5 Gold-Rated Funds to Beat the Market

The Morningstar Medalist rating gives us confidence that these picks should outpace the indexes over the long haul.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

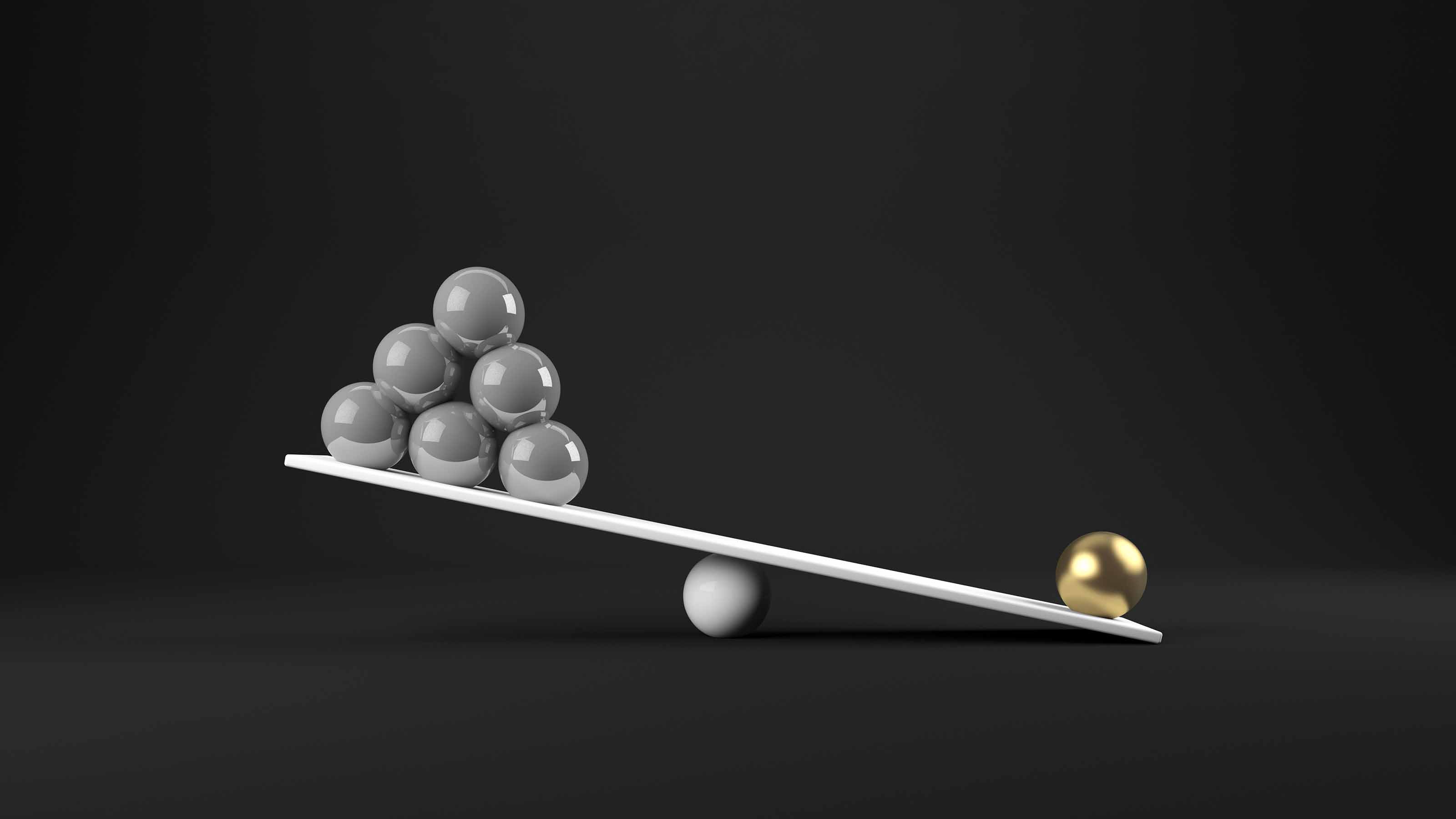

Index funds are all the rage nowadays—and why not? Over the past 10 years, fewer than one-third of actively managed U.S. stock funds beat their benchmark indexes. But if you want to find funds that, on average, beat their benchmarks, one good place to turn to is Morningstar, the Chicago-based investment research outfit.

Five years ago, Morningstar launched its Morningstar Medalist ratings. The firm’s analysts pick their favorite funds by looking at both quantitative and qualitative factors, then divide their top picks into gold, silver and bronze medalists. The analysts have the most confidence in gold-rated funds, the second most confidence in silver and the third most confidence in bronze.

Over the past five years, a majority of the medalists have beaten their benchmark indexes. Nearly 60% of gold-medalist funds outperformed their benchmark, 54% of silver funds beat their index, and 53% of bronze funds came out ahead.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How do Morningstar analysts pick funds that they think will do well? They start by looking for low costs and strong returns, adjusted for market volatility. But the analysts also include some data points that are difficult for individual investors to evaluate on their own.

