Where to Invest in 2016

In a world of muted economic growth, investors can expect modest gains and more volatility. But the bull lives on.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Is a bear market nipping at our heels? That question, more than any other, will dog investors as we enter 2016. We don’t think you should give up on the bull just yet. Just don’t expect too much from it.

As the bull market heads into its eighth year, investors will have to contend with heightened volatility as the Federal Reserve Board nudges interest rates toward more-normal levels, election-year rhetoric boils over, and economic growth—here and abroad—starts and stutters. Corporate profits will grow tepidly, and price-earnings ratios, a measure of how much investors are willing to pay for each dollar of a company’s earnings, are unlikely to expand.

As a result, investors can expect stock prices to appreciate on average by mid-single-digit percentages over the coming year, commensurate with the modest earnings gains expected from corporate America. That would put Standard & Poor’s 500-stock index at 2200 or a bit higher (figure on the Dow Jones industrials approaching 19,000). Add in two percentage points to account for dividends and that brings the expected total return for U.S. stocks to roughly 8%. “The majority of the bull market is behind us,” says Matthew Berler, a portfolio manager at Osterweis Capital Management. “But this is not 2007 or 1999—we are not on the precipice of a bear market.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That doesn’t mean you can rule out more pullbacks of the sort that agitated investors last summer. Expect rolling corrections within sectors and industries, says Ernest Cecilia, chief investment officer at Bryn Mawr Trust. “We’ve had huge run-ups, then the air comes out, without the whole market falling,” he says. “That will continue.” Your portfolio may require more tending as market leaders and laggards trade places. A regimen of regularly pocketing gains and using the proceeds to scout for bargains will pay off.

The China factor

The chief worry for investors in 2016 is whether a global economy that’s already in low gear will downshift further. For now, improvement in the developed world, albeit lackluster, is partially offset by the bleak picture in emerging markets. All eyes are on China, as it navigates a transition from a fast-growing manufacturing economy to a slower-growing, consumer-driven one. IHS Economics expects global economic growth of roughly 3% in 2016—within the 2.5%-to-3% range the world has been stuck in since 2011.

The U.S. economy will strengthen, but only modestly. Kiplinger expects gross domestic product growth of 2.8% in 2016, up from an expected 2.5% for 2015. Commodity prices will continue to languish due to lack of demand, but oil, at least, will stabilize, averaging between $45 and $55 a barrel in 2016, up from its August low of $38 a barrel. The dollar, already up nearly 20% since July 2014, will tack on another 5% to 7% against a basket of major foreign currencies as the Fed embarks on a course of modest, gradual rate hikes, while central bankers in Europe, Japan and China go in the opposite direction. A beefier buck will continue to bedevil U.S. multinational companies, as their goods become more expensive overseas and foreign sales translate into fewer dollars.

Emerging from the profit doldrums of 2015 will be key to market gains in 2016. When the tallies are in for 2015, analysts expect zero earnings growth for the year. Although the profit slump was mainly confined to the energy sector, a victim of plunging oil prices, and multinationals, which were hurt by the strong dollar, sluggish corporate revenues are a more widespread challenge. Sales growth remains the Godot of corporate America; it has yet to materialize, at least with any strength, although we’ve been waiting for years. Investors are right to question how much longer corporate America can engineer earnings gains by cutting costs, buying back shares and acquiring other companies.

What could go wrong

For pessimists looking for a worst-case scenario, it’s not hard to imagine the stock market derailed by some kind of economic shock. Analysts at Bank of America Merrill Lynch posit another possibility, more banal but equally devastating: Growth expectations simply suffer “significant downward revision by a thousand cuts.”

There’s plenty to worry about, for sure. But we still think the weight of the evidence favors the bull. For one thing, neither the economic recovery nor the bull market is as old as it might seem. Economic expansions last 58 months, on average, and this one is 78 months long at the start of 2016. But the three recoveries since 1981, which occurred during periods of relatively low inflation, may be more comparable, and they lasted an average of 95 months. “Recoveries aren’t over because of a ‘sell-by’ date,” says economist John Canally, of LPL Financial, a brokerage firm. He thinks the economy won’t contract until 2018 or 2019 because we have yet to see the excesses of overbuilding or runaway inflation that typically precede a downturn.

