Is Your High-Performing Mutual Fund Killing Your Portfolio?

You should be more concerned about a fund's volatility than its average annual return.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Mutual funds are the cornerstone of many investors' portfolios. Choosing the right one for your retirement plan can be complicated. There are thousands of mutual funds in the U.S. alone, holding trillions of dollars in assets.

With so many choices, how do you pick the right mutual funds for a successful investment strategy?

Consider this real-life example (names have been changed, of course, to protect confidentiality): Bob and Sally walked into my office looking for advice about mutual funds. They had narrowed their choices to two funds, but that's when it got tricky.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Each fund had the exact same average annual return over the past five years: 5.53%. They wondered, "Which one do we choose?"

You would think two funds with the same average annual return would produce the same amount of money, right?

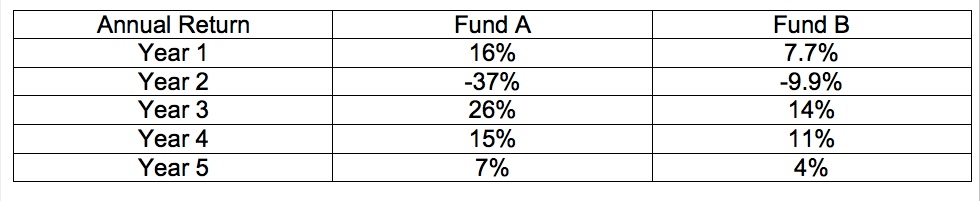

Let's take a closer look. Here's a chart showing a side-by-side comparison of the two funds' rates of return.

Over the past five years, the holdings in Fund A produced big returns (nearly twice as big as Fund B's gains) four out of five years with one bad year. The five-year average annual return was 5.53%.

The five-year average annual return of Fund B was also 5.53%. It posted lower returns than Fund A four out of five years and recorded a smaller loss in Year 2.

Okay, so which one should Bob and Sally choose?

The answer is Fund B. Emphatically. It's not even close, and here's why:

With $500,000 invested in each fund, and with an average return of 5.53% a year, Fund A earned $69,477.

Mutual Fund B earned $143,357.

That's an eye-popping difference of $73,880!

What's going on here? Volatility. It's all about the volatility within a mutual fund. The fund with the least amount of volatility produced more cash over five years.

People generally think rate of return is the most important factor to a fund's success. But the truth is volatility is a bigger factor.

For example, if a mutual fund drops 25% one year, then you need a 33% increase just to break even. Bigger losses require even bigger gains—a 50% drop needs a 100% increase to get back to even.

Bob and Sally's example serves as an important heads-up if you're buying in the current market, now at historic highs, because volatility in a dramatic downturn could translate into significantly less money for your portfolio over a period of years.

This lesson raises a key question: Why do we accept higher risk, and volatility, in our personal portfolios?

It goes back to the basic investment principle that we're all led to believe: take the higher return to earn more money; accept more risk for more return.

But that's not necessarily the right choice. Mutual funds experiencing big fluctuations like the one above—Fund A with a 37% drop in one year—are detrimental to your portfolio. That's an eye-opening lesson.

Reducing Volatility

Apply the same principle to your own investment portfolio. Can you reduce volatility in your portfolio through smart asset allocation? Make sure your portfolio is not weighted too heavily with one type of fund. That strategy will better protect you from big market downturns.

You'd be surprised by the number of investors walking into my office who firmly believe their portfolio has low volatility like our Fund B, but a closer look reveals they actually own something closer to Fund A. About 70% discover they have too much volatility.

One other thing to consider: Many people buy passively managed mutual funds because they charge lower fees. Low fees mean low turnover in the fund; managers are not trading much.

That strategy is great for a rising market, but in a year like 2016 with lots of ups and downs, you want your portfolio to have more flexibility so you can adjust them during market fluctuations.

Giving managers the option to grab discounts, or sell poor performers, could reduce volatility and put your portfolio in a better position over the long term. Not making changes can cost you.

Now you're better prepared to put together a winning retirement portfolio. You understand it's more important to evaluate the volatility in a fund rather than its average rate of return.

That's a valuable lesson whether you're in your 40s or 50s, or nearing retirement like Bob and Sally.

Talk to an investment adviser about performing a full analysis on your mutual funds. It will reveal whether volatility in your high-performing mutual fund is actually killing your portfolio, and if you need to adjust your game plan.

Reid Johnson is president and founder of Lake Point Advisory Group LLC, outside of Dallas, Texas. He is an Investment Adviser Representative and insurance professional. His personal mission is to help people achieve financial security so they're comfortable in retirement.

Dave Heller contributed to this article.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Reid Johnson, TX license 1068067, is president and founder of Texas-based Lake Point Advisory Group, LLC (www.lakepointadvisorygroup.com). As a financial professional and fiduciary when providing financial advice, he is dedicated to providing his clients with the individual attention necessary to help them pursue their financial goals. He has contributed to various media sites, including Wall Street Select, CNN and The Star-Telegram.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works Instead

For the 2% Club, the Guardrails Approach and the 4% Rule Do Not Work: Here's What Works InsteadFor retirees with a pension, traditional withdrawal rules could be too restrictive. You need a tailored income plan that is much more flexible and realistic.

-

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look Like

Retiring Next Year? Now Is the Time to Start Designing What Your Retirement Will Look LikeThis is when you should be shifting your focus from growing your portfolio to designing an income and tax strategy that aligns your resources with your purpose.

-

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your Stress

I'm a Financial Planner: This Layered Approach for Your Retirement Money Can Help Lower Your StressTo be confident about retirement, consider building a safety net by dividing assets into distinct layers and establishing a regular review process. Here's how.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.