Where to Invest in 2019

Making money in stocks won’t be a walk in the park. You’ll need some protective armor to shine in a market facing a thicket of risks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

At this stage in the stock market’s long, historic run, investors might want to start thinking of the market a little differently—as a bear in a bull-market suit, for instance. That’s not to say that the bull market is over, just that the bear might be closer than it appears, and that it’s time to prepare accordingly. That means you’ll need to suit up in 2019, too, donning some defensive armor to survive and thrive in a market facing increasing risks.

For now, the financial backdrop still supports stocks. The economy will keep growing, albeit at a slower pace; corporate earnings will increase as well, if not as briskly as before. The cloud of uncertainty that hung over the midterm elections has lifted. “The overarching message is that the economic and investing environment is healthy, but it’s becoming less favorable,” says David Joy, chief market strategist at Ameriprise. CFRA chief investment strategist Sam Stovall says, “I’m a bull, but a bull with a small b.”

That describes our outlook to a t. We see moderate gains for stock investors in 2019, with more volatility and no guarantee that the market will finish in December at the high point for the year. In other words, gains in the market may not be linear or monolithic—you’ll have to choose carefully and rebalance your holdings religiously as different market sectors and investing styles seesaw throughout the year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We think Standard & Poor’s 500-stock index could reach a level somewhere between 2950 and 3000 in 2019, which would deliver a total return, including dividends, of roughly 8% or 9%. A similar price gain would put the Dow Jones industrial average in the neighborhood of 27,800. Indexes could spike higher in a volatile market, especially earlier in the year. But for reasons we explain below, we think investors should rein in any speculative tendencies and approach the market in a disciplined way. (Prices and returns in this story are through November 9, when the S&P 500 closed at 2781.)

Such a guarded view seems discordant with a robust financial backdrop. The economy grew at a 3.5% annual rate in the third quarter, according to the government’s most recent report. Corporate earnings are on track for a gain of 20%-plus for 2018. At 3.7%, unemployment currently is the lowest it has been since Diana Ross and the Supremes topped the pop music charts, and worker raises have topped 3% for the first time in a decade.

Good, But Not Better

It would be a big mistake for investors to extrapolate the blockbuster economic picture we’re seeing now into future stock gains, says Liz Ann Sonders, chief investment strategist at Charles Schwab. “The data’s always great at market tops. When it comes to the relationship between the economy and the market, better or worse matters more than good or bad,” she says.

The market can claim some “decidedly bullish attributes,” says John Linehan, chief investment officer for stocks at T. Rowe Price. “You have strong consumer and business confidence, tax cuts and a lot of fiscal stimulus filtering through the economy, and continued deregulation,” he says. Balanced against that are “more unknowns than we’ve seen in a while.”

And there’s no getting around the fact that key market drivers are slowing. Topping 2018 growth rates for the economy and for corporate revenues and earnings would be “next to impossible” in 2019, says strategist Ed Yardeni, of Yardeni Research, because of the boost in 2018 from tax cuts and a jump in government spending.

A survey by Blue Chip Economic Indicators shows that economists expect U.S. economic growth to slow from an annual rate of 3.1% in the fourth quarter of 2018 to 2.3% for the fourth quarter of 2019. Kiplinger expects an overall growth rate in 2019 of 2.7%, down from 2.9% in 2018. Meanwhile, profit growth for companies in the S&P 500 is expected to slow from a meteoric 24% to 8.8%, according to analyst estimates from earnings tracker Refinitiv.

Even those estimates might be too optimistic, given the building pressure on corporate profit margins. Expectations for plumper margins in 2019 are “lofty,” says Michael Wilson, chief U.S. stock strategist at Morgan Stanley Wealth Management. He believes there’s a good chance that margins will shrink instead of increase as firms face higher costs for labor, debt service and materials, as well as tariffs.

