Savings Bonds: EE-I, EE-I, Oh!

Savings bonds offer competitive yields, unquestioned safety and some unique tax features, too.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Once thought of chiefly as a haven for scaredy-cats and an obvious gift for kids' birthdays and bar mitzvahs, savings bonds have been finding their way into serious investors' portfolios since the government floated interest rates in the early 1980s. Today, savings bonds offer competitive yields, unquestioned safety and some unique tax features that make them especially suited for savers with an eye on college costs or retirement some years away.

Savings bonds are protected against default by the full faith and credit of the U.S. government. The only way you can lose the principal is to lose the bond, and if you do lose the bond (or if it is stolen or destroyed), you can get it replaced by completing form 1048 and mailing it to the Bureau of the Fiscal Service, P.O. Box 7012, Parkersburg, WV 26106-7012

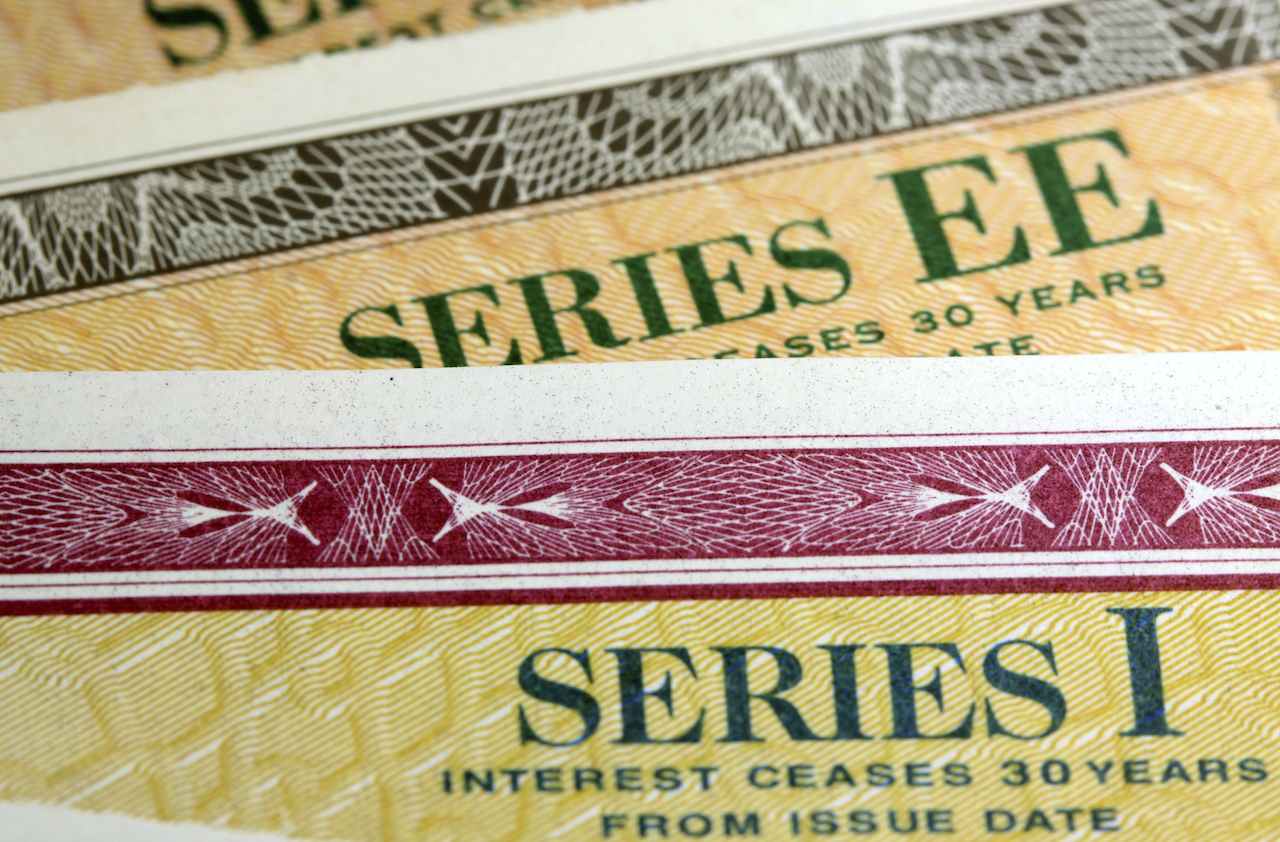

Through the years, an alphabet of savings bonds have been issued, and while some of these bonds may still be gathering interest, they are no longer available for purchase. Today, investors can only buy series EE and I bonds. Here's how they break down:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

EE bonds are sold for half of face value in denominations ranging from $50 to $10,000 for paper bonds -- bonds bought online are sold for face value ranging from $25 to $30,000. EEs earn a fixed rate of interest for 30 years. Rates for new issues are adjusted twice a year, in May and November, with each new rate effective for all bonds purchased over the next six months. EE bonds pay all of their accrued interest when they are redeemed.

The interest paid by I bonds actually comes in two parts: You get an underlying fixed rate, which is announced when the bonds are issued, plus a second rate that equals the level of inflation. For example, if the flat rate is 3% and inflation is 2%, then I bonds would pay 5% that year. Potential buyers shouldn't be put off by the relatively low fixed rate paid by I bonds. Consider them an inflation hedge and think of them this way: With a fixed rate of 3% and low inflation, your return will be low but you'll still be beating inflation by 3%, year after year. If inflation soars to, say, 10%, the return on your I bonds will be 13%. Like EE bonds, I bonds earn interest for 30 years and pay that interest when the bonds are redeemed.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

The U.S. Economy Will Gain Steam This Year

The U.S. Economy Will Gain Steam This YearThe Kiplinger Letter The Letter editors review the projected pace of the economy for 2026. Bigger tax refunds and resilient consumers will keep the economy humming in 2026.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

Special Report: The Future of American Politics

Special Report: The Future of American PoliticsThe Kiplinger Letter The Political Trends and Challenges that Will Define the Next Decade

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.

-

Shoppers Hit the Brakes on EV Purchases After Tax Credits Expire

Shoppers Hit the Brakes on EV Purchases After Tax Credits ExpireThe Letter Electric cars are here to stay, but they'll have to compete harder to get shoppers interested without the federal tax credit.

-

The Economy on a Knife's Edge

The Economy on a Knife's EdgeThe Letter GDP is growing, but employers have all but stopped hiring as they watch how the trade war plays out.