Cashing In on Fast-Growing Small Caps

This fund’s goal: Invest in firms that can generate annual earnings gains of at least 15%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you had been prescient enough to invest in Amazon.com when it went public 20 years ago and was still just an online bookseller, your investment today would be worth 500 times more. You probably didn’t, but you can console yourself with the knowledge that for every upstart that goes on to conquer the world, many more fizzle out. That makes small, fast-growing firms especially well suited for funds.

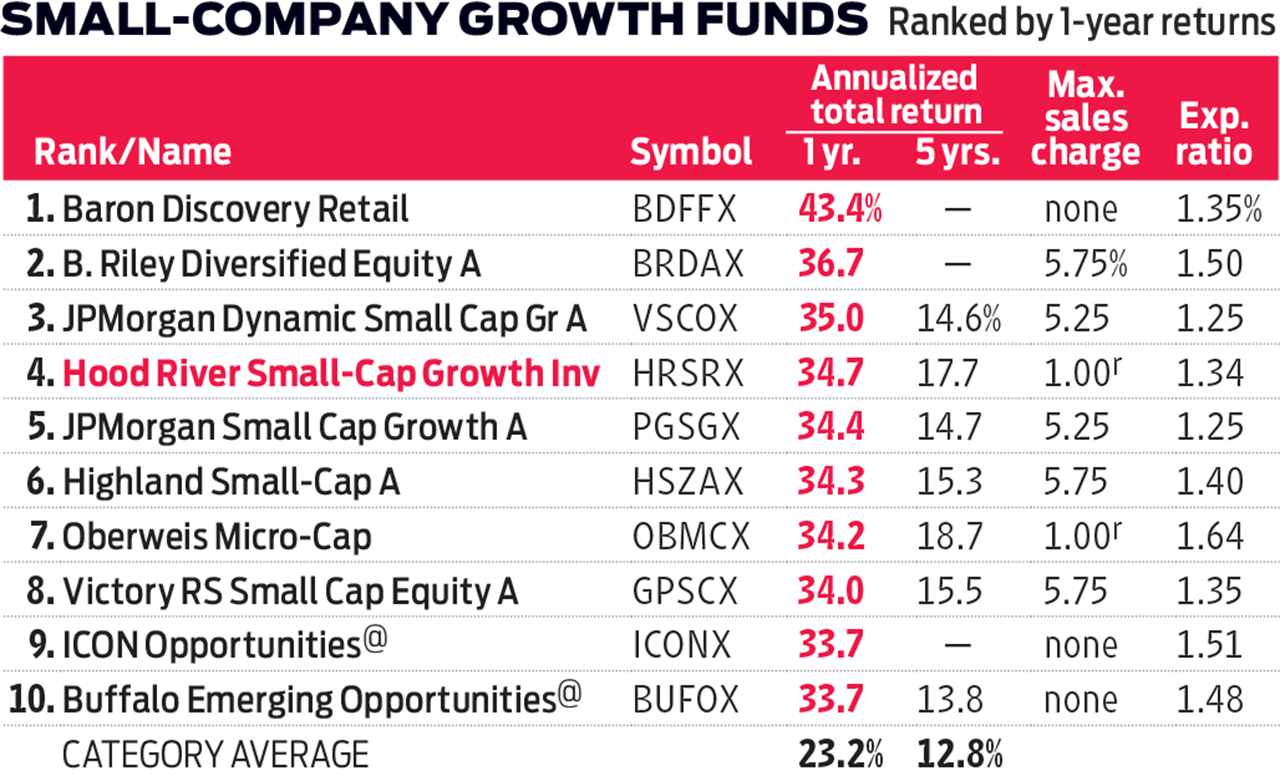

In recent years, few have done a better job navigating these treacherous waters than Hood River Small-Cap Growth (HRSRX). The fund has outpaced the small-company Russell 2000 Growth index in each of the past six calendar years (including the first half of 2017). And over the past five years, it handily beat the large-company-oriented Standard & Poor’s 500-stock index.

In charge of Small-Cap Growth are Robert Marvin and Brian Smoluch, who have been with the fund since its 2003 launch, and David Swank, a comanager since 2009. Focusing on stocks with market values of less than $4 billion, they seek companies they believe will boost earnings per share by 15% annually over the next three to five years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

After identifying these potential winners, the managers talk with executives, suppliers, customers and competitors to identify high-quality companies that Wall Street analysts are underestimating. If analysts expect a firm to earn, say, $1 per share, that projection is already reflected in the price of the stock, says Smoluch. “We’ll invest if we think it will be $1.50,” he says. Aiding the trio is what they call a “research gap”—the growing tendency of Wall Street firms to focus on large concerns, which makes it easier for diligent managers to uncover attractive small-company stocks.

Take Red Robin Gourmet Burgers. Hood River, which had previously owned and sold shares in the restaurant chain, repurchased the stock early this year after the firm brought in new leadership from fellow restaurant operator Brinker International. Those execs, says Marvin, helped boost Brinker’s profit margins sharply, and they could well do the same for Red Robin. Analysts weren’t baking the improved outlook into their earnings estimates, so the fund snapped up the stock. Since then, the shares have surged by 23%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

How to Position Investments to Minimize Taxes for Your Heirs

How to Position Investments to Minimize Taxes for Your HeirsTo minimize your heirs' tax burden, focus on aligning your investment account types and assets with your estate plan, and pay attention to the impact of RMDs.

-

Are You 'Too Old' to Benefit From an Annuity?

Are You 'Too Old' to Benefit From an Annuity?Probably not, even if you're in your 70s or 80s, but it depends on your circumstances and the kind of annuity you're considering.

-

Seeing Retirement Ahead? Why Your 50s Will Be So Significant

Seeing Retirement Ahead? Why Your 50s Will Be So SignificantThis is the perfect time to assess whether your retirement planning is on track and determine what steps you need to take if it's not.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.