7 Cash-Rich Stocks to Buy Now

Companies loaded with the green stuff can provide smoother sailing in a turbulent global economy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In times of economic and market turmoil, having a chunk of cash in the bank gives comfort. It’s the same for companies: A hefty cash cushion can provide security and financial flexibility when business slows or markets suffer an unexpected shock. And in good times, cash can fund expansion or acquisitions if a company prefers to avoid taking on debt or issuing more shares.

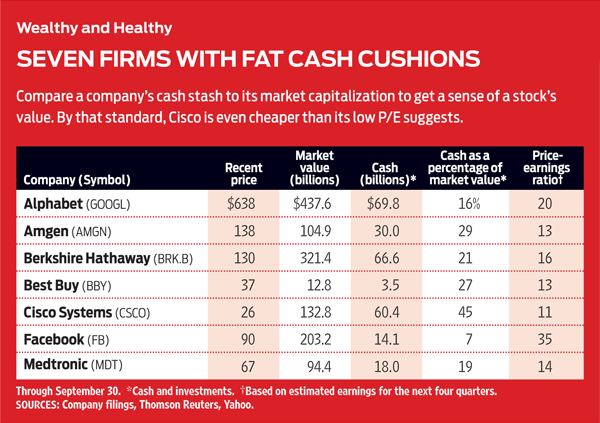

The rap on cash is that it doesn’t earn anything—-or at least that has been the case since 2008, as the Federal Reserve has held short-term interest rates near 0%. But the wild market ride of recent months, a still-dicey global economy and the likelihood of Fed rate hikes ahead may fuel a new appreciation for companies that have built sizable cash buffers. Below, we list seven companies that we believe have great opportunities to use their large holdings of cash and securities for the long-term benefit of shareholders. (We skipped Apple, the biggest cash hoarder of all, because so much has been written about its $200 billion stash.)

A few caveats: First, many U.S. multinational companies keep cash abroad rather than bringing it home and facing stiff tax bills. That can limit how much they’re able to tap without penalty. Second, holding a big cash stake may not mean a company is debt-free. Some firms have sold long-term bonds in recent years to lock in low interest rates, even as they’ve accumulated cash. But with all that cash in the vault, those companies could easily pay off much or all of their debts. Finally, holding a lot of cash is no guarantee of business success. What matters is how well a company puts that money to work for shareholders. Below are our cash-rich seven (prices and related data are as of September 30).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

1. Alphabet (symbol GOOGL, $638)

Never heard of Alphabet? It’s the new name for Internet search titan Google, which reorganized its corporate structure in October while keeping the stock symbol that hints at the company’s origins.

Sitting on cash and investments of $70 billion—-third among all companies, behind only Apple and Microsoft—-Alphabet has faced some of the same questions as its rivals about how to use its wealth. The company’s answer was to assure investors that however it spends the money, it will do so transparently. The reorganization financially separated the core Google businesses, which include search, Gmail, YouTube and the Android operating system, from the firm’s more speculative ventures, such as health care innovations and driverless cars. Goldman Sachs hailed the move as a way to give investors more confidence in the company overall—and to showcase what Goldman believes will be rising profit margins at the Google unit thanks to more disciplined spending. The upshot, Goldman says, is that investors should award a higher price-earnings ratio to the stock, which now sells for 20 times estimated year-ahead earnings.

As for the core Google business, the company is so dominant in Internet search that it is effectively untouchable. But like rival Facebook, Google’s long-term challenge is to generate more ad revenue from the mass of humanity using its products. YouTube may hold some of the greatest profit potential. Brokerage Wells Fargo Securities says YouTube is now the “best positioned” online option to grab ad dollars directed at consumers whose TV watching is waning. Like Goldman, Wells Fargo also believes Alphabet’s stock has been underappreciated—but maybe not for long.

