Everyday Investors Turn to Alternative Investments as a Buffer from Volatility

Sponsored Content from DiversyFund

New platforms make it easier and more affordable to diversify your portfolio — by investing in multifamily apartment buildings, for example.

Recent declines in the stock market are a distressing reminder of the importance of a diversified portfolio. Even having bonds in your asset mix is not a complete solution (as corporate bond returns have been down as well).

That’s why it’s also prudent for your portfolio to include alternative investments that don’t move in tandem with either of those markets. One option is real estate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

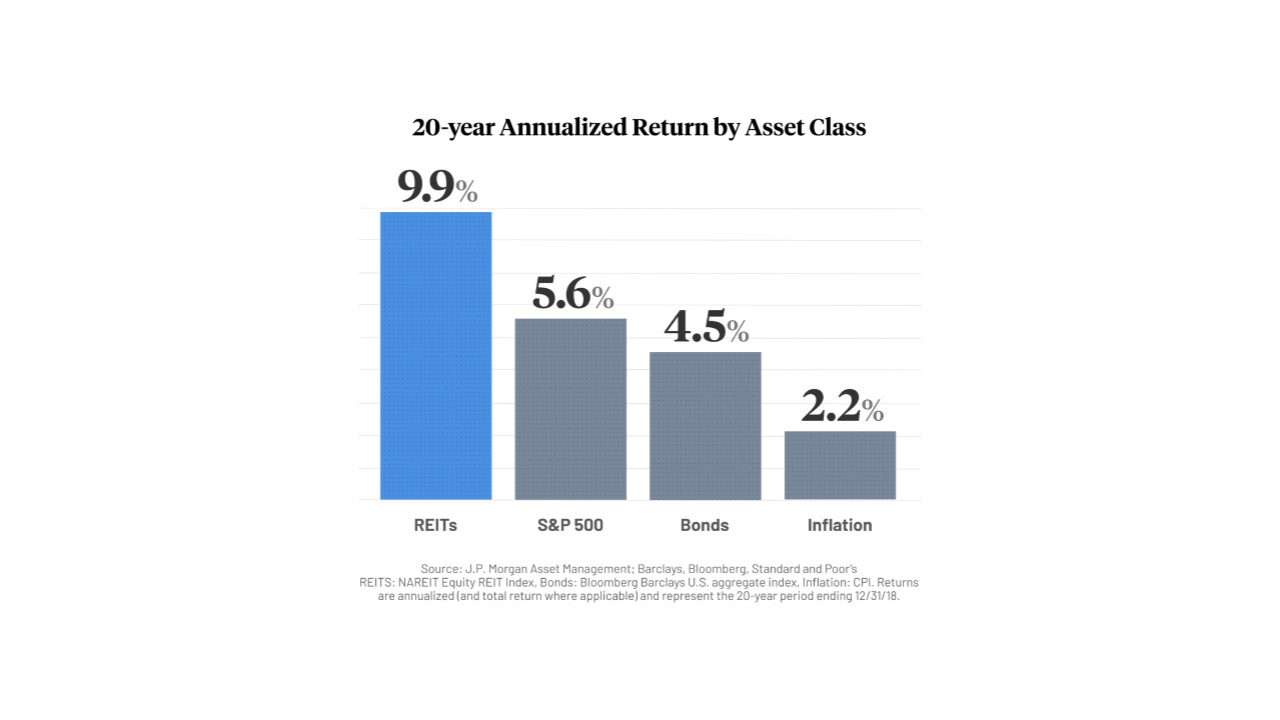

Investments in commercial real estate — such as multifamily apartment buildings — can not only help buffer your portfolio from daily stock market gyrations, but this asset class has also outperformed stocks over the long haul. See the chart below.

Your investing options

You could buy a property outright, if you have a large lump sum of cash and enough ibuprofen to ease the headaches of being a landlord. But a simpler way to invest is through a real estate investment trust, or REIT.

REITs enable everyday investors to co-own properties, and many will buy commercial properties in a certain category, say, hospitals, shopping malls or office buildings. They usually manage them, too.

See also, “Real Estate Investors Build Wealth Two Ways.”

There are 3 types of REITs:

- Publicly traded REITs are bought and sold daily on exchanges like stocks and are available to small investors, although the share price can swing based on shifts in market sentiment.

- Private REITs are available only to “accredited” investors, meaning people with high incomes or substantial net worth (typically the top 1%).