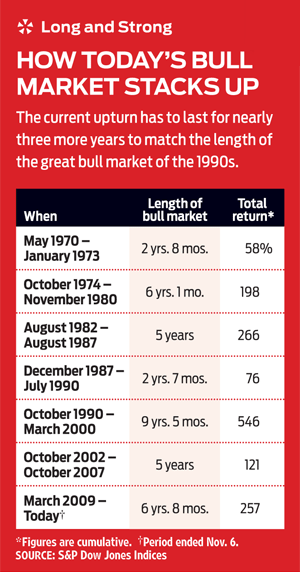

The same goes for the stock market. The bull market, which celebrates its seventh birthday in March, will by then be nearly three years longer than the average bull market. But it will also be three years shorter than the nearly 10-year run that began in 1990. Shares in the S&P 500 trade at 16 times expected earnings for 2016—-higher than the historical average of 15, but down from 17 times earnings last spring. “The market is not expensive, but it’s not cheap, either,” says Darrell Cronk, president of Wells Fargo Investment Institute, which provides research to Wells Fargo advisers and their clients. “It can go up as much as earnings can grow.” Cronk is calling for average earnings growth of 6.5% for companies in the S&P 500, while analysts on average expect 8%. We think 6% to 8% is a fair range. In any case, the risk is that P/Es contract in the coming year if investors decide to pay less for their share of earnings, muting returns.

Investors should consider bumping up their allocations to foreign stocks in 2016, but they’ll have to choose carefully. Fears of a hard landing for China’s economy (which is what threw the U.S. market into a tailspin last summer) are overblown. The jury is out on whether Japan can climb convincingly out of its funk, but Europe is attracting a fair share of bulls, including us. Intrepid investors who are ready to embrace their inner contrarian can explore emerging markets in 2016.

[page break]

Eyes on central bankers

More than anything else, the fate of overseas markets—and to some extent, ours, too—depends on actions taken (and signals telegraphed) by central bankers in foreign lands. A bullish sign for investors is that those bankers are likely to maintain easy-money policies and low interest rates throughout 2016.

Even here, where rates will creep higher, Wall Street’s mantra remains “lower for longer.” Still, fixed-income investing will remain a challenge. “Rates will remain low enough that it will be hard to find decent returns, but it will be dangerous to stretch to find that return,” says Scott Clemons, chief investment strategist at money-management firm Brown Brothers Harriman. For more on consumer rates, see Get Ahead of Rising Interest Rates

.

In a world of slow economic growth and modest profit expectations, the most dependable returns will come from companies with stellar finances and stable earnings. Such high-quality shares usually stand up well to market volatility, too. Think names such as CVS Health (symbol CVS, $99), the drugstore chain and pharmacy-benefits manager; Kroger (KR, $38), the supermarket giant; and apparel maker V.F. Corp. (VFC, $68).

Even in a middling market, investors can find plenty of pockets of strength. Start by looking in the mirror: Consumers are in good shape. Wages have ticked higher but not enough to stoke inflation. And savings from lower gasoline prices are at last fueling spending at restaurants, retailers and other consumer-goods companies, says Jason Pride, director of investment strategy at money-management firm Glenmede. We’re spending 78 cents of every dollar saved at the pump, up from just 45 cents in March.

S&P Capital IQ recommends that investors tilt their portfolios toward companies that make and market nonessential consumer goods. Although the stocks were up by double-digit percentages in 2015, the group is expected to log earnings growth of 15% in 2016, beating estimated earnings gains for the S&P 500 by a long shot. One way to invest is through Consumer Discretionary Select Sector SPDR (XLY), an exchange-traded fund. Top holdings include Amazon.com (AMZN), Home Depot (HD) and Nike (NKE).

Investors who prefer individual stocks might like Walt Disney Co. (DIS, $114), “an iconic brand that’s extremely well managed,” says Henry Smith, chief investment officer at Haverford Trust, who thinks Disney’s December 2015 release of Star Wars: The Force Awakens, plus all the movie spin-off products to follow, bodes well for the company.

Bargain hunters might take a chance on home-goods retailer Bed Bath & Beyond (BBBY, $60). The company has struggled to integrate in-store and online shopping, and its stock sells at 11 times expected earnings for the fiscal year that ends in February 2017, compared with a five-year average P/E of 15 (and a P/E of 17 for the specialty retail group overall). “We think the company has turned the corner,” says Bryn Mawr’s Cecilia.

