Lower Your Expectations for Returns Over the Next Decade

The best you can hope for is modest gains. The solution? Save more.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

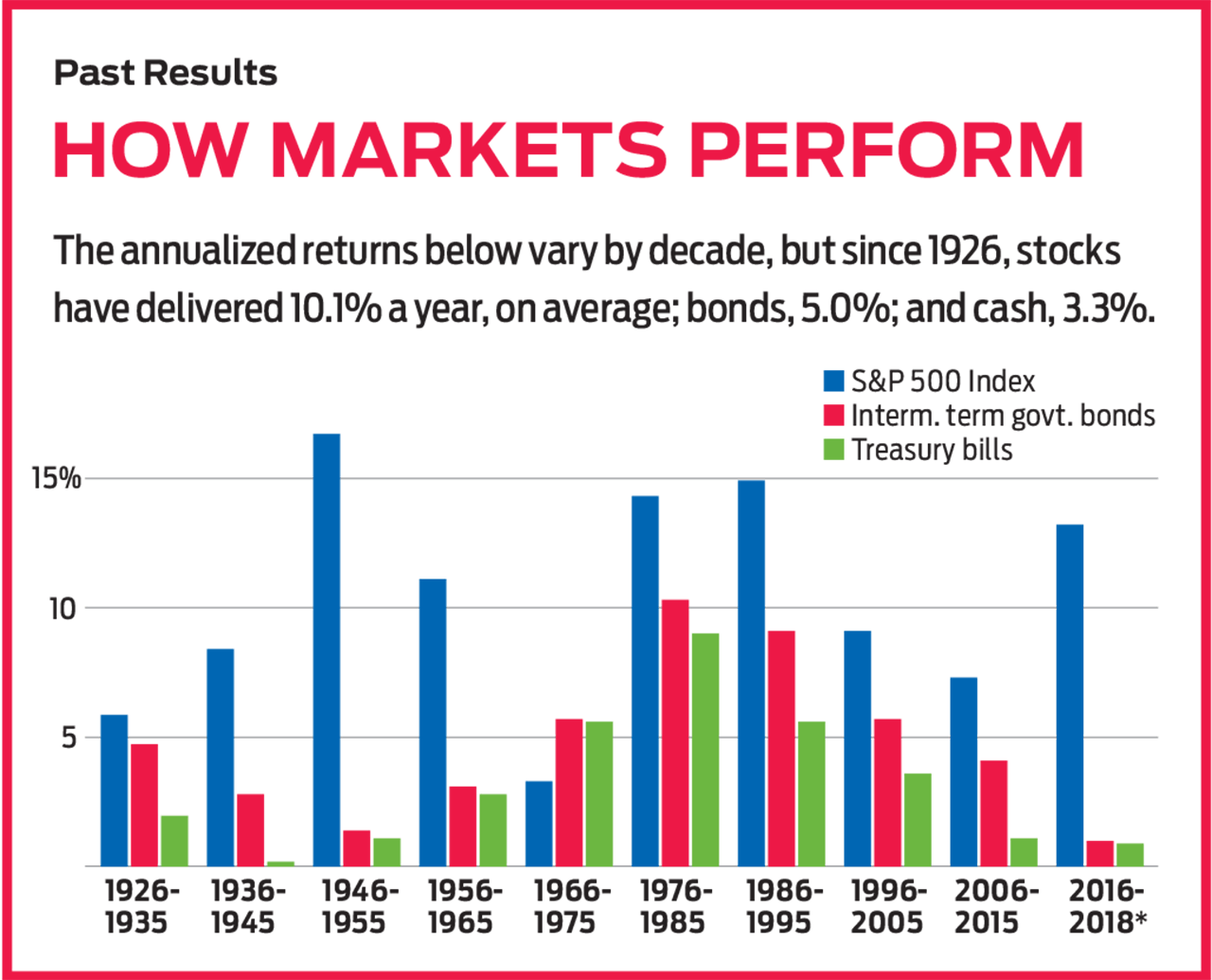

Most financial pundits will tell you that the average annual return from large-company stocks since 1926 is 10.1%. If your investment horizon is a very long way off, you may well get that much. Over any given decade, however, there is a huge variation from the long-term average.

No one has a crystal ball, but you can make assumptions based on current economic trends, corporate earnings projections and stock prices. And that can give you an idea of how much to invest in stocks, bonds and cash over the next decade.

A lot to live up to. Standard & Poor’s 500-stock index averaged a 14.0% annual gain, including dividends, over the past 10 years. Don’t expect that for the next 10 years. Brian Singer, head of the Dynamic Asset Allocation Strategies team at institutional investment house William Blair, thinks large-company stocks—such as those in the S&P 500—will gain a below-average 6% annually over the next decade.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Blame the bull market. The run that began in 2009 is the longest bull market ever, and it has gained three times the amount an average bull market does. Typically, big bull markets are followed by big losses, says Sam Stovall, chief investment strategist of U.S. equity strategy at CFRA—say, 40% or more. A bear that big would tear a hunk out of the stock market’s projected 10-year return.

You might increase your stock returns by investing abroad—especially in emerging markets, if you can tolerate the risk. It’s a matter of playing catch-up. Foreign stocks have lagged their U.S. counterparts over the past decade, particularly lately. The MSCI Europe, Australasia and Far East index has fallen 9.0% over the past 12 months, and the MSCI Emerging Markets index has fallen 8.7%. The S&P 500 is up 1.8% over the same period.

Foreign currencies have fallen against the U.S. dollar as well, and if they rebound, they could put some extra octane into your portfolio as returns earned abroad translate into more dollars here. “The odds are 90 to 10 that emerging markets will beat U.S. stocks,” says Rob Arnott, founder of Research Affiliates. He’s forecasting a 9.7% annualized return for emerging markets over the next decade—about the same as their 30-year average. Foreign developed markets, where earnings growth is slower than in emerging markets, should return 7.5% annualized over the next decade, he says.

Bonds will disappoint. Government bonds have earned an annualized 5.0% since 1926. It’s unlikely that interest rates will return to the long-term average, which includes the towering yields of the 1970s and early 1980s. In today’s global and disinflationary economy, the 10-year yield is unlikely to rise above 4%, up from 2.9% recently. Mix in the likelihood of principal losses as yields drift higher (prices and yields move in opposite directions), and you get disappointing bond returns over the next 10 years. “We see a 2.5% to 4% annual return from bonds,” says Roger Aliaga-Díaz, senior economist at Vanguard’s Investment Strategy Group.

Cash is the third asset class in a balanced portfolio. Barring a surge in inflation, the Federal Reserve is unlikely to push up its benchmark short-term interest rate much past 3%, and savings rates follow that closely. A 3% return from cash over the next 10 years wouldn’t be unusual: Treasury bills have returned an average 3.3% a year since 1926. What’s unusual is how close cash returns could be to bond returns. Just don’t give up on bonds. You’ll want them in your portfolio if there’s a recession and a bear market in stocks.

If the next decade produces lower-than-average returns on stocks and bonds, your best bet is to save more. If you increase your saving rate, and your investments provide more than the middling returns expected, you won’t just reach your goals, you’ll roar past them.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)

Why Picking a Retirement Age Feels Impossible (and How to Finally Decide)Struggling with picking a date? Experts explain how to get out of your head and retire on your own terms.

-

The Best Precious Metals ETFs to Buy in 2026

The Best Precious Metals ETFs to Buy in 2026Precious metals ETFs provide a hedge against monetary debasement and exposure to industrial-related tailwinds from emerging markets.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.