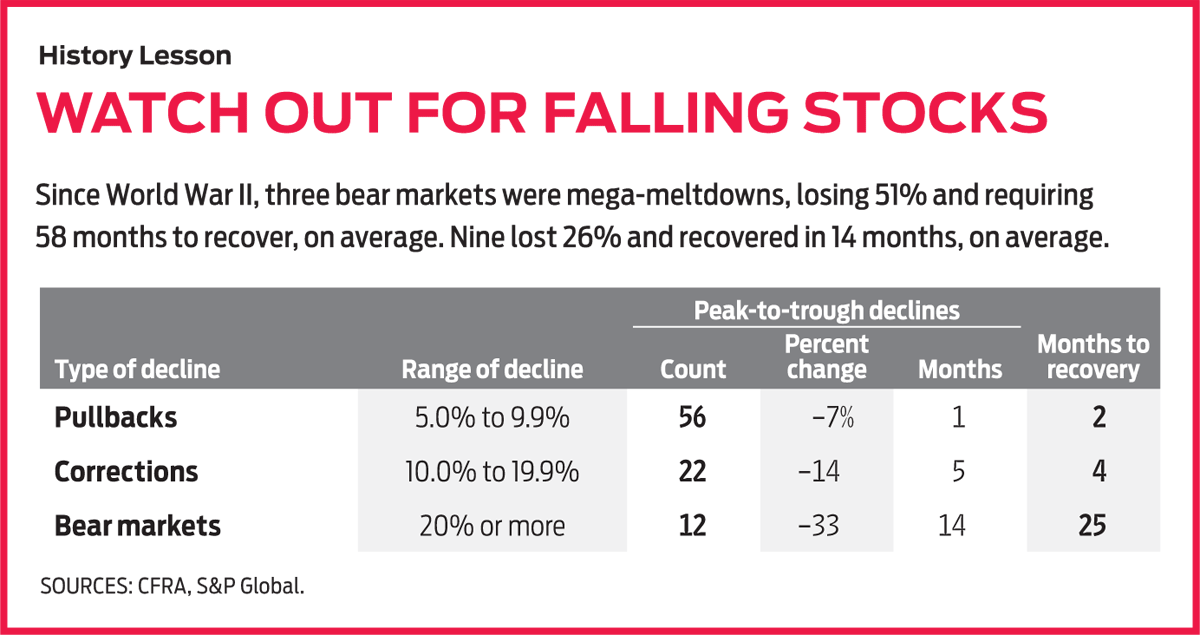

If margins come in below expectations, so will profits. Chris Hyzy, chief investment officer of Merrill Lynch and U.S. Trust, says earnings growth of 6% to 7% is more realistic for 2019. That would put earnings per share for the S&P 500 in the low $170s, compared with estimates of $177 per share now. When earnings growth peaks, it’s typically bad news for investors, says CFRA’s Stovall. A majority of peaks are accompanied by a bear market (typically defined as a downturn of at least 20%) or a correction (defined as a drop of more than 10% but less than 20%).

Dents in the Armor

At the top of the list of market risks are trade tensions and rising interest rates, both of which will put the economy and corporate profitability to the test. “The risk of recession is a little higher and less distant than what the consensus is jelling around, and the runway between now and the next recession could get shorter if the trade battle escalates further,” Sonders says. She and other strategists are skeptical of a comprehensive trade deal with China coming to fruition. Meanwhile, higher tariffs and tariffs on more goods are slated to go into effect in 2019. Adding up levies that are either in place, pending or proposed, Sonders figures they could clip economic growth by one percentage point. “Taking one point off growth that’s going back down to 2% to 3% is meaningful,” she says.

Keep your eyes on the Federal Reserve in 2019. The central bank has been hiking short-term interest rates since 2015, and hikes will continue throughout 2019—but how much and how often they rise are key to whether the bull market lives or dies, says Joy, of Ameriprise. The investing world is of the view that the Fed will raise rates just twice in 2019, says Joy, but the Fed has indicated three hikes, which is also what Kiplinger expects. Investors should hope for a letup. “If the Fed pauses, it might be a signal that the bull market is not ready to expire,” Joy says. If the Fed keeps hiking in a zeal to choke off inflation, it could choke off the market, too, he says.

Bear Watch

When the next bear market will arrive is anybody’s guess. But consider the fall swoon that took the S&P 500 down 10% “a dress rehearsal for the real thing,” says Joy. In fact, the downdraft was brutal enough to be considered a bear market for many individual issues. Over roughly the same period, Amazon.com fell 25% as investors took aim at high-tech market leaders; Advanced Micro Devices fell 49% in a semiconductor washout.

