Will a Government Shutdown Trigger a Market Meltdown?

The clock is ticking on a potential government shutdown, leaving investors to wonder what could happen to this bull run in stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Congress is working on its fourth stopgap spending bill since the 2018 fiscal year started in October 2017. If it can’t pass a bill by the end of Friday, Jan. 18, America could suffer a partial government shutdown – and even if the Legislature does get the job done, it will merely kick the can down the road to next month, where another impasse may loom.

But whether it’s Friday, or in February, or whenever – if the government shuts down, that does not mean the bull market will too.

It’s understandable if investors are getting nervous. They’re celebrating the market’s record sprint to Dow 26,000, and now the folks in Washington, D.C., look like they might just dump something in the punch bowl.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A government shutdown is serious business. It creates chaos and hurts the economy. Even if lawmakers come up with another last-minute, stopgap funding bill, that just creates more uncertainty down the road. And as you may have heard, the market hates uncertainty.

With the clock ticking down, investors are rightly wondering what they should do in the event of a government shutdown. We’re here to help. Here’s how to handle the situation in three easy steps:

Don’t Panic

Stocks are at all-time highs. By some measures, they're more expensive than they have been in nearly a decade, with the Standard & Poor’s 500-stock index going for more than 26 times trailing 12-month earnings. Moreover, the current bull market is the second-longest in history, just months away from reaching the nine-year mark.

It’s natural, then, to worry about headlines that could put an end to the rally.

However, neither worrying about government shutdowns nor the actual shutdowns themselves are novel experiences for equity investors, experts note. And it always has worked out OK in the past.

“The market has seen this before, and while the short-term reaction is unpredictable, it tends to be short-lived,” says Oliver Pursche, chief market strategist at Bruderman Asset Management.

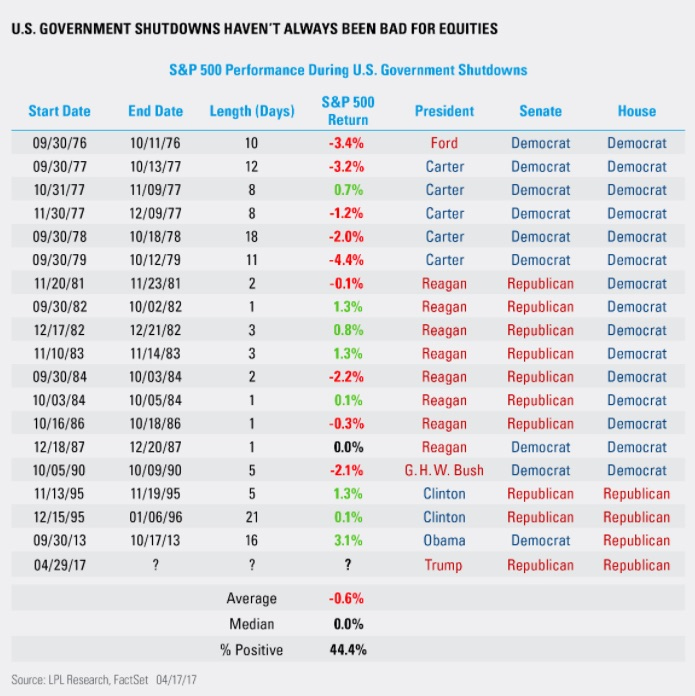

Indeed, there have been 18 government shutdowns since 1976, according to LPL Financial and FactSet. They have ranged in length from one to 21 days, and have produced an average loss for the S&P 500 of – wait for it – 0.6%. Even the worst loss, from September to October 1979, was a mere 4.4% that the market clawed back by the start of 1980.

Historically speaking, the market doesn’t seem to care about whether Washington shows up for work.

Buy Dips

Investors still should be at least prepared for a potential hiccup in the markets – that’s just prudent planning. After all, a short government shutdown would affect some small level of spending, which could put an unexpected blemish on what’s otherwise expected to be a rosy 2018 for corporate America.

But rather than being ready to head for the hills, investors should put together a shopping list.

A massive corporate tax cut promises to boost profits for many American companies. And a repatriation tax holiday on overseas cash has numerous corporations bringing home billions of dollars, much of which is being pledged toward new jobs, wage hikes and other investments that should fuel domestic growth. That all points to continued gains for stocks – which is why a government shutdown-sparked drop in the market should be viewed as a dip-buying opportunity.

After all, the idea is to buy low, and when estimated earnings-growth rates are taken into account, stock prices don’t look so out of whack. The S&P 500 trades for a bit more than 18 times analysts’ expectations for future earnings, according to data from Thomson Reuters. That’s not much higher than its long-term average of 17.6, according to FactSet.

Any pullback in share prices, then, will afford investors an opportunity to buy stocks at valuations closer to historical norms.

Enjoy the Ride?

If anything, the market seems to have almost developed an appreciation of government shutdowns. The S&P 500 has actually delivered gains the past three times Congress couldn’t agree on a spending bill.

When the government was closed for 16 days in 2013, the S&P 500 rose a whopping 3.1%. (See the accompanying table, courtesy of LPL Financial and FactSet.) A 21-day shutdown from December 1995 to January 1996 resulted in a 0.1% increase in the benchmark index. And a five-day shutdown in November 1995 delivered a gain of 1.3%.

With numbers like that, investors should be praying for as many shutdowns as they can get.

That is said in jest, of course. But this does hammer home the point that Wall Street does not view government shutdowns as top-priority bear triggers. Why? Because they ultimately have little effect on what actually moves share prices.

“Markets rise and fall based on economic conditions and corporate earnings,” Pursche says. “And right now, it looks like both are going to continue to rise, which should bode well for the market. In short, ignore the news headlines and focus on what matters – data, and the data looks good.”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.