Consistency Is the Key to Investing When You're Retired

Once your account is dormant, you can no longer use the volatility of the markets to your advantage.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Most investors, and even some advisers, do not understand the difference between active and dormant accounts. But knowing how to invest in each is paramount to having a successful retirement.

In an active account, such as a 401(k), 403(b) or individual retirement account, you're still buying assets and contributing regularly. When the market goes down in value, you probably don't like it, but you don't worry excessively because you're still buying shares, and you can get them at a lower price. That helps you recover more quickly when the market goes up. Buying mutual fund shares regularly in an active account can be appropriate for some investors because you can take advantage of the volatility.

You generally want to avoid mutual funds in a dormant account, however. A dormant account is any account that you are not putting money into on a monthly basis; or even less ideal, an account from which you are withdrawing money. Both stock and bond markets are volatile, and the fee structure of a mutual fund acts like an anchor over time on dormant account. When the market goes down in value, you are going to lose money, and you will not be using the volatility to your advantage. Instead you have to wait and hope that the market recovers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For example, let's say your lifestyle needs require you to take out 5% annually from the $1,000,000 in your account, or $50,000. If you continue to do so when your account total has dropped, the amount you withdraw can never go back up in value. It's gone. You don't recover from that type of scenario. That's why it is typically inadvisable to depend solely on an account that fluctuates with the markets to provide you with retirement income.

Still, I meet with people every day who have dormant accounts that are 80% or 100% invested in mutual funds. In most cases, it's a scenario that isn't working well for them. Over the last 10 years, it hasn't been a good approach, in my opinion, nor do I see it as an appropriate strategy for the next decade.

Put another way: If you have one dollar invested in a stock market index, and the market crashes, losing 50% of its value, your dollar will be worth 50 cents. If you sit tight and the next year the market rallies, gaining 50%, do you have your dollar back? No, you have 75 cents. You'd have to have a return of 100% to offset the 50% loss.

Once your account goes dormant, you're better off investing in assets that will not lose value due to market volatility. Examples include certain annuities (fixed and indexed), certificates of deposit or exchange-traded funds with a stop-loss attached to it. Whatever type of investment you prefer, the most important thing is that you avoid volatility.

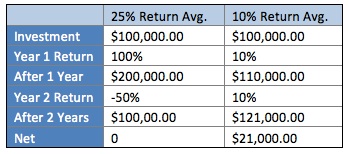

Consistency is what counts when you're retired and relying on a dormant account for income. If you get a 10% average return on your money, that can actually outperform a 25% average return.

Let me go over an example of how it works: Say that you put $100,000 in a potentially volatile investment—perhaps someone convinced you that in the long run you would be fine. The first year it works well for you: You chose the right initial public offering or technology stock and got a 100% return. You now have $200,000. You're happy, so you do it again, and in the second year, because of a market correction, you lose half the account value. You're back to $100,000. It went up 100%, but then it went down 50%. On average, your return over the two-year period is 25%—but in reality, you know you haven't gained a cent. And when you enter fees into the equation, it makes the situation even worse.

Now let's say that you don't want to take a whole lot of risk, and you look for more consistency. So you put your $100,000 into an account, and the first year you get a 10% return. Your $100,000 is now $110,000. The second year you invest the same way and get another 10% return. You now have $121,000. The average advertised rate of return on that investment is 10%. The other accounts advertised average rate of return is 25%, but the account that averaged 10% is worth more money.

It's the volatility, therefore, that can destroy a retirement. You need consistent, predictable, and all-but-guaranteed results when the account must support your lifestyle for the next 10, 20 or 30 years. It's all really very simple math. It's the way that the numbers shape up through consistent returns year after year after year. It's a wise strategy that can allow you to live more boldly in retirement.

Matt Dicken is the founder and CEO of Strategic Wealth Designers, a financial services firm working to help both retirees and pre-retirees on the path toward a more confident financial future. He is an Investment Adviser Representative and insurance professional.

Steve Post contributed to this article.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Matt Dicken is the founder and CEO of Strategic Wealth Designers, a financial services firm working to help both retirees and pre-retirees on the path toward a more confident financial future. He is an Investment Adviser Representative and insurance professional. Dicken is the author of two books and host of the TV show "Strategic Wealth with Matt Dicken," which airs on ABC and CBS affiliates.

-

Money Questions Couples Should Ask Before Combining Finances or Planning a Future Together

Money Questions Couples Should Ask Before Combining Finances or Planning a Future TogetherHonest financial conversations can reduce stress, strengthen trust and help couples align long-term goals.

-

Ask the Tax Editor: IRAs

Ask the Tax Editor: IRAsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on IRAs

-

At-Fault States Where No-Fault Insurance Still Applies

At-Fault States Where No-Fault Insurance Still AppliesThink you live in an at-fault car insurance state? These four still have some tricky no-fault insurance laws you should know about.

-

4 Pro Tips for Successfully Scaling the Medicare Mountain

4 Pro Tips for Successfully Scaling the Medicare MountainAttempting to conquer Medicare without a plan is risky. The safest route requires a thorough understanding of your options and never leaves decisions to chance.

-

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised FundIf a charitable remainder trust puts too many constraints on your family's charitable giving, consider combining it with a donor-advised fund for more control.

-

The Illinois 'Cliff Tax': A Single Dollar Could Cost Families Hundreds of Thousands

The Illinois 'Cliff Tax': A Single Dollar Could Cost Families Hundreds of ThousandsIllinois' estate tax "threshold" (rather than "exemption") can surprise families, but proactive planning can help preserve more for heirs and charitable causes.

-

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in RetirementThis kind of planning focuses on the intentional design of your estate, philanthropy and long-term care protection.

-

Fixed Indexed Annuities and Bonds: The Perfect Match as Interest Rates Inch Lower?

Fixed Indexed Annuities and Bonds: The Perfect Match as Interest Rates Inch Lower?The prospect of more interest rate cuts has investors wondering how to enhance the bond portion of their portfolio. A fixed indexed annuity could be the answer.

-

'Fee-Only' and 'Fiduciary' Are Not the Same: A Financial Pro Sets the Record Straight

'Fee-Only' and 'Fiduciary' Are Not the Same: A Financial Pro Sets the Record StraightThe terms fiduciary and fee-only are not interchangeable. Knowing the difference ensures investors get the advice and the consumer protection they need.

-

I'm a Financial Adviser: This Is Why a Second (Gray) Divorce Could Cost You Big-Time

I'm a Financial Adviser: This Is Why a Second (Gray) Divorce Could Cost You Big-TimeDivorce isn't any easier the second time, especially if you've remarried later in life. Rushing to settle without proper advice can have serious consequences.

-

A Matter of Trustees: Is Your Spouse the Best Person to Manage the Kids' Trusts?

A Matter of Trustees: Is Your Spouse the Best Person to Manage the Kids' Trusts?Naming your spouse as trustee can provide invaluable familial insight and continuity, but you should carefully weigh those benefits against potential risks.