The question keeping investors up at night: Is the correction a pause that will enable a tired bull, which has already claimed the mantle of the longest bull market ever, to keep grinding higher—and celebrate its 10th birthday in March—or is it the beginning of the end of the bull run?

For most investors, timing the arrival of the next bear market is far less important than making sure your portfolio can stand whatever comes, meaning it is properly diversified, with a risk profile that reflects your stage in life. We may well escape 2019 without getting mauled, and exiting a bull market early can cost you dearly.

The tendency for the biggest gains to come in the first tenth and the last tenth of a bull market argues against making all-or-nothing bets now, say Schwab strategists. Even so, few would disagree that we’re closer to the end of this bull market than the beginning. Market tops can be long, drawn out affairs that take months to develop. And investors would do well to remember that bear-market downturns precede economic recessions by six to 12 months, on average.

Still, you can think of the U.S. market as the best house on a mostly bad block. Blue Chip Economic Indicators economists forecast a slowdown in growth in Europe, from an expected 2.0% in 2018 to 1.8% in 2019. Emerging markets are struggling to manage debt made more onerous by rising rates and volatile currencies. China’s economy is expected to grow at a 6% clip, but that’s down from a 10-year average of 8%.

U.S. stock investors who have done well by letting their winners ride will have to take a more hands-on approach in 2019

Nonetheless, diversified investors can find bright spots even in dicey markets. “We’re starting to see opportunities in Europe,” says Linehan. French oil company Total (symbol TOT, $57), which trades on the New York Stock Exchange, is the “best collection of growth and return of any company in the industry,” he says. Patient, long-term investors should not abandon emerging-markets stocks, which are trading at an average discount relative to stocks in developed markets that’s nearly double its usual amount, says Hyzy. Market-friendly governments in Brazil and India bode well for investments there, says BNY Mellon chief strategist Alicia Levine. We recommend Baron Emerging Markets (BEXFX), on the Kiplinger 25 list of our favorite mutual funds.

Japan is also attractive now, says Levine. “It has had 20 years of stagnation but several quarters of economic growth recently—not gangbusters, but many companies are doing well,” she says. The consumer sector is interesting, she adds. Unemployment is low, and wages are growing. Fidelity Japan Smaller Companies (FJSCX) has a sizable stake in consumer-focused stocks.

U.S. stock investors who have done well by letting their winners ride will have to take a more hands-on approach in 2019. “You’ve been rewarded for being overweight in stocks for the past couple of years,” says Joy. “But you should at the very least trim positions back to neutral. If you’re more concerned about the market, go ahead and move to an underweight position in stocks,” he says.

For investors who want to beef up bond holdings, rising rates present challenges because bond prices fall when rates are rising. Kiplinger expects the yield on 10-year Treasury notes to end 2019 with a 3.6% yield, up from an expected 3.2% at the end of 2018. (For more on our bond outlook, see Income Investing.) Short- and intermediate-term bonds are less sensitive to interest rate swings, so look for bonds or funds with a duration (a measure of interest rate sensitivity) of two to seven years. “That’s the sweet spot where you get the most yield for the least risk,” says Kathy Jones, Schwab’s chief fixed-income strategist. Kip 25 member Fidelity Strategic Income (FADMX), a go-anywhere fund with a duration of 4.3 years and a yield of 3.9%, is a good choice. (For more, see the Kiplinger 25 Update.)

For the first time in years, investors can plump up their cash cushions without feeling shortchanged. Vanguard Prime Money Market Fund (VMMXX) yields 2.21%, compared with a current 1.9% yield on the S&P 500. The highest-yielding online banks and CDs will deliver 2.25% to 2.7%. Fidelity Conservative Income Bond (FCONX) yields 2.2% and can be considered a cash alternative, say Morningstar analysts. (For more strategies and picks, see Cash Is No Longer Trash.)

When it comes to the stocks that you do hold, understand that it’s going to be a choppy market, as likely to fall 10% as to rally 15%, says T. Rowe Price’s Linehan. “Try to take advantage of the opportunities,” he says. Stay diversified and rebalance frequently by paring back winners and adding to laggards. “Portfolio construction becomes very important late in the market cycle to make sure your risk budget doesn’t get out of whack,” says Hyzy at Merrill Lynch.

