Consider Alternative Funds to Hedge Against a Market Downturn

These funds can smooth out the ride in a bumpy market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The stock market’s gains may have you dancing a jig. But they may also have you breaking into a sweat. To ease your anxiety, you might consider adding a small dose of alternative investments—things that zig when the stock market zags—to your portfolio, even if it means giving up some potential returns. “As exciting as the stock market is today,” says Dayna Kleinman, of financial services firm Robert W. Baird & Co., “you should prepare your portfolio for a market shift by adding an investment that doesn’t move in lock step with the market.”

The results can be eye-opening. Consider the performance of one type of alternative investment, market-neutral funds, during the financial crisis a decade ago. These funds try to achieve zero market risk by employing an array of strategies with a number of different assets. While Standard & Poor’s 500-stock index lost a cumulative 55.3%, including dividends, from October 9, 2007, through March 9, 2009, market-neutral funds dipped just 1.8%, on average. Other alternatives pull in the opposite direction of the overall bond market.

The category sounds exotic, but alternatives, once the province of ultra-rich or professional investors, have become more mainstream thanks to the launch of hundreds of mutual funds and exchange-traded funds. These days, many experts say alternatives should be a part of your total asset allocation. “Alternatives smooth the ride of your overall portfolio” so you’re less likely to sell at the wrong time, says Matt Osborne, of Altegris, a money management firm. “That’s the goal of diversification.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Some advisers are recommending that clients boost their exposure to alternatives now in order to guard against the risks of a stock market that’s reaching a top and a bond market that’s coping with rising interest rates (bond prices fall when rates go up). Wells Fargo Investment Institute, the research and strategy arm of the giant bank, recommends a 23% allotment to various alternative investments for moderate-risk investors, for example, up from 16% two years ago. At Altfest Personal Wealth Management, in New York, 15% of client assets are invested in alternatives, up from 10% last year.

How they work. The diverse array of alternative investments share one common trait: They don’t behave as stocks or bonds do. The expansive category includes securities that aren’t traditional stocks or bonds, as well as strategies that might include stocks or bonds but eschew a conventional buy-and-hold approach. Commodities and currencies fit in here, as do funds that use options to hedge the stock market.

Alternatives are a tough sell. The strategies can be complex, and alternative funds charge 1.57% in annual fees, on average—more than the 1.11% expense ratio for the average actively managed large-company stock fund. Alternative funds have short track records, so most haven’t been tested in a bear market.

But the biggest hurdle for alternatives is that investors tend to misunderstand their role as portfolio diversifiers. Contrary to popular belief, most alternative strategies aren’t designed to beat the broad indexes. They’re supposed to cushion market dips or supply ballast in rocky markets, giving you greater peace of mind. “It’s like a seat belt. You put it on, but you hope you won’t need it,” says Baird’s Kleinman.

Consider the performance of two hypothetical portfolios. For the 20-year period through December 2016, a traditional portfolio with 60% invested in the S&P 500 and 40% in Bloomberg Barclays U.S. Aggregate Bond index returned an annualized 7.1%, according to Baird’s calculations. But a portfolio with 50% in stocks, 40% in bonds and 10% in indexes that included various alternative strategies returned 7.4%, with fewer ups and downs. The largest loss in the stock-and-bond portfolio over that stretch was 33.1%, compared with a 27.3% loss for the portfolio with a 10% allocation to alternatives.

Choose the right strategies. The key to alternative investing is to focus on strategies that mitigate your market concerns. For investors willing to give alternatives a shot, Morningstar alternatives analyst Tayfun Icten suggests a trio of strategies that together should offer a balanced approach to reducing stock market risk and volatility. With this trio, says Icten, you’ll give up some stock market gains, but you’ll make up for it if things head south.Start small. Divide 5% of your overall portfolio among the three types of investments listed below (in order of increasing risk), with a goal of inching up to a 10% allocation as your comfort level with alternatives increases (returns are as of December 8, unless otherwise noted).

