Midyear Investing Outlook, 2016: Investing in an Up-and-Down Market

Stocks should end the year with modest gains. We show you how to boost your returns by focusing on value stocks and companies that raise their dividends.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Financier J.P. Morgan got it right when he was once asked what the stock market would do. “It will fluctuate,” he quipped. The market’s performance so far in 2016 underscores the wisdom of his humor. The major indexes started the year with sharp declines, then followed with strong rebounds. As midyear approached, investors found themselves essentially where they were at the start of 2016.

We think the market could eke out more gains this year, as the economy muddles along, corporate profits begin to rise again and the Federal Reserve Board exercises restraint on the interest-rate front. But don’t expect the bull to sprint too far past Standard & Poor’s 500-stock index’s record closing high of 2,131, set in May 2015. “The bull is old, wrinkled and walks with a cane,” says Robert Doll, chief stock strategist at Nuveen Asset Management. “But it’s not dead.”

Our January forecast calling for the S&P 500 to generate a total return of roughly 8% still seems doable, if optimistic. (As of May 10, the index had returned 3% year-to-date.) Look for the S&P to end the year at about 2,150, which would suggest a return, including two percentage points’ worth of dividends, of about 7%. An equivalent target for the Dow Jones industrial average would be about 18,300. (Prices, returns and yields are as of May 10.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Don’t be fooled by what might look like a lack of progress in stock market indexes. There will be plenty of thrills and spills, even in a mostly range-bound market, and investors should be prepared to take advantage of them. “Investors need to be more tactical,” says Burt White, chief investment officer at LPL Financial. “When you get rallies, trim a little bit. In a pullback, buy a little.”

Brian Belski, chief strategist at BMO Capital Markets, has found 14 periods since 1990 when the S&P 500 was roughly flat for six months or more. During those periods, share prices of one-third of S&P stocks advanced by double-digit percentages, with average annualized jumps of nearly 30%. What’s more, the gainers came from all of the market’s sectors. So whether you call today’s stock market a crab (skittering sideways), a bunny (because it hops around) or a buffalo (part bull, part bear—see our interview with Bank of America's Christopher Hyzy), here’s what you need to know to make money the rest of the year.

[page break]

The Case for Value

From 2007 through 2015, shares of fast-growing companies blew past value stocks—those that trade at low prices in relation to profits, revenues and other key measures. The pattern started to change early this year, with some big-name tech stocks stumbling and some of the more economically sensitive sectors, such as automakers and energy, performing better. So far this year, value stocks in the S&P 500 have gained 4%, while S&P 500 growth stocks have edged up 1%.

Value stocks tend to perform best in the aftermath of a market correction (one ended in February) and when the economy and earnings growth are improving. Despite the recent gains in bargain stocks, “value assets have further to run—that’s the right place to focus,” says Richard Turnill, chief investment strategist at money management giant BlackRock.

Finding value in an aging bull market is tricky. U.S. stocks trade at nearly 17 times estimated year-ahead earnings, compared with an average price-earnings ratio of 15 since 1986. But you can find bargains outside such traditional value sectors as financials, industrials and energy. For example, average P/Es for health care stocks, which are normally 13% greater than the P/E of the S&P 500, today are 12% less than the market’s P/E, says Bank of America Merrill Lynch.

Opportunities vary within sectors, too, so selection is key. “We look at things name by name,” says Mark Finn, manager of T. Rowe Price Value (symbol TRVLX), a member of the Kiplinger 25. One stock he finds attractive is Royal Dutch Shell (RDS-B, $51), a global energy giant well positioned for the long term. He also likes MetLife (MET, $44), an insurer that sells for 8 times estimated year-ahead earnings and sports a dividend yield of 3.6%. Exchange-traded-fund investors who want a diversified portfolio of value stocks can explore iShares MSCI USA Value Factor (VLUE, $61), which targets the cheapest stocks in each sector. Or check out PowerShares Dynamic Large Cap Value ETF (PWV, $30), newly added to the Kiplinger ETF 20.

