Is a Debt Bomb Ticking?

Corporations have amassed a ton of debt. Protect yourself with these funds and ETFs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

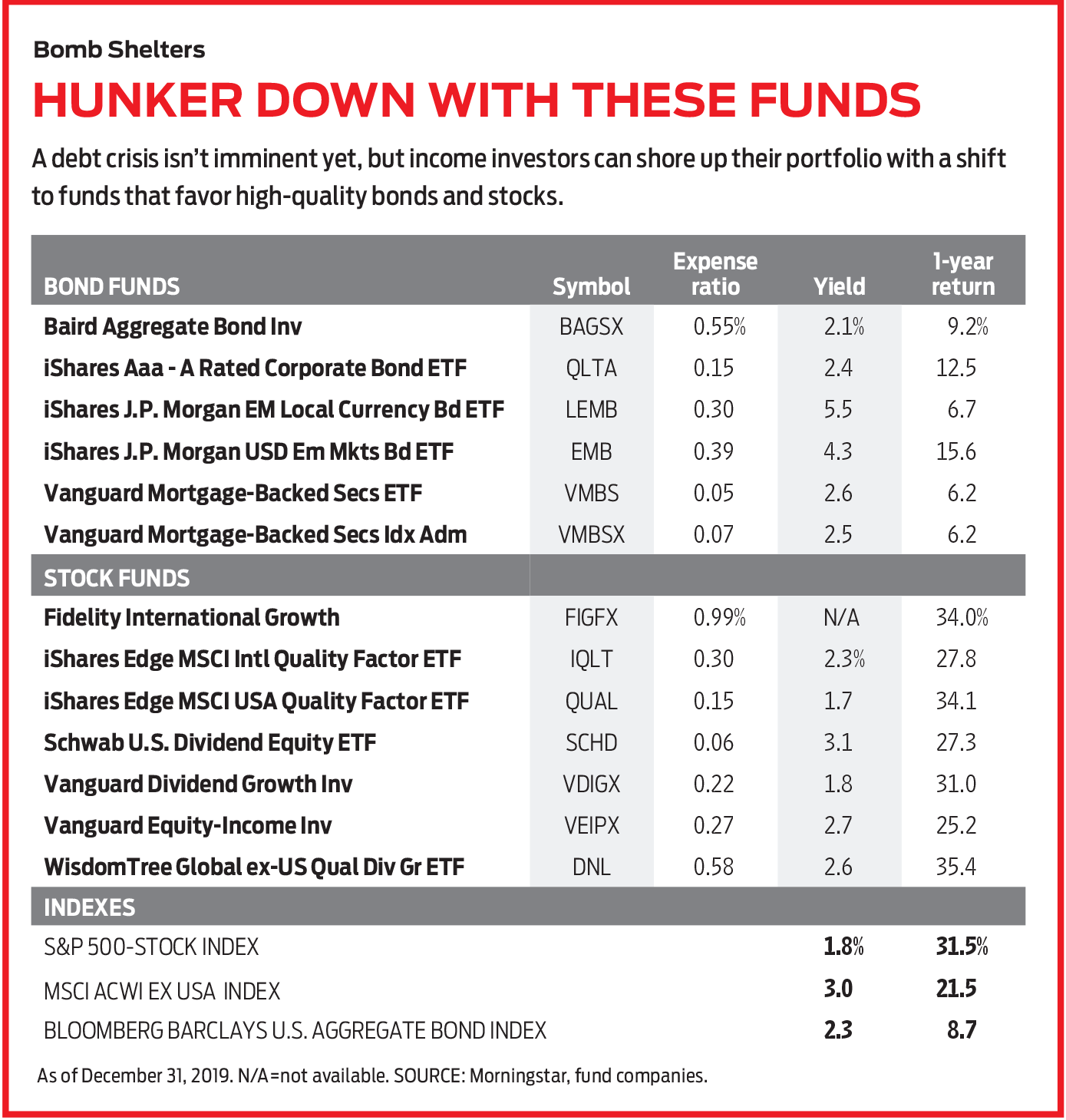

If debt lights the fire of every financial crisis, as author Andrew Ross Sorkin once observed, then we may have a problem brewing. Companies have loaded up on a record amount of debt in recent years, thanks in part to rock-bottom interest rates. Most market watchers don’t expect the buildup to trigger an imminent credit disaster. Still, investors should be aware of risks that are building and choose carefully as they invest in bonds or stocks.

Bond investors

Build a core. A well-balanced portfolio needs a core bond fund for ballast. A true core bond fund holds mostly A-rated debt and no more than 5% of assets in high-yield bonds. The managers at Baird Aggregate Bond Fund (symbol BAGSX, expense ratio 0.55%) buy only investment-grade bonds. More than half of the fund’s assets sit in triple-A-rated debt, including Treasuries and government-backed mortgage securities. The rest of the fund’s holdings include high-quality corporate debt (40%) and other asset-backed securities (8%). The fund yields 2.09%, which may not impress income seekers, but its main role is to hold up in hard times. Consider it an insurance policy against a recession.

