Allianz Analyst Kristina Hooper Sees U.S. Stocks in the Lead

But she cautions that not having some global exposure could mean missed opportunities, particularly in Europe.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Kristina Hooper is the U.S. investment strategist for Allianz Global Investors. Here are excerpts from our interview:

Kiplinger’s: Where do you see stocks headed in 2015?

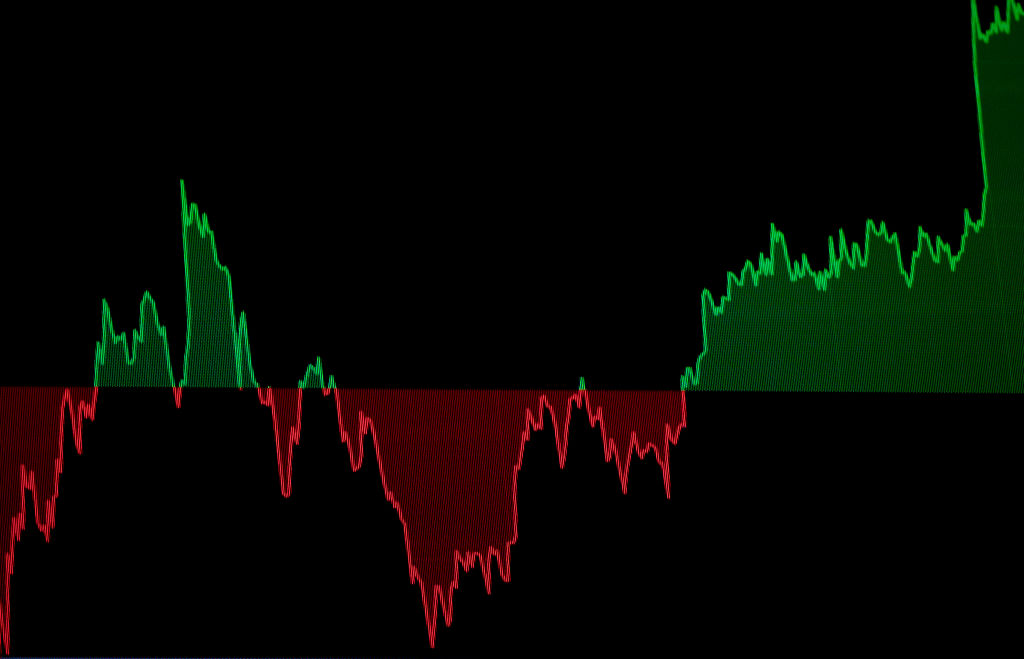

Hooper: That depends on where those stocks are located. We expect more decoupling of our markets from other markets. We believe the U.S. economy will continue to improve, while global economic growth will decelerate. In this environment, we expect the U.S. stock market to continue to move up. It will be a bumpy road, but we expect U.S. stocks to deliver better relative returns than other major investments, although there’s a place in your portfolio for investment-grade and high-yield U.S. bonds, too.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What kind of stock market returns are you looking for? We expect high-single-digit to low-double-digit returns—most likely high-single-digit. But we’re going to see significant volatility. That’s because although we have an improving economy, we continue to see a large number of investors who lack confidence in this market. That’s not changing in 2015, particularly with concerns about a global economic slowdown and a less accommodative Federal Reserve Board.

What’s driving the economy? Improvement in the employment situation. Beyond that, we are starting to see capital expenditures improve. Companies have the ability to deploy a significant amount of cash toward capital spending. We also recognize a significant tailwind coming from lower energy prices. That’s a plus for consumers and companies. The U.S. is experiencing a manufacturing renaissance because of lower energy prices and anemic wage growth. The whole thesis behind shipping jobs overseas has changed.

Where should investors put their money now? We’re positive on U.S. stocks. But you have to recognize the threat posed by the rising dollar, which makes exports less competitive and results in earnings from overseas translating into fewer dollars here. We favor some large-company stocks—but not the biggest ones—and midsize companies that don’t derive substantial revenues from outside the U.S. To ensure that you are diversified, make sure you have some global exposure. European stocks could deliver positive surprises in 2015 because expectations are so low.

Where else do you see value? We believe strongly that investors need to focus on dividend-paying stocks. They serve two purposes: One, in an environment in which we expect volatility to remain high, dividend-paying stocks are shock absorbers for stock market investors. Two, given that we don’t expect robust returns from price appreciation alone, dividends will play an important role in contributing to total returns.

Where will investors find the kinds of stocks you mention? Technology is one area. A lot of tech stocks are paying dividends these days—it’s the second-highest dividend-paying sector. Financials offer attractive value right now. With the exception of high-end retailers, many consumer stocks have been lackluster. That could reverse, with things improving for less-upscale retailers, given that consumers have a lot more breathing room thanks to lower energy prices and improvement in the labor market.

Any stocks in particular that Allianz portfolio managers like right now? Tech names that Allianz likes include Cisco Systems (symbol CSCO, $24), Palo Alto Networks (PANW, $106) and SanDisk (SNDK, $94). In the financial sector, our managers like Navient (NAVI, $20), which services government loans, as well as PNC Financial Services (PNC, $86), Wells Fargo (WFC, $53) and JPMorgan Chase (JPM, $60). Wal-Mart Stores (WMT, $76) is seeing a recovery among middle- and lower-income consumers and sells at an attractive price; Macy’s (M, $58) could benefit from a stronger middle-income consumer as well as from a rising dollar, since the retailer imports goods from overseas but sells its clothing primarily in the U.S.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.

-

Dow Climbs 327 Points, Crosses 48,000: Stock Market Today

Dow Climbs 327 Points, Crosses 48,000: Stock Market TodayMarkets are pricing the end of the longest government shutdown in history – and another solid set of quarterly earnings.

-

Stock Market Today: Stocks Slip After Powell Talks Rate Cuts

Stock Market Today: Stocks Slip After Powell Talks Rate CutsThe main indexes closed lower Thursday after Fed Chair Powell said there's no rush to cut rates.

-

Cisco Stock: Why Wall Street Is Bullish After Earnings

Cisco Stock: Why Wall Street Is Bullish After EarningsCisco stock is lower Thursday despite the tech giant's beat-and-raise quarter, but analysts aren't concerned. Here's what you need to know.

-

Cisco Leads Dow Stocks After Earnings, Job Cuts: What to Know

Cisco Leads Dow Stocks After Earnings, Job Cuts: What to KnowCisco Systems is the best Dow Jones stock Thursday after the tech giant beat earnings expectations and announced a new round of layoffs.

-

Stock Market Today: Stocks End Wild Week With a Win

Stock Market Today: Stocks End Wild Week With a WinPalantir Technologies and Sweetgreen were two notable gainers Friday, while Intel continued to fall.

-

Stock Market Today: Dow Flirts With 40K After Walmart Earnings

Stock Market Today: Dow Flirts With 40K After Walmart EarningsThe 30-stock index briefly traded above the 40,000 mark as blue chip retail stock Walmart surged after earnings.