[page break]

The economy limps along

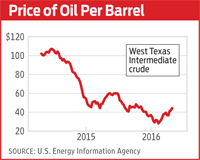

The outlook is improving in the oil patch. As energy producers have cut back in response to low prices, the growth in supply has declined and demand has held steady, says market strategist Paul Christopher, of Wells Fargo Investment Institute, the research arm of the financial-services giant. After skidding 76% from June 2014 through February, the price of oil rebounded 76%, to $45 per barrel, in early May.

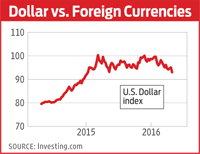

The other key to earnings improvement is the dollar. The greenback has reversed a nearly 30% surge against a basket of foreign currencies since mid 2014 and is down about 6% since November. A weaker dollar helps exporters and multinational companies by making their goods more competitive overseas and by translating sales generated overseas into more dollars here. “The dollar’s weakening has mostly played out,” says Christopher. That’s okay, he adds, especially if the global economy picks up steam. “The value of the dollar will become less important as growth around the world improves.”

Think of an earnings recovery as the engine that could kick the stock market into gear in the second half of the year. Just don’t count on more than low- to mid-single-digit earnings growth, driving low- to mid-single-digit stock market gains. “Earnings growth is a driver, but we’re still in this low-return world,” says BlackRock’s Turnill.

[page break]

Cash is king

Investors have to do some sleuthing to find stocks that can break out of the market’s sideways trend. Companies that generate healthy free cash flow—the amount of cash profit left after capital expenditures—are a great place to start. Executives at big free-cash generators have a lot of options: They can invest in their businesses, buy back stock, acquire other companies, pay dividends or engage in some combination of all four.

Income-seeking investors should focus on dividend growth rather than on the highest-yielding stocks. Companies with the wherewithal to increase dividends have done well in range-bound markets, according to an analysis by BMO strategist Belski. Of 14 flat-market periods since 1990, shares of companies with increasing dividends on average lost ground in only three and saw share prices climb 10% or more in five—and that’s not including the return from the dividends themselves. Moreover, a focus on dividend growth, as opposed to high yield, will lead you to companies that have stronger balance sheets and better earnings growth potential. And the shares of dividend growers are cheaper to boot. For instance, a recent examination by BofA Merrill Lynch found that the 50 highest-yielding stocks in the S&P 500, with a median yield of 4.5%, saw earnings per share fall 9% in the past four quarters, while the top 50 dividend growers, yielding an average of 1.5%, saw nearly 15% earnings growth. But the dividend growers trade at just 14 times estimated year-ahead earnings, on average, and the high-yielders trade at 16 times.

Dividends aren’t just popular with investors; they’re increasingly attractive to corporate America. Since 2007, S&P 500 companies have boosted cash payouts by nearly 60% while spending 3% less on share buybacks. And there’s plenty of room for dividends to grow. The payout ratio for S&P 500 companies—the percentage of earnings paid out as dividends—has risen from 26% in 2011 to 37% in 2016, still well below the historical average of 53%.

You’ll find plenty of companies with superior cash flow and attractive dividends in tech and health care. Two stocks recommended by BMO that fit the theme: biotech giant Amgen (AMGN, $157) and networking leader Cisco Systems (CSCO, $27). Our favorite dividend investment fund is Vanguard Dividend Growth (VDIGX), a member of the Kiplinger 25. Manager Donald Kilbride looks for companies that have increased dividends over time and that are trading at reasonable prices.

Emerging markets beckon

Investors with a long-term view will benefit from looking beyond U.S. borders, in particular to emerging markets. A sharp rally early in the year, followed by a more recent pullback, makes it clear how volatile these markets can be. The best way to invest is gradually, says James Syme, comanager of JOHCM Global Emerging Markets Opportunities (JOEIX). “Don’t try to time a single investment, but buy some today, more in three months and more in six months,” he says.