You can also tweak your holdings for a more defensive stance. Strategists at Schwab recently upgraded their view of real estate investment trusts and utilities while downgrading their outlook for tech and financials. “That was a message that there are ways to get defensive without a wholesale dumping of stocks,” says Schwab’s Sonders. For now, health care is the only sector that Schwab believes will outperform the market.

A Market of Stocks

Expect pockets of opportunity more than sweeping market- or sector-wide moves in 2019. To use an old Wall Street adage, it will be less a stock market and more a market of stocks. When looking for stocks to buy, high quality should be a touchstone. Hallmarks include solid brands, strong cash flows, growing dividends and low debt levels. Think Walt Disney (DIS, $118) or Kiplinger Dividend 15 member Johnson & Johnson (JNJ, $145). Both are recommended by analysts at CFRA and are included in the firm’s High Quality Capital Appreciation portfolio. Managers at Akre Focus (AKREX) are about as choosy as they come. Top holdings include American Tower (AMT, $160), a cell tower REIT, and payments giant Visa (V, $144). We also like T. Rowe Price Blue Chip Growth (TRBCX), a member of the Kip 25.

With profit margins getting squeezed, companies with a history of consistent margin strength could pay off. According to Goldman Sachs, one such company is IDEXX Labs (IDXX, $207), which makes and distributes diagnostic products and services for the veterinary market. Another is drug company Celgene (CELG, $74), one of our stocks to buy now.

Companies with pricing power that can pass on increased costs to customers or withstand an economic slowdown are positioned well for 2019. Airlines, for example, have undergone “tremendous consolidation,” says Linehan. “You can argue that they have more pricing power than they have ever had,” he says. Consider Southwest Airlines (LUV, $52), which boasts a rock-solid balance sheet.

In the wake of the U.S. midterm elections, which resulted in a divided Congress, rare areas of policy agreement could spell gains for affected stocks. An infrastructure spending bill is likely to appeal to both Democrats and Republicans, potentially boosting firms that will “redevelop ports, bridges, utility grids and next-generation broadband,” says Hyzy. That includes construction, engineering and machinery firms, or industrial stocks in general. Conglomerate Honeywell (HON, $150) and Vulcan Materials (VMC, $106), which sells construction materials including concrete and asphalt, are worth exploring. Or consider Kiplinger ETF 20 member Fidelity MSCI Industrials Index (FIDU, $37).

Value stocks have performed poorly for much of the bull market as investors have shunned bargain-priced fare for growth-oriented names, but that performance gap should narrow in 2019. One of our favorite value funds, Kip 25 member Dodge and Cox Stock (DODGX), has outsize positions in health care and financials. Value funds also tend to lose less in down markets. Over the past year, for every $1 loss in the S&P 500, AMG Yacktman (YACKX) has lost less than 41 cents.

2018 Update: Pretty Good

Last year’s outlook called for an 8% total return in the broad stock market, putting Standard & Poor’s 500-stock index at roughly 2730. The market returned 10.2% between last January’s issue and this one, with the index closing about 50 points above our target, at 2781. We got more bullish as the year wore on, pushing our midyear target to 2900 or a bit higher on the S&P 500; the index peaked in September at 2931. Our bullish call on tech and financials bore mixed results, with the tech sector (which got reshuffled in September) doing well until a fall downdraft, and financials struggling much of the year.

The eight stocks we recommended for 2018 returned 7.7%, on average. Intuitive Surgical, which develops technologies, tools and services for robotics-assisted surgeries, led the way with a 41.9% return. Had you bet on Microsoft, benefiting from a shift to mobile computing, you would have earned 34.1%. Insurer United Healthcare rose 33.3%.

Among the duds were auto-parts company Aptiv (formerly Delphi Automotive), which lost 9.5%, and IT services firm DXC Technology, down 24.6%. Microchip equipment maker Applied Materials sank 38.5%.

As for the stocks we said to sell, you would have been smart to jettison General Mills, which surrendered 9.1%. The four others finished in the black.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.