Beef up your safe havens with other government bonds. Agency mortgage-backed securities come with the same guarantee of Treasuries and a touch more yield. Stable interest rates should keep prepayments—a risk with mortgage debt—at bay. Vanguard Mortgage-Backed Securities comes in an exchange-traded-fund share class (VMBS, 0.05%, share price $53) and a mutual fund class (VMBSX, 0.07%). Both hold only triple-A-rated mortgage bonds. The ETF yields 2.55%, and the mutual fund yields 2.53%, a tad more than the typical core bond fund.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Move up in corporate quality. Everything worked in fixed-income markets last year. Take some profits in junkier debt and bolster your exposure to higher-quality bonds. IShares AAA-A Rated Corporate Bond ETF (QLTA, 0.15%, $55) offers exposure to the highest-rated corporate IOUs and yields 2.42%.

Try emerging-markets bonds for extra income. This isn’t the risky sector it once was. Today, more than half of the emerging-markets bond universe is investment grade. The dollar isn’t as strong as it was in late 2017 and early 2018. In fact, it was relatively stable in 2019 against a basket of foreign currencies. And many analysts expect it to weaken this year. “Dollar weakness is positive for EM assets because governments and companies have a lot of dollar-denominated debt. When the dollar rises, it’s like a tax,” says Alec Young, FTSE Russell’s managing director of global markets research. And when it weakens, it’s like a rebate.

See Also: Contrarian Funds: Charting Their Own Path

Be prepared for volatility. The ride with emerging-markets bonds is twice as bumpy as the typical core bond fund. But securities in this sector, on average, yield twice as much. iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB, 0.39%, $115) yields 4.31%. This ETF sidesteps the impact of currency swings by buying dollar-denominated bonds. For a boost in income, you could pair your dollar-based ETF with the version that invests in IOUs in local currencies, iShares J.P. Morgan EM Local Currency Bond ETF (LEMB, 0.30%, $44), which yields 5.50%.

Stock investors

See what supports your dividends. Avoid companies with a lot of debt. Professional stock (and bond) pickers scrutinize balance sheets and income statements to get a sense of whether a company has the wherewithal to pay its debts—because if it comes to a choice between making a debt payment or paying a dividend, the former will always win. “Understanding what a company intends to do with its debt and how it intends to pay it down is paramount to what we do,” says Capital Group’s David Bradin, an investment specialist at American Funds.

Consider two automakers, Ford Motor and Daimler AG. Both offer similar dividend yields: Ford, 6.37%; Daimler, 6.46%. But Ford has a triple-B credit rating and Daimler is rated single-A. Moreover, Daimler generates enough in annual operating income to pay its yearly interest expenses 13 times over. Ford throws off enough to pay three years’ worth of interest payments. “Investors can jump to a conclusion that two companies in a similar industry with similar yields are the same,” says Capital Group’s Hanks. “But one has more risk than the other, and its dividend could get cut. You might want to ask yourself, Am I getting paid for the risk I’m taking?”

Choose a dividend pro. At Vanguard Equity-Income (VEIPX, 0.27%), two firms run the fund but work separately, homing in on large, high-quality firms with above-average yields. The fund yields 2.70%. Schwab U.S. Dividend Equity ETF (SCHD, 0.06%, $58) isn’t actively managed, but the companies in the index it tracks must meet several criteria. Firms must have paid dividends for at least 10 consecutive years, for starters. And only firms with the best relative financial strength, marked by their ratio of cash flow to total debt and their return on equity (a profitability measure), make the final cut. The ETF yields 3.11%. Vanguard Dividend Growth (VDIGX, 0.22%) yields just 1.84%, but manager Donald Kilbride focuses on cash-rich, low-debt firms that can hike dividends over time. Morningstar analyst Alec Lucas says the fund is “a standout when markets tremble.”

Add a dash of high quality. A strong balance sheet—one that’s low in debt—is a key characteristic of a high-quality company. It’s right up there with smart executives at the helm and a solid business niche in its industry.

Double down on high quality with iShares Edge MSCI USA Quality Factor ETF (QUAL, 0.15%, $101). The ETF invests in a diversified group of 125 large and midsize firms that have low debt, stable annual earnings growth and high return on equity. Johnson & Johnson, Pepsico and Facebook are among its top holdings. BlackRock has an international-stock version of this ETF, iShares Edge MSCI International Quality Factor ETF (IQLT, 0.30%, $32), that held up better than the MSCI ACWI ex USA Foreign-Stock index during the 2018 correction. The ETF yields 2.31%, and top holdings include Nestlé and drug company Roche Holding.

Go abroad. Companies in the rest of the world are less indebted, on average, than firms in the U.S. Even better, if you focus on the best players overseas, you might beat the U.S. stock market, says Capital Group’s Robert Lovelace. “A majority of the best-performing stocks over the past 10 years were companies based outside the U.S.”

At Fidelity International Growth (FIGFX, 0.99%), manager Jed Weiss focuses on firms with a competitive edge. If a company can raise prices for its goods without a drop-off in demand, Weiss is happy. That’s a trait that can buoy a business in rough times.

WisdomTree Global ex-U.S. Quality Dividend Growth (DNL, 0.58%, $66) invests in 300 dividend-paying companies in developed and emerging foreign countries. The fund yields 2.6%. The firms must meet certain quality and growth bars, including return on equity and return on assets (another profitability measure), to be included in the fund. As a result, the portfolio has an average debt-to-capital ratio of 29—less than the 34 ratio of the MSCI ACWI ex USA index (and 44 for the S&P 500). The U.K., Japan and Denmark are its biggest country bets.

See Also: Remembering One of the Great Debt Fighters

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.