Morningstar employs more than 100 fund analysts. They visit fund companies and get to know the managers, research analysts and executives through continuing interviews by phone and in person. “We’ve covered most of our medalists for many years,” says Russ Kinnel, Morningstar’s director of manager research.

Among the questions the analysts endeavor to answer: Do the fund’s managers have a competitive advantage that enables them to execute a sound strategy consistently over time? How talented is the manager or managers? How good are the analysts who research the securities owned by the fund? What kind of company runs the fund? Is its corporate culture one of salesmanship or stewardship?

Morningstar’s fund analysts present a tentative rating to a committee for approval. The committee then discusses the rating and ensures that all the needed work has been done before the company issues a final rating.

Only 350 funds currently have five-year records as medalists. Before it came out with its medalist rankings, Morningstar singled out its favorite funds as “analyst picks.” The methodology was slightly different, but it was also successful, more often than not, in picking market-beating funds.

Below are descriptions of some of my favorite gold-rated funds. Returns are as of March 3.

AMG Yacktman Fund Class I (YACKX) lost founding manager Don Yacktman to retirement last year, although he remains an adviser. But Yacktman’s son Stephen and comanager Jason Subotky have been ably doing most of the day-to-day work on the fund for many years. The fund looks for high-quality companies with stocks that sell at depressed prices. Nearly one-third of the fund’s holdings are low-risk companies that make everyday necessities. And 20% of the fund is in cash. That risk-averse positioning has hurt relative returns—the fund has lagged Standard & Poor’s 500-stock index over the past five years. But I believe patient investors will be rewarded. This fund is a keeper.

American Funds International Growth and Income F-1 (IGIFX), like all American funds, is available through several online brokerages, including Fidelity and Schwab, without an initial sales charge. At $11 billion in assets, this is one of the smallest, and therefore most nimble, of the firm’s funds—one of the reasons I like it. Despite the fund’s name, its yield is only 2.3%. The four managers are each responsible individually for a portion of the portfolio.

Dodge & Cox Stock (DODGX), a member of the Kiplinger 25, is a venerable, low-cost, conservative, large-company fund with a focus on bargain-priced stocks. The fund trailed the Russell 100 Value index for 2 1/2 years until the second half of 2016, and it fared even worse against the S&P 500. But it has since returned to its winning ways. The fund buys stocks of companies facing temporary difficulties, then holds on patiently.

Oakmark Fund (OAKMX) has profited recently from a 35% stake in financials. The sector rose 22% in 2016. Veteran comanagers Bill Nygren and Kevin Grant often find value in places others don’t. The fund’s long-term record is superb. Over the past 10 years it returned an annualized 9.2%—an average of 1.3 percentage points a year better than the S&P 500.

T. Rowe Price Real Estate (TRREX) has been managed capably since its inception in 1997 by David Lee. Lee and his team look for well-managed real estate investment trusts that are likely to keep growing, with shares that trade below the net asset value of the underlying properties. Lee is incredibly patient; turnover is less than 10% annually, which means that in the course of a year, the fund changes fewer than one in 10 holdings.

The real trick with actively managed funds, in my view, isn’t so much picking good funds initially (although that’s not easy). The hardest part is sticking with active funds during the inevitable years when they lag their benchmarks. Even the best of funds will go through two-year or three-year periods when they trail their indexes. Holding on and not selling can be incredibly difficult—particularly if a fund lags by a lot. Owning a fund with a Morningstar gold rating can help you remain patient during the bad times.

Steve Goldberg is an investment adviser in the Washington, D.C., area.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

BlackRock Event Driven Equity Profits from Corporate Change

BlackRock Event Driven Equity Profits from Corporate Changemutual funds BALPX capitalizes on mergers, executive turnover and other events.

-

Double Your ESG Impact With Funds Tied to Charities

Double Your ESG Impact With Funds Tied to CharitiesFinancial Planning A growing number of funds donate directly to causes you might care about. Are they good investments?

-

ESG Gives Russia the Cold Shoulder, Too

ESG Gives Russia the Cold Shoulder, TooESG MSCI jumped on the Russia dogpile this week, reducing the country's ESG government rating to the lowest possible level.

-

When Actively Managed Funds Are Worth It

When Actively Managed Funds Are Worth ItBecoming an Investor For some investment categories, choosing an actively managed fund makes sense.

-

The Truth About Index Funds

The Truth About Index FundsIndex Funds You may think you're diversified by buying an S&P 500 Index fund, but you're making a substantial wager on a handful of stocks.

-

How to Profit From ETFs

How to Profit From ETFsBecoming an Investor Exchange-traded funds aren’t new, but they’re still red-hot. Here’s a detailed look at why you should consider these investment vehicles, for both your stock and bond allocations.

-

Invest in Scandinavia

Invest in ScandinaviaForeign Stocks & Emerging Markets A fund specializing in Nordic stocks has trounced international competitors.

-

Understand the Major Stock Market Indexes

Understand the Major Stock Market Indexesinvesting “The market” has many proxies, but there are important differences among them.