Closed-End Muni Funds Offer Hefty Yields

Not impressed by the yields on your municipal bond mutual funds? Tax-sensitive income investors might find muni closed-end funds more rewarding.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Investors have been flocking to the relative safety and tax-free income of muni bonds, pouring nearly $40 billion in net new money into muni bond funds in the 12 months ending May 31. But such demand has pushed prices up and yields down: The average national intermediate-term municipal bond fund now yields less than 2.3%, according to investment-research firm Morningstar, down from about 2.5% in mid 2015.

Muni closed-end funds, however, offer a more tempting distribution rate—about 4.7%, on average. (The distribution rate is the annualized distribution divided by the share price.)

That juicier income comes with some unique advantages provided by the closed-end fund structure—but also some significant risks. A closed-end fund has a fixed number of shares that trade all day long on an exchange. That means their share prices can drift far from the value of their underlying holdings, whereas traditional mutual funds trade at the value of their portfolio holdings. And most muni closed-end funds use leverage, or borrowed money. “That’s going to boost returns when things are going well and can cause more severe drawdowns when things aren’t,” says Jason Kephart, an analyst at Morningstar.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Like their traditional fund peers, muni closed-end funds have been popular lately. The average muni closed-end fund traded late last year at a more than 7% discount to the value of its underlying holdings; by June, that discount had narrowed to less than 0.1%, making it tougher to find bargains in this space.

And the ride for investors got a little rocky recently. In late May, fears of rising rates drove down muni closed-end fund share prices. In June, many muni closed-end funds cut distributions as longer-term rates fell and managers saw higher-yielding bonds called away.

Yet these vehicles still offer good opportunities for long-term investors who can stomach the risks, money managers and analysts say, and there are some attractive funds still trading at wide discounts.

The closed-end fund structure can be a particular advantage in the world of tax-free bonds because municipals tend to be less liquid—in other words, it can be costly to buy and sell them, especially in times of market turmoil. Unlike traditional fund managers, who have to deal with investor money flowing in and out of the fund every day, closed-end fund managers aren’t forced to buy or sell bonds based on fund flows.

Look Under the Fund’s Hood

To keep a lid on volatility, avoid those funds that are using much more leverage than their peers. Enter the fund’s name or ticker symbol in the quote box at Morningstar.com and look at the “total leverage ratio.” A 30% leverage ratio, for example, shows that for every $1 of investable capital, 30 cents is borrowed money.

Check out a fund’s ability to sustain steady payouts by clicking the “distribution” tab on the fund’s page at Morningstar.com or CEFconnnect.com. If recent payouts consist largely of “return of capital,” that means the fund is simply handing back your original investment in the form of a distribution—a big red flag.

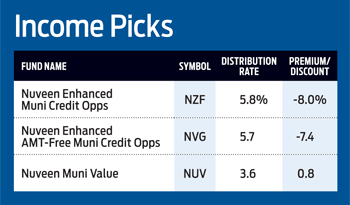

Jim Robinson, manager of Robinson Tax Advantaged Income, a mutual fund that invests in muni closed-end funds, likes Nuveen Enhanced Municipal Credit Opportunities and Nuveen Enhanced AMT-Free Municipal Credit Opportunities. Both funds are still trading at wide discounts. Earlier this year, Nuveen merged six other muni closed-end funds into these two funds. That move benefits shareholders by reducing costs and by creating larger funds, which tend to be easier to trade and have narrower discounts, Robinson says.

Another large, liquid option is Nuveen Municipal Value, which gets a positive rating from Morningstar analysts. This Nuveen fund trades at a slight premium, but it uses very little leverage, making the fund a relatively stable option for conservative investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.