Here Come the Hot IPOs

Investors could buy shares in big-name firms, including Uber and Lyft, in 2019.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

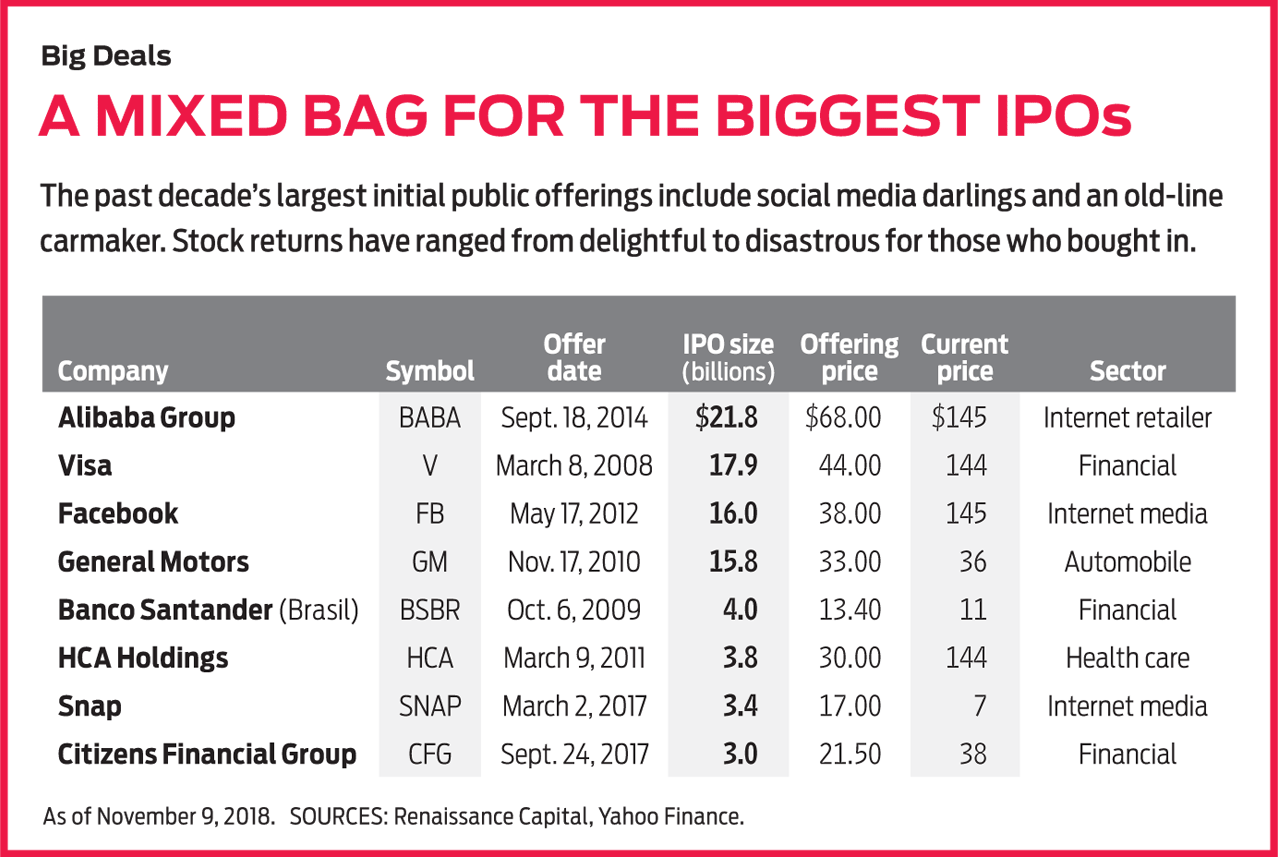

The Chinese zodiac tells us that 2019 is the year of the pig, but investors in initial public offerings may begin calling it the year of the unicorn. The mythical beast is also the nickname for privately held start-up companies valued at $1 billion or more, and a herd of them may be galloping to the public market this year. Analysts at Renaissance Capital, a provider of IPO-themed exchange-traded funds and research, say that companies on track for 2019 IPOs include ride-sharing companies Uber and Lyft, photo-sharing app Pinterest, popular workplace messaging app Slack and stationary bike seller Peloton. Renaissance says offerings are also possible from home-rental platform Airbnb, Elon Musk–led aerospace firm SpaceX and Greek-yogurt maker Chobani.

A huge year for IPOs in 2019 would represent a continuation of 2018’s torrid tempo. Through the first three quarters, 156 companies had gone public—50 more than the same period in 2017—and the $39.8 billion those companies raised was 62% more than the take the year before. At that pace, 2018 will likely have been the biggest IPO year since 2014 and just the third year in the past decade to surpass 200 IPOs, says Renaissance.

