Contrarian Funds: Charting Their Own Path

Funds that go against the flow have struggled lately but are due for a turnaround.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Warren Buffett best described how to be a contrarian investor: "Be fearful when others are greedy, and greedy when others are fearful." In other words, move counter to the crowd. Investors like Buffett are proof that a contrarian approach can reap big rewards. But in recent years, most contrarians have underperformed as a small group of popular, fast-growing tech companies have fueled stock market gains.

Consider: Standard & Poor's 500-stock index climbed 13.7% annualized over the past 10 years, while Amazon.com, for example, returned 37.0% and Netflix returned a whopping 47.8%. The lengthy economic recovery and the persistent growth of trends such as cloud computing and streaming video have "pulled all the indexes up, making a high hurdle for contrarians to overcome," says Bruce Kaser, head of stock research at the Turnaround Letter, a contrarian investment newsletter. (Returns and other data are as of September 6.)

That said, a smart investor would do well to give stock funds with a contrarian approach a closer look, given their recent underperformance. There's reason to believe this investment style will see better days ahead. Volatility is higher, for one thing, which bodes well for contrarian investors. "It leads to more opportunities," says Kaser.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Contrarians buy what others shun, whether it's an individual stock (say, Boeing or General Electric), an industry sector (these days, energy or health care) or a significant slice of an entire asset class (emerging-markets stocks or small-company stocks, for instance). Because out-of-favor assets tend to be cheap, the strategy of contrarian investing is similar to value investing, which focuses on assets that are underpriced based on certain measures. But not all contrarian stocks are value stocks. A fast-growing tech firm can be a contrarian choice at times. For example, gaming-chip maker Nvidia was deeply out of favor in 2012, but even at its nadir no one would have mistaken it for a value play. And Amazon had its share of haters in 2014.

Good stock pickers with a contrarian tilt start with underpriced shares that the market has spurned, but they only buy if they can identify a catalyst or good strategic plan to turn things around. As Charles Pohl, chairman and chief investment officer of fund firm Dodge & Cox, says, "Many of the companies we're invested in could be described as contrarian, but they are really value investments based on in-depth research. We're not knee-jerk contrarians. We don't just buy stuff because everybody else hates it."

