REITs Making a Comeback

After a horrible 2013, conditions are looking brighter for real estate investment trusts. These five have good prospects.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Like bonds, real estate stocks struggled last year when the Federal Reserve began to unwind its easy-money policies. The average property-owning real estate investment trust returned just 2.5% in 2013, trailing the overall stock market by 30 percentage points.

But a combination of gently rising interest rates and gradual economic growth isn’t the worst thing for REITs, which can raise rents and benefit from improving property values. Since 1993, there have been eight stretches of 12 months or longer when yields on ten-year Treasury bonds climbed by at least a half-percentage point. During those periods, REITs returned an average of 14.8%, according to Cohen & Steers, an investment shop that specializes in real estate stocks.

The situation is playing out similarly this year. Year to date through April 4, REITs surged 10.6%, compared with a return of just 1.4% for Standard & Poor’s 500-stock index. Those figures include dividends, and that is important because REITs are known for delivering high income. In fact, to qualify for REIT status, a company must pay out at least 90% of its taxable income to shareholders. The average property REIT yields 3.9% today.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

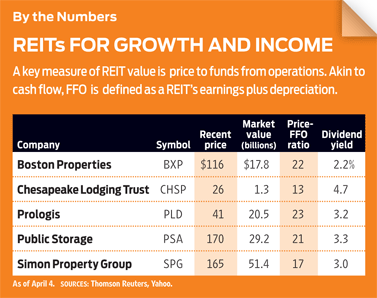

REITs are not particularly cheap today. The average ratio of REIT share prices to funds from operations (the industry’s preferred measure of profits) stands at 16, up from the average since 2000 of 15.

So what should you do? Most advisers suggest allocating 5% to 10% of your total portfolio to REITs because real estate stocks don’t always move in tandem with the broad market. If you need to build up that allocation, stick with REITs that own properties with potential for appreciation and are in a good position to boost rents. Here are five attractive candidates.

Upscale hotelier. Lodging REITs have a lot of flexibility when it comes to raising rents because operators can change rates overnight. That advantage has not been lost on investors: Hotel REITs led the pack in 2013, with an average return of 27%. This year, demand for rooms is expected to be strong, while fewer new hotels are opening for business than in 2008. Those factors should continue to boost lodging REITs, such as Chesapeake Lodging Trust (symbol CHSP). The REIT owns 20 upscale hotels in major U.S. cities, such as New York, Chicago and San Francisco. It is renovating three of its properties this year, but even counting those hotels as out of commission, the Annapolis, Md.–based REIT expects average revenue per room to rise by as much as 5.5%, about on par with the industry. Meanwhile, the stock trades at a reasonable 13 times estimated funds from operations.

The rise of online shopping has hurt malls across the nation. But analysts say that some high-end shopping centers can withstand the onslaught of technology. “These class-A malls sell an experience you can’t get online,” says Marc Halle, a senior portfolio manager at Prudential. As such, he argues, firms that specialize in top-tier malls offer rare value in the REIT sector today.

One of the best examples is Simon Property Group (SPG). The company, based in Indianapolis, owns 156 malls, including Copley Place in Boston and The Galleria in Houston, as well as 66 Premium Outlet shopping centers across the country. Simon also has interests in properties abroad. Last year, occupancy grew from 95.3% to 96.1%, and the firm was able to increase rents by an average of 4%. New mall development will be limited in the next few years, which should allow Simon to raise rents, says S&P Capital IQ. And the stock commands only a slight premium to the market, trading at 17 times estimated FFO.

Even though some malls are doing well, it’s hard to deny the growth of e-commerce. To ride that end of the shopping wave, consider Prologis (PLD). The San Francisco-based REIT owns and manages 569 million square feet of distribution facilities that it leases to retailers, logistics providers and transportation companies, among others, in 21 countries. The economic recovery, albeit slow, is helping fuel demand for that space. Occupancy rates grew from 94.0% in December 2012 to 95.1% by the end of 2013, and rates could edge up as much as another percentage point this year. As space tightens, property values should rise. Research firm Green Street Advisors says industrial property values are still an average of 1% below their 2007 peak. Prologis forecasts that rents will rise by as much as 25% over the next four years.

With such bright prospects, Prologis does not come cheap. The stock trades at 23 times estimated FFO and may be ripe for a temporary drop. If its price falls by, say, 10%, pounce.

As consumers shop, they may need to put some of their old stuff into storage. Until a few years ago, the storage business was largely made up of mom-and-pop shops. Now, the industry is consolidating, and Public Storage (PSA), the largest player, stands to benefit. At last count, Public Storage had 2,200 locations in 38 states, as well as 188 properties in Western Europe. The Glendale, Cal.-based REIT has developed a strong brand that attracts new customers. Last year, occupancy rates climbed from 91.9% to 93.3% (based on facilities that had existed for at least one year), allowing the company to boost rents by 5.4%. Plus, few developers are building new locations. “The spaces can take a while to lease up and, as a result, can be difficult to get financing to build,” says Jason Yablon, a portfolio manager at Cohen & Steers.

The stock trades at 21 times estimated FFO. So, as with Prologis, you may want to wait for a pullback of, say, 5% to 10% before you buy.

Office buildings may not seem like a high-growth area because a slow job market has kept national vacancy rates high. According to Reis, which keeps tabs on the commercial real estate market, the rate nationally was 16.9% at the end of 2013, only 0.2 percentage point lower than it was at the end of 2012.

But as with everything in real estate, location matters. In New York City, for example, the vacancy rate was only 9.9% at the end of last year. So office REITs with a foothold in low-vacancy areas should do well. Boston Properties (BXP) has buildings in five prime locations: Boston, New York, San Francisco, Princeton, N.J., and Washington, D.C. The Boston-based REIT isn’t having trouble attracting tenants. Occupancy rates at the end of 2013 stood at 93.2%, up from 91.1% a year earlier.

Analysts say the stock, which trades at 22 times estimated FFO, could rise as new developments are completed in coming years and investors reward the REIT for Boston Properties’ presence in key markets.

If you’d rather have a pro pick the stocks, you can choose from a number of solid funds. Morningstar analyst David Kathman favors Fidelity Real Estate Investment (FRESX). The fund charges 0.81% in annual fees (the category average is 1.33%). Steve Buller, who has managed the fund since 1997, screens stocks based on property values and rent growth, but also looks at so-called technical indicators, such as a stock’s price history. Over the past 15 years, the fund returned 11.5% annualized, compared with 10.8% for the typical real estate fund.

Another possibility: T. Rowe Price Real Estate (TRREX). Manager David Lee, in charge since 1997, tends to buy REITs that trade at a discount to the value of their properties. The fund charges 0.79% and has delivered an annualized return of 12.0% over the past 15 years.

For a lower-cost option, consider Vanguard REIT Index (VNQ). The exchange-traded fund, which launched in 2004, charges a rock-bottom 0.10% annually.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.