Is the Worst Over for Stocks?

Even if it isn’t, investors who wait for the market bottom may well miss it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The bull market was the longest in history; its collapse into bear market status was accomplished in a record 23 trading sessions. Since the low on March 23 that lopped 34% off Standard & Poor’s 500-stock index, stocks have bounced back an incredible 29% in just 18 trading days, also unprecedented in modern stock market history. “Surprisingly,” notes Goldman Sachs chief strategist David Kostin, “the largest shock to the global economy in 90 years” has left the S&P 500, which closed at 2875 on April 17, just 15% shy of the record high set in mid February. Not surprisingly, investors are asking: Is that it for the bear?

We’ll only know in hindsight. In mid April, the death toll from COVID-19 continued to mount, post-pandemic unemployment claims passed 26 million, and volatile oil prices roiled the market, raising questions about whether the economy was in even worse shape than it seemed. But hopeful signs also emerged. Boeing Co. announced it would resume production of commercial jets in Washington state. Johnson & Johnson, Procter & Gamble and Costco Wholesale bucked the recent trend of dividend cuts and suspensions by raising their payouts. Countries in Europe began to relax travel restrictions and business closures, and as the rise of new infections started to slow here, states began to unveil their plans for restarting the U.S. economy.

Still, investors who simply revert to the buy-the-dip strategy that became reflexive in recent years should think twice, says Stephen Suttmeier, chief technical strategist for stocks at BofA Global Research. “I find it hard to believe that we’re going to just go to new highs here,” he says. He expects stocks to meet resistance at levels between 2800 and 3000 on the S&P 500, which is where many investors turned bullish last year. “They didn’t get a chance to get out, given how fast the decline was. They’ll be looking to get out closer to breakeven,” he says. If the S&P 500 fails to hold the 2650 level, says Suttmeier, the next stops on the way down could be somewhere around the March 2020 or December 2018 index lows, between 2200 and 2350, and after that, 2000 or below.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Downright ugly. Corporate earnings season will ramp up over the next few weeks. A year ago, analysts expected first-quarter 2020 profits for S&P 500 firms to be up more than 15%, on average, from 2019’s first quarter. Now, those estimates call for a 13.5% decline, with earnings for the consumer discretionary, financial and industrial sectors all down more than 30%. Energy stocks are looking at profit declines of 58%, according to consensus estimates. Economic reports will be equally disheartening. But investors should remind themselves that these are backward-looking data in a forward-looking market, say Goldman Sachs strategists. Barring a resurgence of coronavirus infections as the economy reopens, the market could well stay focused on expected economic and profits recoveries in 2021.

With defensive stock groups trading at premium prices, investors should consider gradually diversifying into laggards

Consider, too, the unique nature of this crisis. Normally, bear markets unfold over time, as economic reports gradually weaken. This time, says Jim Paulsen, chief strategist at investment firm Leuthold Group, “there was no debate about whether we were heading into a recession—it was recession by proclamation.” That explains the “warp speed” bear market and the immediate, dramatic policy response from the Federal Reserve and the federal government, says Paulsen. “I’m not saying there’s not going to be a setback. But I think the low is in.”