[page break]

2. Amgen (AMGN, $138)

One of the first profitable biotech companies, Amgen was a growth-stock star of the 1990s, thanks to its groundbreaking treatments for red and white blood cell deficiencies. But by 2007, sales began to stagnate, and an earnings slowdown followed. The stock’s price was no higher in the middle of 2012 than it had been seven years earlier. In the past few years, however, Wall Street has rekindled its enthusiasm for Amgen, and the shares have soared to new highs. Key to its resurgence has been a slew of new drugs, including cholesterol-lowering Repatha, bone-loss treatment Prolia and blood-cancer drug Kyprolis. Amgen’s sales and earnings are expected to reach a record $21.2 billion and $9.76 per share, respectively, in 2015.

Sales of some of the company’s oldest drugs are still declining as new rivals emerge. But Amgen has used its recent growth, along with tight expense controls and low-cost, long-term borrowing, to build up a rich war chest. Even after paying $9.7 billion to buy Kyprolis developer Onyx Pharmaceuticals in 2013, Amgen’s cash and investments have swelled, hitting a record $30 billion in mid 2015. That has allowed the company to spend heavily on research while buying back stock and sharply boosting its dividend (to a current annual rate of $3.16 per share).

Some on Wall Street have other ideas for Amgen: In October 2014, activist investor Dan Loeb said the company should consider splitting in two, separating its high-growth and low-growth product lines. There’s no sign that Amgen intends to do that, but bulls such as research firm Cowen and Co. say the stock remains undervalued given Amgen’s pipeline of new drugs, strong earnings prospects and steadily rising dividends.

[page break]

3. Berkshire Hathaway (BRK.B, $130)

Warren Buffett’s holding company is a fabled refuge for investors who expect their corporate managers to be highly value-conscious in putting money to work—and to think long term. To that end, Berkshire has religiously kept hefty cash sums on hand, ready to invest when bargains arise. In August, Berkshire said that it would buy aerospace parts supplier Precision Castparts in a deal worth $37 billion—Buffett’s biggest purchase ever. Even after that, Berkshire should have more than $40 billion in cash, about half of which Buffett can use to take advantage of other opportunities (he prefers to have at least $20 billion in the till).

With Berkshire Class B shares down 14% from their 2015 high, the stock is priced at about 1.3 times the company’s book value (assets minus liabilities) per share. In the past, Buffett has suggested that Berkshire would be a bargain at about 1.2 times book value. Berkshire investors get a conglomerate that is a widely diversified bet on long-term economic growth. It includes a core insurance business (led by Geico), a stable of about 60 individual firms (including Duracell, Burlington Northern railroad, See’s Candies and Fruit of the Loom) and a stock portfolio that includes big stakes in Coca-Cola, IBM, Wells Fargo and others. All in all, analysts on average estimate that Berkshire will generate revenues of $212 billion in 2015.

Some investors may fret about another number: 85, Buffett’s age. To invest in Berkshire now, you have to trust Buffett when he says he has built a company that will have no trouble outliving him.

[page break]

4. Best Buy (BBY, $37)

The continuing boom in online shopping has marked many brick-and-mortar retailers for extinction. That appeared to include Best Buy three years ago, when shares of the largest U.S. electronics retailer fell to as low as $11. But Wall Street’s funeral plans turned out to be premature, as Best Buy’s sales and earnings have been rising again after a long slump. In the quarter that ended August 1, sales at U.S. stores open at least one year rose 3.8% from a year earlier, the fourth straight quarterly advance. Total sales were $8.5 billion, and operating earnings jumped 18%, to 46 cents per share. CEO Hubert Joly says the results affirmed his belief that consumers still want a physical place to shop for electronics and get first-rate advice.

To turn itself around, Best Buy cut costs by a total of $1 billion over 2013 and 2014, pulled out of China, shrank Canadian operations, trimmed the U.S. store count to the current 1,400 and matched many of archrival Amazon.com’s prices. Best Buy’s online sales showed particular strength in the quarter that ended August 1, jumping 17% from a year earlier. In addition, the company has been stressing the “store within a store” concept for brands such as Apple and Samsung.