The direction of the dollar is key. A surging greenback pressures emerging nations because many have to repay debt denominated in dollars. And many developing countries rely on the export of commodities that are priced in dollars and tend to fall in price when the greenback appreciates. “Weakness in the dollar won’t persist, but it should be soft enough that emerging markets will do well in the second half of the year,” says Ameriprise strategist Joy.

The fortunes of a large share of emerging nations depend on China, where economic growth is slowing, although it is still expanding at a 6%-plus annual clip. “For every data point that’s negative, I can find another one that’s positive,” says Richard Schmidt, comanager of Harding Loevner Emerging Markets (HLEMX). The risk, he says, is that the massive debt taken on by state-owned enterprises will become a black hole that obliterates economic growth. “That’s not my operating assumption, but it’s a risk,” he says.

The Harding Loevner fund, a member of the Kiplinger 25, is our favorite fund for investing in these dicey markets. Schmidt and his colleagues are focusing on countries where reformist governments have adopted pro-growth economic policies, including India and Mexico, and on smaller nations, such as Indonesia and Colombia. He’s also positive on Brazil, a country roiled in recent months by political upheaval. Syme favors India and China, as well as countries that export to the U.S., specifically South Korea (which some analysts classify as a developed market) and Taiwan.

[page break]

More of the same for bonds

Bonds will have a tougher slog than stocks throughout the rest of 2016. The global economy still supports a “lower for longer” point of view when it comes to bond yields (see Income Investing: Why I Think Interest Rates Will Stay Low), which means investors needn’t fear bond market Armageddon, even as the Fed hikes rates once or twice this year. But it’s also true that even modest rate creep, along with reawakening inflation, presents challenges. (Bond prices fall when interest rates rise, and inflation eats away at bonds’ value.) “There’s a disconnect between current low yields and the reality of the economic and inflation picture,” says Nuveen’s Doll.

The trick is to find the parts of the bond market that will deliver more than a minuscule yield while limiting the risk of default, as well as do at least okay when rates rise in earnest. For now, the sweet spot is in medium-maturity, high-quality corporate bonds, says Wells Fargo’s Christopher. “Investors are getting paid to take risk in investment-grade corporates.” Vanguard Intermediate-Term Investment Grade (VFICX), yielding 2.4%, is a good choice. Christopher also recommends Treasury Inflation-Protected Securities, or TIPS. “People hate TIPS now, but inflation expectations will rebound,” he says. Buy TIPS directly from your broker or from Uncle Sam at TreasuryDirect.gov. TIPS maturing in 10 years provide an after-inflation yield of 0.15%.

Investors who can ignore the scary headlines about struggles in Puerto Rico, Chicago and elsewhere can find opportunities in municipal bonds, says James Dearborn, head of muni bonds at money management firm Columbia Threadneedle. He reminds investors that the muni market includes more than 50,000 issuers, and that state and local revenues have now eclipsed the peaks reached prior to the financial crisis. Fidelity Tax-Free Bond (FTABX) yields 1.8%, which is the equivalent of a taxable yield of 3.2% for investors who pay the top federal rate of 43.4%.

Gold’s restored luster

The dazzling 19% rise in the price of bullion so far this year—and the remarkable 78% surge in gold stocks—is raising hopes that the bear market in gold that began in 2011 is over. Given the history of gold-market cycles, however, it seems too soon to project a new bull market in the precious metal.

Still, investors should devote a sliver of their portfolio to gold or mining stocks as a hedge against some of today’s key risks, says strategist Christopher Hyzy, of Bank of America. Among them: a potentially weaker dollar (the price of gold usually moves in the opposite direction), a pickup in inflation and the threat of geopolitical crises. Would-be gold bugs can explore iShares Gold Trust (IAU, $12), which tracks the price of bullion, and Market Vectors Gold Mining (GDX, $24), which tracks the more-volatile mining stocks.

SEE ALSO:

An Investors' Guide to the Gold Rally

p>

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Bonus Deduction Means for Medicare IRMAATax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.