- The third type — public non-traded REITs — share features with the other two. Like publicly traded REITs, they are open to smaller investors and are registered with the SEC. This means they must file regular financial disclosures that make them more transparent than their private counterparts. But like private REITs, investors in public non-traded REITs must commit to keeping their money invested for a certain period.

Also, thanks to changes in regulations in recent years, public non-traded REITs can now be sold directly to investors through alternative investing platforms such as DiversyFund.

See also, “Why More People Are Choosing Indirect Ownership of Real Estate to Build Wealth.”

New investing platform

If you’re interested in this third option, DiversyFund’s investment platform makes it quick, easy and affordable to buy into its current Growth REIT (with additional funds to come).

The SEC-qualified Growth REIT is open to all investors – accredited or not – for a minimum investment of $500. It focuses on cash-flowing, multifamily apartment buildings in growing markets, buying properties that already generate cash flow from rents but need a bit of updating. By making upgrades to the properties, DiversyFund can then command higher rents, as well as a bigger price when the buildings are eventually sold.

Your monthly dividends generated by rents will be automatically reinvested in buying or updating properties. The REIT’s goal is to buy properties nationwide, giving it a geographically diverse portfolio. Currently, it owns three properties in Texas and California, and it’s poised to acquire two apartment buildings in North Carolina. Each opportunity is carefully analyzed by the experienced DiversyFund investment team. Interested investors can view the list of fully vetted portfolio of properties here.

Past returns for DiversyFund properties have ranged from 11% to 18%. Find out more about its historical performance.

Getting started

It’s simple. And because DiversyFund manages everything in house, there are no transaction fees.

- Go to DiversyFund.com to open an online account (You’ll need to provide your Social Security number for tax purposes).

- Enter how much you want to invest – minimum $500 – along with your banking information to complete the purchase.

- Track your dividends and progress on your account.

Once you’re an investor, you can purchase more shares through your account or elect to have a set amount of money regularly deducted from your bank account and invested in the REIT. You can even invest in new Diversyfund REITs, as they become available.

Got questions? Check out these FAQs or live chat with a DiversyFund investment professional.

What to know before you invest

The DiversyFund Growth REIT is a long-term investment. Unlike a publicly traded REIT, DiversyFund Growth is not a liquid investment that you can invest in one day and pull your money out the next if you need it. The REIT, launched in 2018, is expected to wind down its operations at the end of 2023 or potentially a couple of years after that.

That means your principal plus your reinvested dividends can be tied up for about five years. After that, the properties will be sold, and investors will receive their investment returns. (The returns will be prorated based on how long someone has been an investor.) Investors can also opt to roll their proceeds into DiversyFund’s next REIT.

Even though dividends are reinvested, they are subject to ordinary income taxes each year. DiversyFund will send you an annual 1099-DIV tax form with the amount of your taxable dividends, which you file with your tax return.

See also, the “Tax Benefits of Real Estate Investing.”

Real estate: An alternative

The record-long bull market ended abruptly and severely, highlighting the need for investors to own securities that don’t move in sync with the stock market. Real estate can fill that role.

Though not immune to downturns, real estate’s long-term trend is one that’s less volatile than stocks and even outperforms them. For decades, those with substantial means have been able to build wealth by investing in real estate.

Now everyday investors have that option, too. With DiversyFund’s platform, these investors can buy shares in the DiversyFund Growth REIT, become co-owners of properties, and watch their wealth build over time.

Diversify your portfolio beyond stocks and bonds. Sign up today and discover how easy and affordable it is to invest in commercial real estate with DiversyFund.

This content was provided by DiversyFund. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

What You Need to Know About Sustainable Investing

What You Need to Know About Sustainable InvestingSponsored Content from Domini Impact Investments

-

A Look at the World’s Rarest Precious Metal and its Growing International Market

A Look at the World’s Rarest Precious Metal and its Growing International MarketSponsored Content from the Osmium Institute

-

Raising a glass to an investment in wine

Raising a glass to an investment in wineSponsored Content from Cult Wines

-

Here's How to Invest in the Robotic Chefs That Are Ready to Take Over the Fast Food Game

Sponsored Content from Miso Robotics

-

The Best-Kept Secret to Income Investing

Sponsored Content from Aberdeen

-

How families, financial professionals and communities win by investing in education

A 2021 roundtable on the positive impact of 529 plans

-

A Unique Perspective on Real Estate Investing

Sponsored Content from RAD Diversified

-

The positive impact of 529 college savings plans

Terms and Privacy Policy