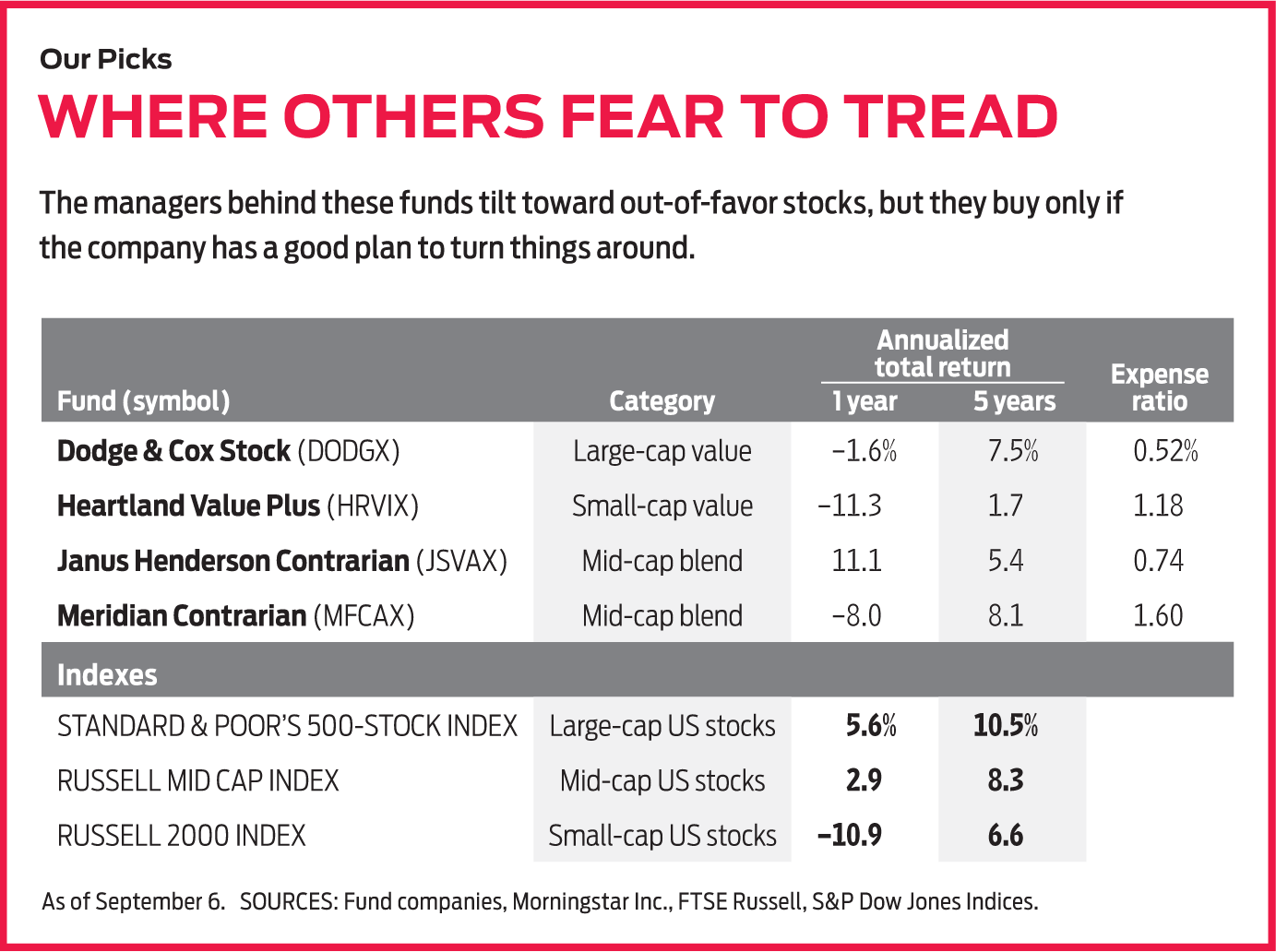

You have to hunt for contrarian funds. A handful of funds have the word contrarian in their name, but there isn't a fund category for this strategy. We found four that we think qualify for the designation, though not all of the managers who run them would call themselves strict contrarians. Recent performance may not impress, but that's in part what makes them intriguing opportunities today.

Bear in mind that contrarian investing requires patience. "It can take time for the herd mentality to reverse," says Kaser. That's why contrarian bets should be only a portion of a diverse portfolio. If you're thinking about buying shares in any of the funds below (or making a bet on an out-of-favor sector or individual stock), make sure your portfolio has a strong mix of assets and investment approaches for balance.

DODGE & COX STOCK (symbol DODGX). This member of the Kiplinger 25, the list of our favorite actively managed no-load funds, boasts the lowest annual expense ratio of our contrarian picks: 0.52%. The 10 value-oriented managers at this large-company U.S. stock fund invest with a three-to-five-year holding period in mind and will wait even longer for troubled firms to turn around.

Some of their investments are controversial. "I can give you countless examples of times people thought I was out of my mind with various stocks we bought," says Pohl, who is also a comanager of Stock. "We were heavily criticized" for an early 2000s bet on computer maker Hewlett-Packard, he says. The stock languished, for the most part, until 2013. "You've got to have a lot of patience and persistence, and you've got to have a thick skin," says Pohl. In late 2015, Hewlett-Packard split into two companies—HP and Hewlett Packard Enterprise—and each stock has since beaten the S&P 500, with better than 12% annualized returns. The fund continues to hold both stocks.

In recent months, the managers have been adding to their stakes in two beaten-down health care companies, Cigna and Bristol-Myers Squibb, even as those shares sink further.

The fund's strategy tends to result in streaky returns. With a 1.6% loss for the past 12 months, it trails 72% of its peers—funds that focus on large-company, value-priced stocks. But investors who stick with the fund have been richly rewarded. Over the past 10 years, for instance, Stock outpaced the S&P 500 and ranked among the top 20% of its peers.

HEARTLAND VALUE PLUS (HRVIX). Bradford Evans says he and Andrew Fleming, his comanager at Heartland Value Plus, are "dyed-in-the-wool contrarians." They look for unloved, underfollowed and undervalued small-cap stocks with strong balance sheets. Dividends are a plus, too. On top of that, Evans and Fleming want to see a solid plan to improve revenues and earnings and a management team that makes shareholder-friendly moves, such as paying down debt or buying back shares. The portfolio holds 43 stocks, with an average market value of $1.7 billion. The fund currently yields 0.59%.

