Why You Still Need TIPS

Treasury inflation-protected securities will safeguard your buying power.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Treasury inflation-protected securities are the go-to income investments if you want to protect principal from the ravages of inflation. But there’s a problem: TIPS can lose money and can do so surprisingly quickly.

The downside of TIPS came to light over the spring and early summer, when global credit markets sank in response to suggestions by the Federal Reserve that it might cut back its easy-money policies. TIPS tumbled, too. From May 2 through June 24, a Barclays index of U.S. TIPS with maturities of at least one year plunged 9%.

How they work. Introduced in the 1990s, TIPS are Treasury bonds that are linked to the consumer price index. Interest is paid twice a year, and the bonds’ principal value increases with inflation and decreases with deflation. When the bond matures, you receive either the inflation-adjusted principal plus interest or, in the event of deflation, the original principal plus interest.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In recent years, investors have poured money into TIPS and other Treasury bonds as a hedge against turmoil in Europe and other parts of the world. Investors also worried that the Fed’s massive bond-buying program would spark inflation. Because of the strong demand, TIPS prices rose, and their yields, which move in the opposite direction, turned negative. (A negative TIPS yield means your return will be less than the change in consumer prices.)

But when chairman Ben Bernanke suggested that the Fed might soon back away from its bond purchases, the fixed-income market—including TIPS—went into a tizzy. Not only did investors flee TIPS under the threat of higher rates, but inflation was nowhere to be found, a terrible combination for TIPS holders.

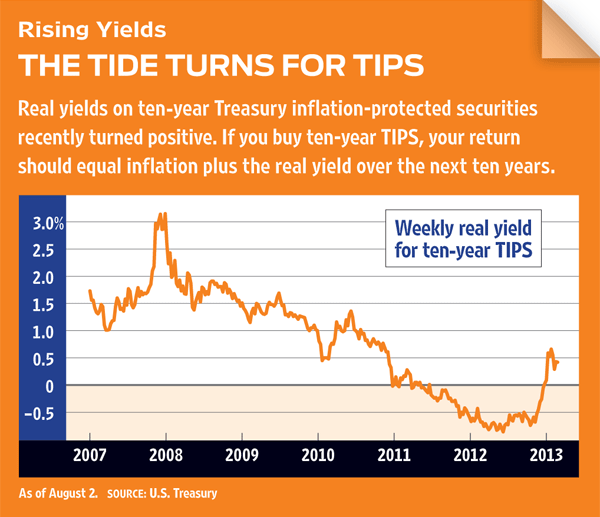

Some good news did come out of the bond rout. As prices fell, yields on ten-year TIPS became positive for the first time in a year and a half. As of August 2, the real, or inflation-adjusted, yield on ten-year TIPS is 0.42%. That means if you were to buy a ten-year TIPS today, your annual return over the holding period would be roughly the inflation rate plus 0.42 percentage point.

So are TIPS bargains now? To see whether TIPS make sense, experts look at the so-called break-even rate. That’s the difference between yields on TIPS and yields on regular Treasuries, recently 2.6 percentage points on bonds with ten-year maturities. Annual inflation would have to average more than 2.6% for investors to earn more on TIPS than they would on regular Treasuries. Over the past year through June, consumer prices climbed 1.8%, but inflation has averaged about 3% annually for most of the past century.

Most investors should hold TIPS. Think of them as a way of hedging against future erosion of your purchasing power—with some volatility along the way, to be sure, but with less volatility than many other inflation hedges, such as gold.

Morningstar analyst Michelle Canavan suggests investing in TIPS with short maturities, which are less sensitive to rising rates than TIPS with long maturities. Consider Vanguard Short-Term Inflation-Protected Securities Index Fund (symbol VTAPX), which was launched last October, or its exchange-traded sibling, which trades under the symbol VTIP. Both versions show a current negative yield of about 1%. Year-to-date through August 2, the mutual fund version lost 1.1%. Expenses are just 0.10% per year.

Funds and ETFs offer convenience, but if you want a guarantee that you’ll get your principal back at maturity, you can buy TIPS directly from Uncle Sam without commission at www.treasurydirect.gov. TIPS are sold in maturities of five, ten and 30 years; the minimum purchase is $100.

You don’t have to rush into TIPS. But if you’re investing for the long haul, keep in mind that although inflation has been mild and may stay low for a while, it rarely disappears entirely.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

The November CPI Report Is Out. Here's What It Means for Rising Prices

The November CPI Report Is Out. Here's What It Means for Rising PricesThe November CPI report came in lighter than expected, but the delayed data give an incomplete picture of inflation, say economists.

-

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate Cuts

The Delayed November Jobs Report Is Out. Here's What It Means for the Fed and Rate CutsThe November jobs report came in higher than expected, although it still shows plenty of signs of weakness in the labor market.