Vanguard Target Retirement 2030 Keeps Its Eye on the Prize

With these retirement-focused funds, staying put is the best strategy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When the stock market crashes, the hardest thing to do is to do nothing. But target-date fund investors who took that route came out of the sell-off just fine.

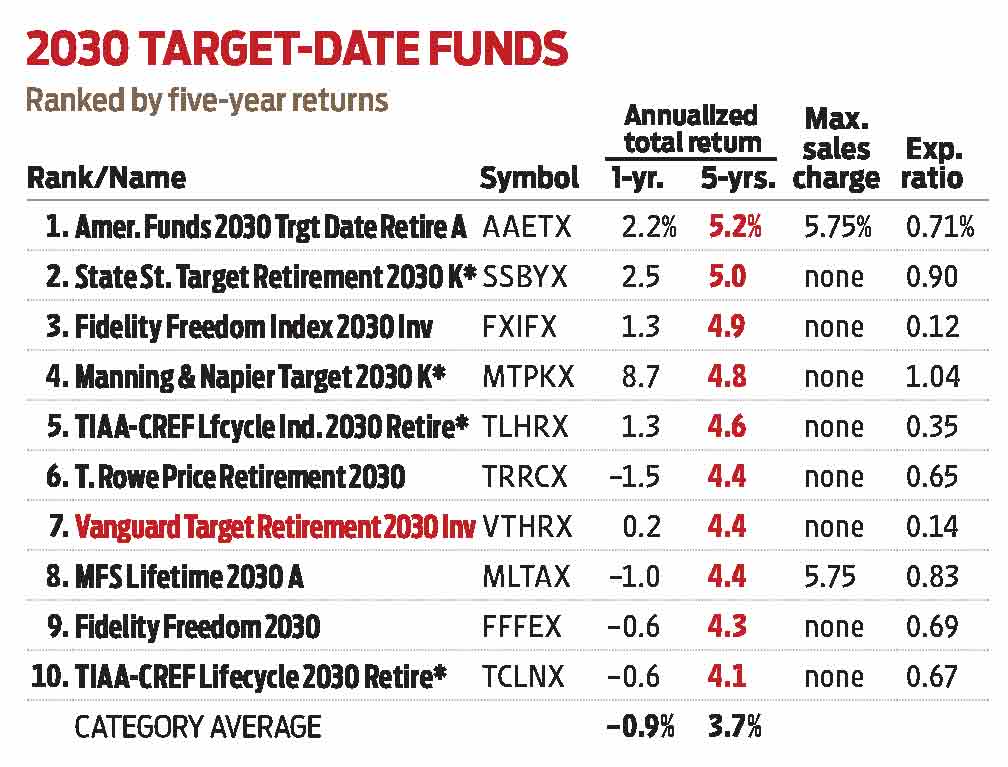

Vanguard Target Retirement 2030 (symbol, VTHRX), a proxy for all target-date funds but designed for people with 10 years to go before retirement, returned 0.2% over the past 12 months, including a 24.9% loss from peak to trough in February and March. That beats 71% of all target-date 2030 funds. For context, Standard & Poor’s 500-stock index lost 34% during the winter sell-off.

Target-date funds, which hold stocks and bonds, are designed to help people invest appropriately for retirement. Experts make the investing decisions, rebalance the portfolio when needed and shift holdings to a more conservative mix as you age. The Target Retirement 2030 fund has 67% of assets in stocks, 31% in bonds and 2% in cash.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

These funds, fixtures in 401(k) plans, also help save investors from themselves. Most target-date fund investors buy shares with every paycheck, automatically buying at lower prices in down markets. They tend not to sell until they’re close to retirement.

During the historic sell-off, some shareholders did unload a few shares. The net inflow (money coming in, less money going out) in Vanguard’s Target Retirement series, which includes 12 funds, was negative in March by $3.9 billion. That was unusual but modest, given that the firm manages a total of $726 billion in target-date fund assets, says Vanguard spokesperson Carolyn Wegemann.

Shareholders who sold missed out on rebalancing moves in March, when portfolios took profits in higher-priced fare to buy low-priced assets in order to keep target allocations intact. Given market volatility, Vanguard rebalanced Target Retirement portfolios, which hold index funds, more than usual. “Sometimes the market was down 10% one day and up 10% the next,” says Marty Klepp, who heads Vanguard’s index strategy team.

Over the long haul, Vanguard Target Retirement 2030 has delivered solid returns. Since its June 2006 inception, the fund has gained 6.0% annualized, better than the 4.9% annualized return in the typical fund with a 2030 target date.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Smart Ways to Invest Your Money This Year

Smart Ways to Invest Your Money This YearFollowing a red-hot run for the equities market, folks are looking for smart ways to invest this year. Stocks, bonds and CDs all have something to offer in 2024.

-

Vanguard's New International Fund Targets Dividend Growth

Vanguard's New International Fund Targets Dividend GrowthInvestors may be skittish about buying international stocks, but this new Vanguard fund that targets stable dividend growers could ease their minds.

-

Best 401(k) Investments: Where to Invest

Best 401(k) Investments: Where to InvestKnowing where to find the best 401(k) investments to put your money can be difficult. Here, we rank 10 of the largest retirement funds.

-

7 Best Stocks to Gift Your Grandchildren

7 Best Stocks to Gift Your GrandchildrenThe best stocks to give your grandchildren have certain qualities in common. Here, we let you know what those are.

-

How to Find the Best 401(k) Investments

How to Find the Best 401(k) InvestmentsMany folks are likely wondering how to find the best 401(k) investments after signing up for their company's retirement plan. Here's where to get started.

-

How to Master Index Investing

How to Master Index InvestingIndex investing allows market participants the ability to build their ideal portfolios using baskets of stocks and bonds. Here's how it works.

-

The Best Vanguard ETFs to Buy

The Best Vanguard ETFs to BuyThe best Vanguard ETFs all feature rock-bottom fees, large asset bases and long trading histories. Here are a few of our favorites.