The managers are particular about selling, too. If a balance sheet turns "upside down"—liabilities exceed assets—or a catalyst for change fails, they sell immediately. They'll also sell if a firm does everything right and its stock reaches what the managers deem is its full value. "We don't want to get too greedy," says Evans. He and Fleming are finding the current wobbly market a "good stock-picking environment," however, and are finding opportunities in every sector.

Evans and Fleming have run the fund together since 2016, and they beat the fund's benchmark, the Russell 2000 Value index, and its competition (funds that focus on small-company stocks trading at a value price) with an 11.0% annualized return over that time. The fund's expense ratio is 1.18%, which is about average for small-company stock funds.

JANUS HENDERSON CONTRARIAN (JSVAX). Manager Nick Schommer has only two years under his belt at Janus Henderson Contrarian. We'd prefer a longer track record, but so far, so good. Since Schommer took over in mid 2017, the fund has returned 12.2% annualized, which narrowly beats its benchmark, the S&P 500. Expenses are a low 0.74%.

Schommer, who calls himself an opportunistic contrarian, has been busy. He has overhauled the portfolio, winding up with 39 stocks that fit into one of three categories: what he calls misunderstood businesses; undervalued companies whose parts are separately worth more than the whole; and firms whose earnings and revenue growth rates are underappreciated.

Ball Corp., the aluminum-can maker, was misunderstood in 2017. "Two years ago, it was all about plastic bottles," he says. "No one understood there would be a backlash and a focus on recyclable products." And shares of French media conglomerate Vivendi were undervalued in late 2017, when Schommer bought shares because, he says, few recognized the digital streaming value of its music business, Universal Music Group. PagSeguro Digital, a Brazilian mobile payment company, falls in the underappreciated growth-stock category. The stock was sagging in early 2018 because of overblown competition fears, says Schommer. But Brazil is a decade behind the U.S. in digital penetration, and PagSeguro has a "long runway to grow," he says. (About 9% of the fund's assets are invested in foreign stocks.)

The blend of contrarian picks helps to smooth the fund's returns, says Schommer. "It creates different opportunity sets so the portfolio can perform throughout different parts of the [market and economic] cycle and not just when value is in favor," he says. "I didn't want to build a portfolio that was always waiting for next year to realize the value of the companies."

Schommer has been finding "ample" opportunities these days, he says, especially in misunderstood businesses. He recently picked up shares in private-equity powerhouse Apollo Global Management, which owns a number of businesses, including the gaming hotel and casino company Caesars Entertainment and the parent company of cruise line Regent Seven Seas.

MERIDIAN CONTRARIAN (MFCAX). You've got to take the good with the bad with this fund. The A shares of Meridian Contrarian charge a 5.75% load, but you can buy shares for no fee through Schwab. The high, 1.60% annual expense ratio is a turnoff, too, but in the past, the fund's performance has made up for it. Over the past five years, it returned 8.1% annualized. That beats its benchmark—the Russell 2500 index, which tracks small and midsize companies—and 86% of its peers, or funds that invest in midsize companies with growth and value characteristics. (Contrarian has an Investor share class, whose symbol is MFCIX, with a 1.35% expense ratio, but the initial minimum investment is $99,999, which could be prohibitive.)

Manager James England favors small and midsize companies, but he can invest in firms of any size. The fund's 60-odd holdings have an average market value of $5.5 billion (squarely in the midsize range). But nearly 13% of the fund's assets are invested in large-company stocks, including the giant insurer American International Group and chip maker Advanced Micro Devices.

England's ideal stock trades at a discount, but a cheap price isn't enough. The business has to have a problem that can be fixed and a good strategy to fix it. "Having a catalyst that can improve long-term earnings growth helps us avoid value traps," he says, referring to discount stocks that fail to recover in price. He avoided the electronic game store GameStop, for instance, because its industry is moving increasingly online. "If there's no prospect for the business to actually turn around," says England, a cheap stock price doesn't really matter.

He holds on to winners long after they've earned back admirers, unlike some contrarians. Nvidia is one example. England first bought shares in 2012. The stock was depressed because of an acquisition in a mobile-phone chip maker that many viewed as a misstep. But England saw other prospects for the firm's chips—in cars, among other things. The stock climbed from roughly $13 a share in 2013 to $280 in 2018. The fund still holds shares of Nvidia, which is currently undergoing another "pause" in its business, England says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.