Technology stocks have been top performers, too, but remain well priced. Apple (AAPL, $120), for example, sells for just 12 times estimated earnings for the fiscal year that ends next September. “Apple is going to be returning cash to shareholders in terms of significant share buybacks and dividend increases for years to come,” says Smith. Mutual fund investors can find scads of today’s tech leaders in T. Rowe Price Global Technology Fund (PRGTX).

Income-seeking investors will in many cases do better with stocks than with bonds, especially as rates begin to rise and as bond prices, which move in the opposite direction, fall. More than 60% of S&P 500 companies pay more than the 1.6% yield of the five-year Treasury note. Avoid the highest-yielding stocks; the underlying companies typically generate little, if any, earnings growth. Instead, seek rising-dividend stocks, which are likely to do better than their more bondlike counterparts when rates start going up.

An analysis from BofA Merrill shows chip maker Skyworks Solutions (SWKS, $77) among stocks increasing dividends the fastest. Sherwin-Williams Co. (SHW, $267), the paint manufacturer, is among the most consistent dividend raisers; retailer Costco Wholesale (COST, $158) has room to increase its dividend; and Celgene (CELG, $123), a biotechnology firm, fits the financial profile of companies that don’t pay dividends now but have the wherewithal to begin doing so soon (see also Three Great Future Dividend Payers.) A great choice for fund investors is Vanguard Dividend Growth (VDIGX), a member of the Kiplinger 25.

Volatility is unnerving, but investors able to keep their heads can use it to their advantage. There’s sure to be a lot of heated political rhetoric in 2016 about limiting drug costs, for example. That could be a cue to shop for bargains among top-notch pharmaceutical firms and other health care stocks. Health care prospects to pounce on include drug giant Abbvie (ABBV, $60) and instrument maker Thermo Fisher Scientific (TMO, $131).

Finally, investors should be on the lookout for a resurgence in the industrial sector, which has shown signs of strength since the summer market rout. “Softness in manufacturing has made industrials cheap,” says Cronk, of Wells Fargo. Throughout the economic expansion, U.S. corporations have spent liberally on share buybacks, dividends and acquisitions but have put relatively little into buildings and equipment to expand their businesses. “I expect capital spending to pick up in 2016,” says Cronk, “and that’s played through industrials.”

USAA portfolio manager Robert Landry favors industrials that aren’t too dependent on a resurgence of global growth and stronger commodity prices; that means he’s staying away from heavy equipment makers. Rather, he favors global conglomerate General Electric (GE, $29), military contractor Raytheon (RTN, $117), waste management company Republic Services (RSG, $44) and package delivery firm United Parcel Service (UPS, $103).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

I want to sell our beach house to retire now, but my wife wants to keep it.

I want to sell our beach house to retire now, but my wife wants to keep it.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

These Were the Hottest S&P 500 Stocks of the Year

These Were the Hottest S&P 500 Stocks of the YearAI winners lead the list of the S&P 500's top 25 stocks of 2025, but some of the names might surprise you.

-

The Best Health Care Stocks to Buy

The Best Health Care Stocks to BuyThe best health care stocks offer investors a defensive hedge in an uncertain market. Here's how to find them.

-

AI vs the Stock Market: How Did Value Stocks, Gold and PayPal Perform in April?

AI vs the Stock Market: How Did Value Stocks, Gold and PayPal Perform in April?AI is a new tool for investors to use for data analysis, but can it beat the stock market? Here's how a chatbot's stock picks fared in April.

-

Stock Market Today: Tariff Talks Drive Another Up-and-Down Day

Stock Market Today: Tariff Talks Drive Another Up-and-Down DayTrade war negotiations are happening, but the "fear gauge" is gyrating, and investors, traders and speculators are still searching for signs of a bottom.

-

How to Hedge Against Trump's Tariffs

How to Hedge Against Trump's TariffsDonald Trump is taking action on tariffs and this could have a big impact on public companies. Here's how investors can prepare.

-

Stock Market Today: Stocks Rally on Strong Netflix Earnings

Stock Market Today: Stocks Rally on Strong Netflix EarningsMega-cap tech leads the charge as markets rise for a sixth straight week.

-

CVS Stock Falls After Karen Lynch Ouster: What to Know

CVS Stock Falls After Karen Lynch Ouster: What to KnowCVS stock is lower Friday after the embattled healthcare company said Karen Lynch is out as CEO, effective immediately