Earnings Previews: Can Nike (NKE) Regain Its Footing?

The sneaker giant reports its latest quarterly earnings on Tuesday. Plus: Earnings previews for Micron Technology, Rite Aid.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Nike (NKE, $53.19) has churned out a disappointing 2017 so far. Its shares have gained just 2.3%, a fraction of the 10.7% return delivered by Standard & Poor’s 500-stock index. Worse still for buy-and-holders has been the roller-coaster nature of this year’s ride, with the stock trading in a wide range of 16% from trough to peak. (Prices and returns as of Sept. 21.)

Mylanta, then, might be in order for Nike’s upcoming earnings report for its fiscal first quarter ended Aug. 31, slated to be released after Tuesday’s closing bell.

Nike’s last quarterly earnings report, delivered in late June, was a clear success, with fiscal Q4 revenues and profits both coming in ahead of consensus estimates. That – combined with a confirmation that the athletic apparel specialist would be directly selling some of its wares on Amazon.com (AMZN) – sparked a monthlong rally that pushed Nike shares to highs for the year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, Nike enters this week’s earnings report not in stride, but picking up the pieces after a disastrous month and a half. Dreadful mid-August reports from sports retailers Dicks Sporting Goods (DKS) and Foot Locker (FL) jarred shares of Nike and rival Under Armour (UA, UAA), which analysts fear are ceding ground to German athletic gear giant Adidas (ADDYY). Jefferies analyst Randal Konik downgraded Nike shortly thereafter, saying, “our mosaic of five data sources suggests growth and margins are at risk ahead.”

Analysts’ estimates for the to-be-reported August quarter don’t offer much hope of a near-term change in fates.

Nike is expected to earn just 48 cents per share in fiscal Q1 – a 34% decline year-over-year. Analysts believe that will come from a meager 0.3% year-over-year uptick in revenues to $9.1 billion, which looks particularly weak given the full year’s expected top-line growth of 4.8%.

There are a few bulls. For instance, Bernstein analyst Jamie Merriman said on Sept. 12 that Nike still is “best in class” amid initiating the stock at “Outperform” (buy, essentially) with a $69 price target that implied 30% upside at the time. Even then, he sees the potential for Nike’s “Edit to Amplify” product-thinning initiative to continue to weigh on sales for all of fiscal 2018, which ends next May.

But shorter term, investors in Nike should be wary of a Sept. 19 downgrade to “Neutral” from “Positive” by Susquehanna analyst Sam Poser, who specifically warned about slowing basketball product performance, as well as a general problem with oversupply.

While Poser expressed optimism that Nike would fix the oversupply issue, he warned that it “is not something that will be corrected overnight.”

That issue could creep not only into Tuesday’s earnings report, but further into the fiscal year.

EARNINGS CALENDAR HIGHLIGHTS, WEEK OF SEPT. 25-29, 2017

MONDAY

Noteworthy Earnings Report: Red Hat (RHT)

TUESDAY

Earnings Spotlight: Micron Technology (MU) – From a headline perspective, Micron’s earnings report for its fiscal fourth quarter ended Sept. 1 should be a doozy. Due out after Tuesday’s closing bell, Wall Street analysts see the top line expanding by 85% year-over-year to $6 billion – a standout quarter amid a full year that should end up seeing 63% revenue growth. Meanwhile, the analyst consensus sees the bottom line flipping from a 5-cent-per-share loss in the year-ago Q4 to a profit of $1.84 per share. While that’s a high bar to clear, the fact that Wall Street has been warming up to the chipmaker – six analysts have revised their earnings estimates higher in the past month alone – should encourage MU bulls.

Other Noteworthy Reports: Cintas (CTAS), Darden Restaurants (DRI), FactSet Research Systems (FDS)

WEDNESDAY

Noteworthy Earnings Report: Pier 1 Imports (PIR)

THURSDAY

Earnings Spotlight: Rite Aid (RAD) – Pharmacy chain Rite Aid was tripped up again recently following the Federal Trade Commission’s approval of a “skinny” deal with Walgreens Boots Alliance (WBA) involving the sale of fewer Rite Aid stores (1,932) than an earlier bid, and at a lower price (roughly $4.4 billion). It’s not all bad, however, as the remaining stores are expected to be profitable, and the deal proceeds should cut significantly into the company’s $7.2 billion in long-term debt. Shares are off 71% year-to-date, but might perk up should Rite Aid clear a very low bar Thursday morning when it reports results for its fiscal second quarter ended in late August. Analysts on average expect a 2.5% year-over-year decline in revenues to $7.8 billion, which should filter down to a breakeven bottom line.

