Small Bank Stocks Help this Fund Crush Rivals

Investing in dull savings and loans proved exciting for Hennessy Small Cap Financial Fund.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

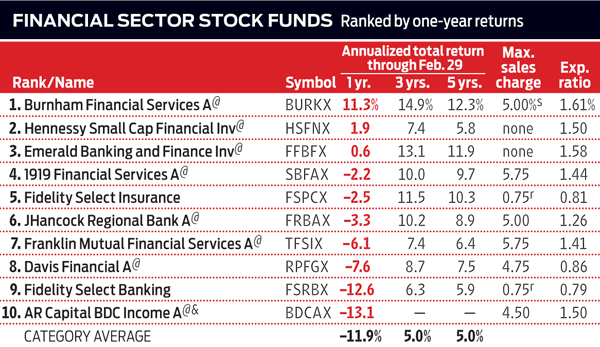

If anything underscores the idea that bigger isn’t always better, it’s the recent results of small-bank stocks in general and of Hennessy Small Cap Financial Fund (HSFNX) in particular. Although the fund gained only 1.9% over the past year, it crushed the average financial sector fund by 13.8 percentage points.

Bank stocks have been flailing because of recession fears, uncertainty about interest rates and concerns that many energy firms may default on their loans. But small banks have held up better than their larger counterparts. Over the past year, the KBW Nasdaq Regional Banking index, which tracks shares of small banks, shed 5.7%, while a KBW index that tracks large banks sagged 14.9%.

Hennessy’s managers, Dave Ellison and Ryan Kelley, invest mainly in savings and loans with market values of less than $3 billion. Small banks earn 70% to 100% of their profits from the “spread”—the difference between the rate at which they borrow and the rate at which they lend. Big banks, Ellison says, rely much more on such things as investment banking and money management. Small banks, he adds, benefit more from higher interest rates, which is why investors flocked to them when it became apparent that the Federal Reserve would raise rates last year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Hennessy held 38 stocks at last report. Its top three holdings were WSFS Financial, Flushing Financial and Independent Bank.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate Cuts

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate CutsThe November jobs report came in higher than expected, although it still shows plenty of signs of weakness in the labor market.

-

December Fed Meeting: Updates and Commentary

December Fed Meeting: Updates and CommentaryThe December Fed meeting is one of the last key economic events of 2025, with Wall Street closely watching what Chair Powell & Co. will do about interest rates.