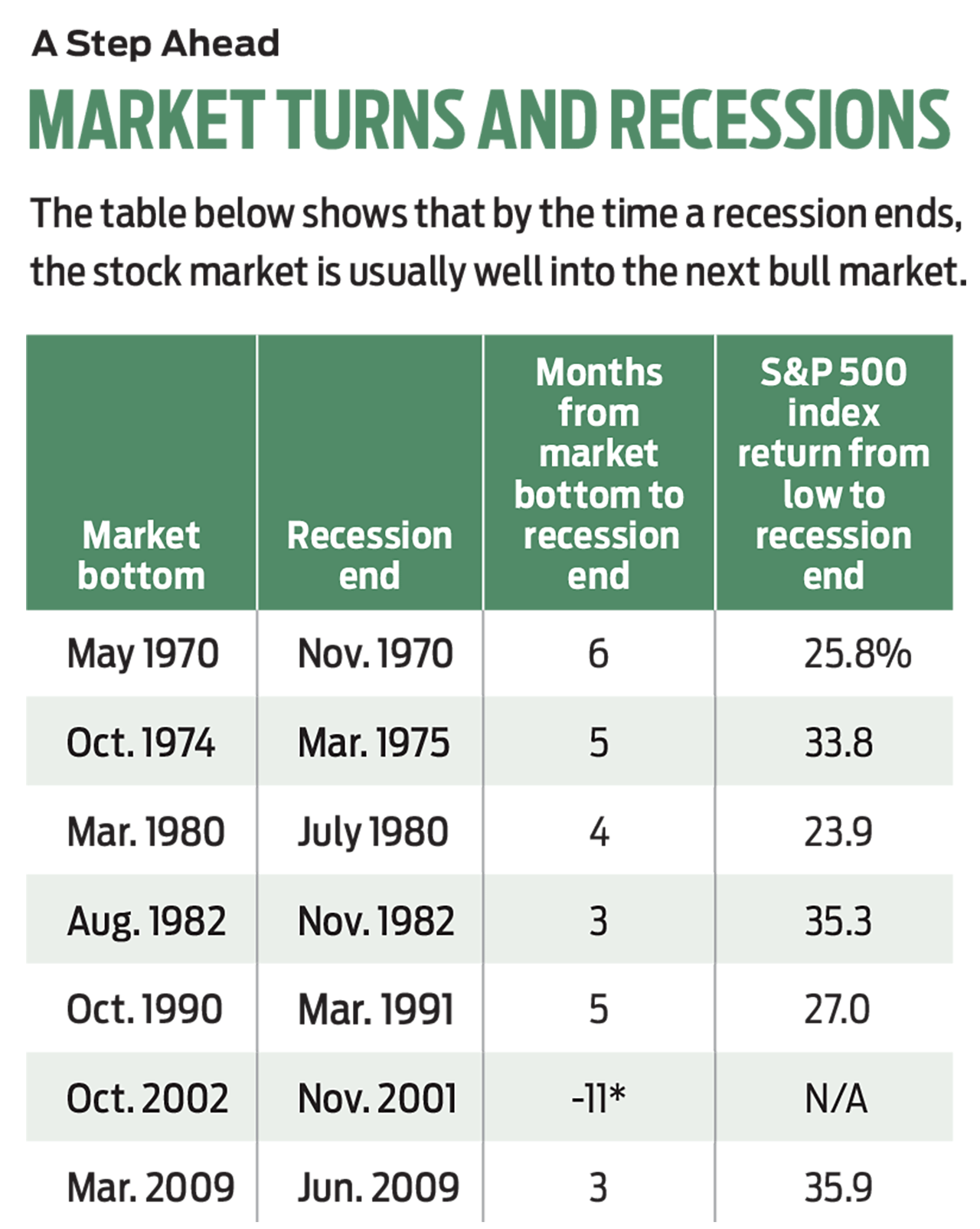

Investors who wait for a market bottom may miss it, Paulsen adds. During the bear market of 2007–09, the S&P 500 was below its 2008 low for only nine trading days, even though the ultimate bottom on March 2009 was 10% lower in price. Measured from the November 2008 trough, the S&P 500 was 45% higher one year later. “Who cares where the low is in the next four to five months if a year from now you’re higher?” says Paulsen.

How to invest. Given the degree of uncertainty surrounding the market’s next move, investors should stick with high-quality stocks that have strong balance sheets, competitive advantages and good growth prospects. Tech titans that led the bull market and have survived the bear are also good choices.

With defensive stock groups trading at premium prices, investors should consider gradually diversifying into laggards, including small-company, foreign and economy-sensitive stocks, says Paulsen.

If history is a guide, then the sectors that fall the furthest during a bear market will lead the way out. This time around, that would be energy, financials and industrials—although energy firms struggling with plunging demand, persistent oversupply and oil prices at a multi-decade low might be too risky for most. BofA’s Suttmeier says it’s too early to make a sector call—with a notably defensive exception: “Health care is a sector we’ve gone to all year,” he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.