditional asset classes. In order to meet their goals in this environment, investors may need to consider non-traditional strategies that offer the potential for better-than-market returns.

Looking Back: Equity Markets Powered Portfolio Returns

In the past, equity market beta has been a powerful driver of portfolio returns. U.S. stocks have generated double digit returns over the past three decades – performance that has informed the 7–8% portfolio return targets often set by investors.

Moving Forward: Investors May Need to Look Beyond Market Beta

Low policy rates are a baseline for returns

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

PIMCO’s New Neutral outlook calls for near-zero neutral policy rates (in real terms) in many developed markets. The level of short-term rates forms a fundamental component of all asset prices.

Fair valuations and soft growth expectations temper upside potential

Unprecedented central bank policies have re-flated asset class valuations globally: PIMCO believes they are now broadly fair. Although we believe risk assets should continue to outperform in this environment, fair valuations and soft global growth expectations have led us to forecast more modest overall stock and bond returns.

How Can Equity Investors Stay on Track?

Consider enhanced equity strategies

With traditional asset classes facing a more muted future, investors may need to employ strategies that tap sources of return above and beyond what the markets may provide. Yet at the same time, the broadly diversified equity exposure offered by traditional passive strategies has noteworthy appeal. With an enhanced equity approach, both are possible. PIMCO offers a number of enhanced equity strategies, including Research Affiliates Equity (RAE) strategies that start with the leading smart beta approach, the RAFI Fundamental Index, and then incorporate additional active insights and enhancements. By using ‘smart beta’ indexes as a starting point for portfolio construction, these strategies may offer a structural performance advantage over those that hew to traditional benchmarks. That is because indexes that weight constituents based on fundamental factors may avoid a pitfall of traditional market-cap weighting: the tendency to overweight overpriced securities and underweight underpriced securities.

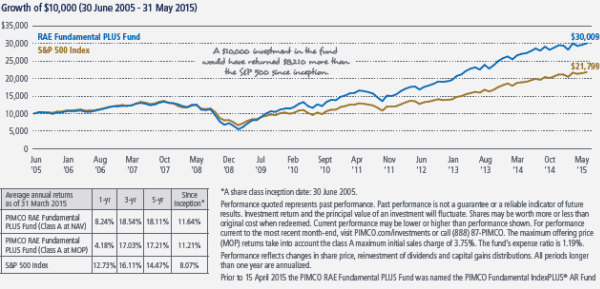

Included in PIMCO’s enhanced equity suite is PIMCO RAE Fundamental PLUS Fund, which combines the RAE Fundamental smart beta-based approach with a complementary source of alpha potential. As this chart shows, a smart beta-based equity strategy PLUS can add up to meaningful market outperformance over time.

1Return estimates are derived from an internal process based on a combination of methods, pulling together historical data, valuation metrics and qualitative inputs based on PIMCO’s secular views. Forecasts and estimates have certain inherent limitations, and unlike an actual performance record, do not reflect actual trading, liquidity constraints, fees, and/or other costs. In addition, references to future results should not be construed as an estimate or promise of results that a client portfolio may achieve.

1Cash is expectations for Citigroup 1-Month Treasury Bill Index, Developed bonds is Barclays Global Aggregate Bond Index USD Hedged and Developed equities is MSCI WORLD Index hedged in USD.

Investors should consider the investment objectives, risks, charges and expenses of the funds carefully before investing. This and other information is contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your investment professional or PIMCO representative or by visiting pimco.com/investments. Please read them carefully before you invest or send money.

A word about risk: All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Management risk is the risk that the investment techniques and risk analyses applied by PIMCO will not produce the desired results, and that certain policies or developments may affect the investment techniques available to PIMCO in connection with managing the strategy.

Smart beta refers to a benchmark designed to deliver a better risk and return trade-off than conventional market cap weighted indexes. Beta is a measure of price sensitivity to market movements. Market beta is 1. Alpha is a measure of performance on a risk-adjusted basis calculated by comparing the volatility (price risk) of a portfolio vs. its risk-adjusted performance to a benchmark index; the excess return relative to the benchmark is alpha.

The Citigroup 1-Month Treasury Bill Index is an unmanaged index representing monthly return equivalents of yield averages of the last 1-month Treasury Bill issues. Barclays U.S. Aggregate Index represents securities that are SEC-registered, taxable, and dollar denominated. Barclays Global Aggregate (USD Hedged) Index provides a broad-based measure of the global investment-grade fixed income markets. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The S&P 500 Index is an unmanaged market index generally considered representative of the stock market as a whole. It is not possible to invest directly in an unmanaged index.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark or registered trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. THE NEW NEUTRAL and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Pacific Investment Management Company LLC in the United States and throughout the world. © 2015 PIMCO

PIMCO Investments LLC, distributor, 1633 Broadway, New York, NY 10019, is a company of PIMCO.

This content was provided by PIMCO Investments. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.