Other Noteworthy Reports: Accenture (ACN), BlackBerry (BBRY), ConAgra Brands (CAG), KB Home (KBH), Vail Resorts (MTN)

FRIDAY

Noteworthy Earnings Reports: None.

Reporting schedules provided by MarketWatch and company websites. Earnings estimate data provided by Thomson Reuters via Yahoo! Finance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

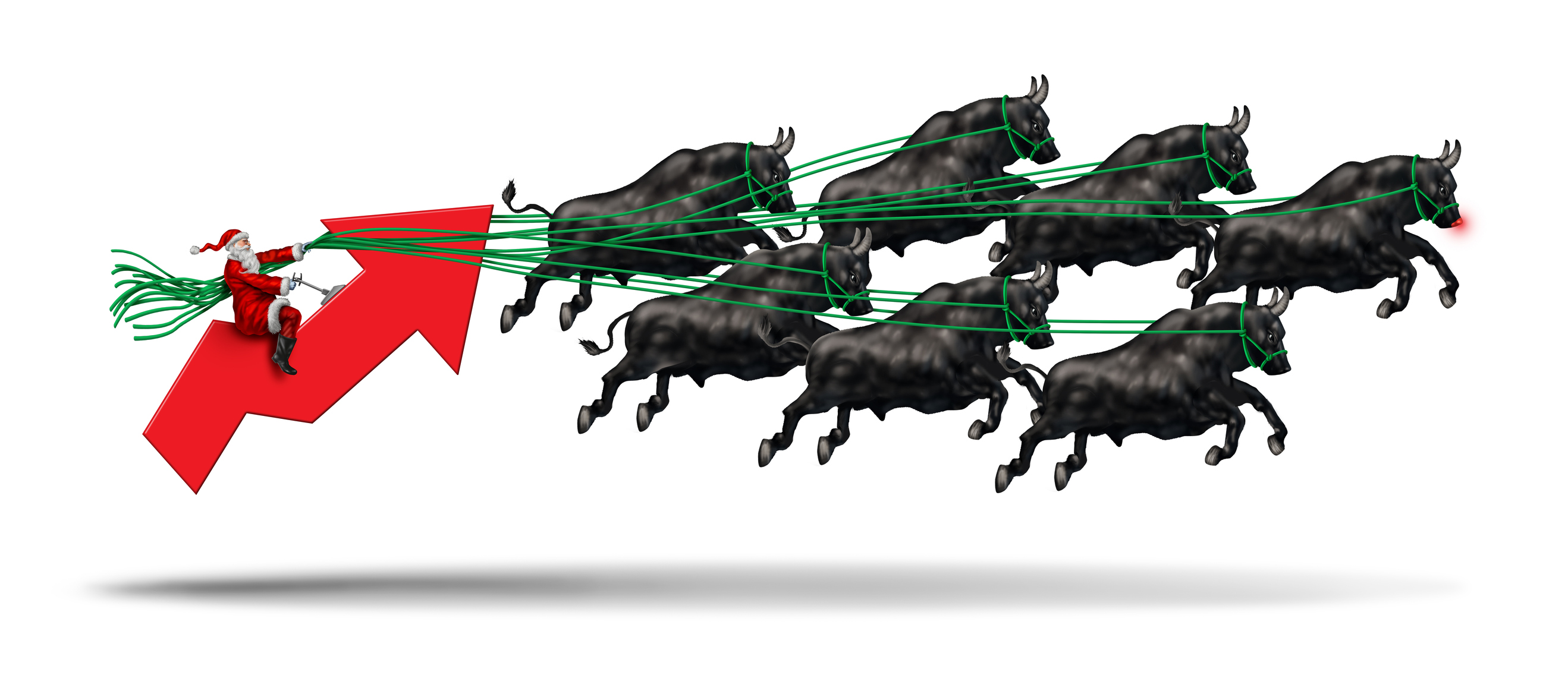

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.