Beyond Chemo: Investing in New Cancer Treatments

November 2014By FIDELITY VIEWPOINTS

Advanced melanoma has been one of the most deadly forms of cancer. With the best treatment available—chemotherapy—just 36% of patients survive for one year. However, new “immuno-oncology” treatments have begun to arrive, and the preliminary results are arresting. According to trials by Bristol-Myers Squibb (NYSE: BMY), 94% of patients survive at least a year.*

The new melanoma treatment may turn out to be just one application for this promising approach to cancer treatment, also called immunotherapy. Other possible applications include non-small cell lung, renal and bladder cancers.

The breakthrough behind this new class of treatments is actually an old idea. In the 1890s, American surgeon William Coley noticed that certain cancer patients recovered when they got a bacterial infection. He surmised that the immune system had been stirred to action and learned to fight the tumor.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

He had some success stimulating that response by injecting patients with other viruses, but with the advent of radiation, chemotherapy and surgery, the therapy went largely unused—until recently. Today, leading scientists and pharmaceutical companies are revisiting the idea of helping the body’s own immune system identify and attack a tumor.

“In trials, these drugs have shown the potential to help more patients and to extend the lives of patients, compared to existing treatments,” says Asher Anolic, manager of the Fidelity Select Pharmaceuticals Portfolio (FPHAX).

The next big wave of treatments is focused on the PD-1 receptor, a key regulator of cell activity.

With most cancer, the body’s immune system fails to recognize the tumor as a threat because the tumor is able to mask itself using the PD-1 receptor. The new drugs have the potential to stop that process. “These drugs have shown a lot of promise, and are poised to come into market in 2015 and 2016,” says Anolic.

Potential investment opportunities

While the potential benefits to patients and their families are profound, the implications may also be significant for investors. The first of this wave of immunotherapy drugs, Bristol-Myers Squib’s Yervoy, began selling in 2011. It has already generated more than $1 billion in sales.**

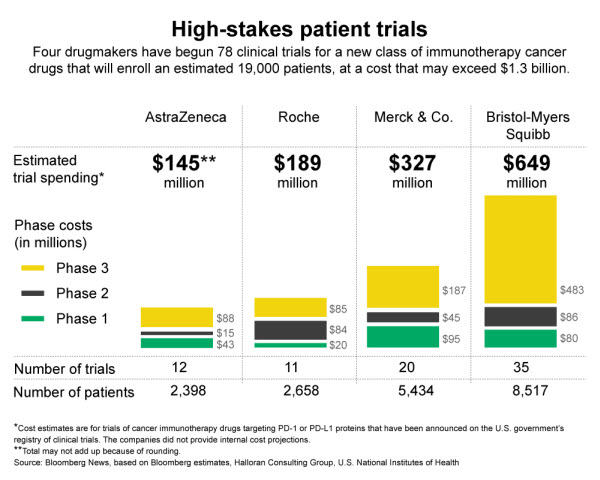

In the coming years, a range of other new treatments may arrive. Four companies are leading the charge to bring more drugs to patients and target additional types of cancer.

As the range of treatments expands, it could fuel earnings growth for the market leaders. What companies are poised to benefit? “I think the big pharma companies are going to end up accruing a large amount of the benefits,” says Anolic.

While investors have been excited about the possibilities of the new treatment, and consequently have bid up stock prices for some of the companies in this space, Anolic thinks there may be reason to be optimistic.

“I think the market accurately understands what approval in melanoma and lung cancer means for each of the companies, and that is reflected in the stock prices,” he says. “But what I don’t think the market is quite grasping yet is what happens if this becomes used in the next wave of tumors for which we may get initial data in at the end of this year. If you believe turning the body’s immune system against cancer is something that will work in more than three or four different tumor types, I think there’s going to be a lot more upside there.”

Learn more

- Asher Anolic manages Fidelity Select Pharmaceuticals Portfolio.

- Find more investing ideas with Fidelity Viewpoints.

** 2 BMS quarterly reports

The information presented reflects the opinions of the speaker as of September 3, 2014. These opinions do not necessarily represent the views of Fidelity or any other person in the Fidelity organization and are subject to change at any time based on market or other conditions. Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

Asher Anolic manages Fidelity Select Pharmaceuticals Portfolio, which invests in some of the stocks mentioned in this article. As of July 31, 2014, the fund held 5.4% of assets in AstraZeneca PLC sponsored ADR, 5.0% in Bristol-Myers Squibb Co., 4.4% in Merck & Co. Inc., and 3.527% in Roche Holding, AG.

As with all your investments through Fidelity, you must make your own determination as to whether an investment in any particular security or fund is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the investment option. Fidelity is not recommending or endorsing any particular investment option by mentioning it in this article or by making it available to its customers. This information is provided for educational purposes only, and you should bear in mind that laws of a particular state and your particular situation may affect this information.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stocks involves risks, including the possible loss of principal.

Fidelity Brokerage Services LLC, Member NYSE, S I P C, 900 Salem Street, Smithfield, RI 02917

698304.2.0

This content was provided by Fidelity Investments and did not involve the Kiplinger editorial staff.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you may be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and More

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and MoreAmazon Prime The Amazon Prime Big Deal Days sale ends soon. Here are the key details you need to know, plus some of our favorite deals members can shop before it's over.

-

How to Shop for Life Insurance in 3 Easy Steps

How to Shop for Life Insurance in 3 Easy Stepsinsurance Shopping for life insurance? You may be able to estimate how much you need online, but that's just the start of your search.