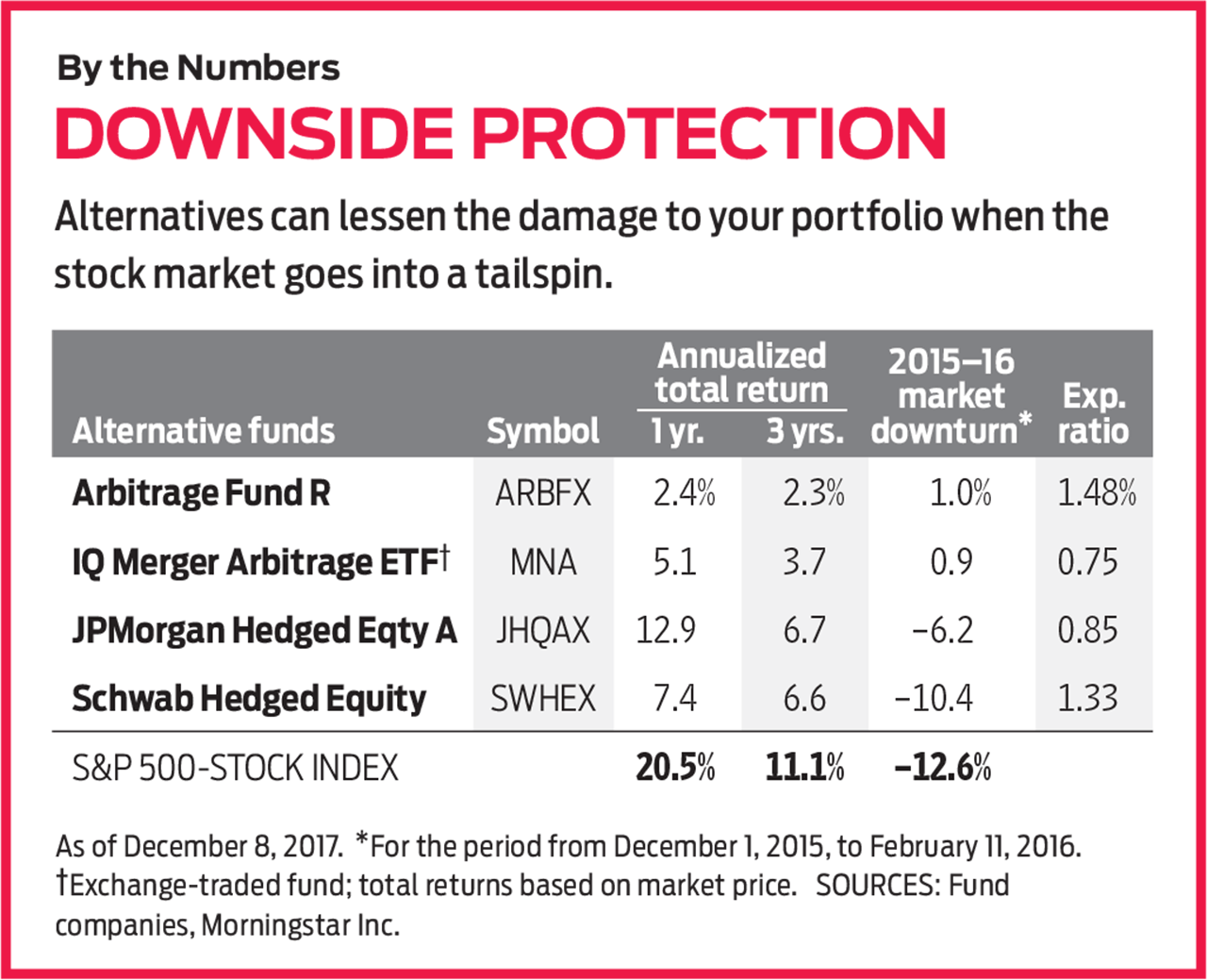

Market-neutral funds. If your goal is to invest in an asset that doesn’t move in sync with the S&P 500, consider a market-neutral fund, such as a merger-arbitrage fund. The funds invest in stocks of already announced takeover and merger targets, hoping to capture the last bit of appreciation before a deal is finalized. Although merger-arbitrage funds invest in stocks, returns are driven by completed deals, not by corporate earnings. The funds tend to hold up well in stock market downturns. And as rates rise, returns for these funds should follow suit. Merger-arbitrage strategies have historically returned three to five percentage points more per year than the yield of Treasury bills (about 1.5% currently). Our favorites include IQ Merger Arbitrage ETF (symbol MNA), which tracks a proprietary index, and Arbitrage Fund R (ARBFX).

Options-based funds. You don’t have to sell stocks to make your portfolio sturdier. Options-based funds allow you to maintain your stock exposure—or even put new money in the market—with some degree of safety. JPMorgan Hedged Equity A (JHQAX) has a lower risk profile than a typical balanced fund of 60% in stocks and 40% in bonds, and a better three-year track record, too.

A portion of the fund holds 200 large-company stocks to approximate the S&P 500. To protect your portfolio from market sell-offs, the other portion uses options—calls, which give you the right to buy a stock at a stated price by a certain date, and puts, which let you sell at a specific price by a certain date. The fund typically charges a sales fee, but you can buy it for no transaction fee (that is, no load) at Fidelity, Schwab and TD Ameritrade. Since Hedged Equity launched in 2013, it has returned 7.6% annualized, which lags the S&P 500, but the fund was 40% less volatile than the index.

Long-short stock funds. These funds bet on some stocks and against others with the goal of delivering respectable returns with low volatility. The funds have been 15% to 25% less volatile than an S&P 500-stock index fund over the past decade. The trade-off: You won’t beat the market, but you likely won’t lag far behind. Since Jonas Svallin became lead manager of Schwab Hedged Equity (SWHEX) in August 2012, the fund has returned 8.9% annualized. That trails the 15.3% gain in the S&P 500 over the same period. But the fund was also 25% less volatile than the index. The managers use a proprietary stock-rating system to buy and hold the top-rated U.S. stocks and sell short (a bet that prices will fall) the bottom-rated stocks. A recent top stock held in a long position was Citigroup, the financial services firm. A top short: Tri Pointe Group, a regional homebuilder based in California.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.

-

Wells Fargo Stock Falls Despite Q2 Beat: Buy, Sell or Hold?

Wells Fargo Stock Falls Despite Q2 Beat: Buy, Sell or Hold?Wells Fargo stock is down despite reporting better-than-expected second-quarter earnings results. Here’s what you need to know.

-

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue NewsReports that major U.S. banks would step in to help First Republic Bank helped stocks swing higher Thursday.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

Stock Market Today: Stocks Swing Higher After Consumer Sentiment Data

Stock Market Today: Stocks Swing Higher After Consumer Sentiment DataA rough start to Friday's session couldn't keep the major benchmarks from extending their daily winning streaks.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Stock Market Today: S&P 500 Extends Losing Streak

Stock Market Today: S&P 500 Extends Losing StreakThe broad market index has now closed lower for five straight sessions.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.