Market slides can disproportionately affect recent IPOs, and if they perform poorly, the pace of new issues could slow. “These stocks tend to be more volatile than more-established names,” says Renaissance principal Kathleen Smith. “When there’s a big market drop, investors tend to sell off or avoid recent IPOs to move to safer corners of the market.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But even persistent market choppiness in the year ahead probably wouldn’t deter the likes of Uber and Lyft from going public, says Josef Schuster, founder of IPOX Schuster, an investment research firm and fund provider that specializes in IPOs. A full-fledged bear market, however, would likely force companies to lower their prospective offering prices significantly, which could sideline even the largest companies. “Many of these firms with multi-billion-dollar valuations are already well funded. They can afford to wait things out so existing investors don’t have to take a haircut on their shares,” he says.

How to play. From 1980 through 2017, IPO stocks rose an average of 18% from their offering price on the first day of trading, according to data from Jay Ritter, a finance professor and IPO expert at the University of Florida. But individual investors rarely receive offering-priced shares, which are typically reserved for institutional investors, prized clients of the issuing brokerage firms, and the company’s “friends and family,” which include employees and their relatives. Clients at major online brokerages, such as Fidelity and TD Ameritrade, can apply to receive early IPO shares if they meet certain requirements, but there are no guarantees.

That leaves most investors in the position of having to invest in IPOs after they hit the open market—a risky proposition, says Schuster. Due to their potential to shoot up or plummet in a single day, “any investment in an IPO should have a very conservative weight in your portfolio,” he says.

Companies that post negative returns on the first day are likely to carry negative momentum in the market, while companies that immediately skyrocket may have trouble living up to the hype.

Once shares hit the open market, there are few predictable patterns in IPOs’ behavior. Analysts tend to initiate ratings on a stock 25 days after an IPO, at which time positive sentiment might boost a stock’s price, Ritter says. After 180 days, a stock’s “lock-up period” expires, allowing pre-IPO investors to sell their shares. That can trigger a sell-off. Schuster says share prices tend to settle down after firms issue their first earnings reports, but the stocks still carry more volatility than more-established securities.

To help mitigate some of the risk of investing in IPOs, read the literature that companies must file with the Securities and Exchange Commission in advance of the offering. One measure to consider, says Schuster, is float, or the percentage of a firm’s stock made available to the public. Companies that drum up demand for a very small number of shares can build momentum and shoot up quickly, but the result is an extremely volatile stock. Any IPO that makes less than 15% of its shares available should give investors pause, he says.

Once a stock begins trading, pay attention to its first-day return. Companies that post negative returns on the first day are likely to carry negative momentum in the market, while companies that immediately skyrocket may have trouble living up to the hype. Schuster looks for first-day returns that fall between 0% and 65%.

Would-be IPOs must disclose information about their revenues, and those with a proven track record tend to do best. From 1980 through 2016, firms with less than $100 million in annual sales posted an average three-year return (after the close of the first trading day) of 11.9%; those with more than $100 million returned 38.4%, according to Ritter. “Companies that have demonstrated that they have a product or service that people are willing to pay for have, on average, been fairly valued by the market,” he says.

What to consider in 2019. Among companies rumored to be going public in 2019, there are a few that investors should keep an eye on. Smith cites Slack, eyeglass seller Warby Parker and online sportswear retailer Fanatics as potential IPO successes. “These companies all appear to be growing sustainably, which means there is less risk associated with them,” she says.

Ritter is bullish on the ride-sharing giants even at their rumored lofty valuations—proposals from investment banks purportedly value Uber at $120 billion; Lyft’s most recent valuation is a more modest $15 billion. “Companies like Uber and Lyft operate in winner-take-all markets where one or two companies can dominate a business and be very profitable,” he says. In that context, the high valuations accorded by investors make sense, he says. Ritter believes the stocks’ high price tags could be justified in future years by the introduction of autonomous vehicles, which will significantly cut the firms’ labor costs.

Palantir Technologies, a software company specializing in data analytics, is a tech giant to watch. The firm, founded in 2004, is seasoned as far as IPOs go, says Schuster, and enjoys a predictable revenue stream from a growing, diverse client base, ranging from private firms to federal, state and local governments. What’s more, demand for data analytics is growing and stable, and the firm should be less affected by swings in the economy than other tech firms, he says. Investors should consider the shares if they’re priced reasonably relative to sales, Schuster says. “Anything between 10 and 15 times sales could be attractive.”

Schuster is also enthusiastic about Beyond Meat, a vegan food company that makes meat substitutes, such as its popular line of burgers, that appeal to omnivores who want vegan offerings that closely mimic the taste and texture of meat. Schuster thinks the company could become a market leader among firms that encourage healthier eating.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.