The rebound in earnings since 2012 has allowed Best Buy to amass a $3.5 billion cash buffer. In turn, the cash pile has funded stock buybacks and an extra dividend payment of 51 cents per share last April (on top of the regular dividend, currently 23 cents per quarter). It still isn’t clear whether Best Buy’s revival will last. But Deutsche Bank Securities says the stock represents “underappreciated growth” and is too cheap to ignore at just 13 times estimated year-ahead earnings.

[page break]

5. Cisco Systems (CSCO, $26)

Cisco has long been the gold standard in computer networking, producing the routers and switches that keep data flowing worldwide. But that business, like others considered old tech, is slowing as new solutions emerge—such as software-defined networking, which allows companies to simplify network operations and quickly increase capacity without spending heavily on new equipment. Although Cisco remains highly profitable, sales growth has been tepid. The $49.2 billion in revenues that the company generated in the fiscal year that ended last July were just 7% greater than sales in the July 2012 year.

Cisco, of course, isn’t sitting still. Thanks to internal expansion as well as acquisitions, the company’s business extends far beyond old-school networking and now includes cloud computing, online security, software and wireless tech. That’s where Cisco’s $60 billion cash hoard comes in. The money will help the company finance its transition to the emerging networking environment. And as it adds new tech offerings, Cisco has an advantage over many smaller rivals, says research firm S&P Capital IQ, because the company’s broad networking expertise means it can offer clients “holistic solutions” rather than just single products. Likewise, Morningstar sees Cisco’s know-how as a “durable competitive advantage.” In the last fiscal year, operating earnings rebounded 7%, to $2.21 per share, from the previous year’s weak results. Analysts expect a modest rise, to $2.30, in the year that ends next July.

Wall Street seems to be growing more comfortable with Cisco’s prospects, despite the relatively slow growth rate: The stock doubled from mid 2011 to early 2015, before pulling back a bit. It helps that Cisco has committed to sharing cash with investors via buybacks and a rising dividend.

[page break]

6. Facebook (FB, $90)

In just 11 years, Facebook has gone from a dorm-room start-up to a global operation with nearly 1 billion daily users. Despite a flubbed initial stock offering in 2012, which saw the shares soar above $40 only to crash below $20, investors have recognized the company’s enormous profit potential as the world’s largest social network. The stock has surged for three straight years, reaching almost $100 last summer. Facebook is expected to earn about $3 billion in 2015 on sales of $17.2 billion. Its profit tsunami in turn has filled its coffers with $14 billion in cash and investments, which is all the more impressive given that the firm has zero debt.

That cash buildup is a source of comfort for investors because Facebook continues to spend heavily on ideas it believes will keep users coming back. Research expenses in 2015 alone are expected to be $2.3 billion. Some investors might prefer that the company rein in spending and focus more on the critical issue of boosting advertising revenues on its sites, including photo-sharing app Instagram and mobile-messaging service Whats-App. Yet founder Mark Zuckerberg has won kudos from analysts for proceeding slowly to avoid irritating loyal consumers and driving them away.

That go-slow approach worked well with Facebook’s move into advertising on its mobile site beginning in 2012. Since then, its mobile ad revenue has rocketed. Given all that could go wrong in such a young business, Facebook stock clearly is only for people with a high tolerance for risk. But brokerage Stifel Nicolaus thinks Facebook is poised to deliver Wall Street’s holy grail: sustained long-term growth.

[page break]

7. Medtronic (MDT, $67)

Already a major supplier of medical devices, Medtronic swelled in size this year with its $50 billion acquisition of Covidien, which makes a wide range of hospital-care products used in surgery, diagnostics, dialysis and other areas. Medtronic makes such items as pacemakers, defibrillators, heart valves, stents, insulin pumps and spinal fixation devices, so the company is partly a play on an aging global population. Covidien brings the ability to partner more closely with hospitals—an important strategy, given increasing pressure on health care costs. Both companies see major growth opportunities in China.

The balance sheet now holds $18 billion in cash and securities (largely offsetting $34 billion in long-term debt). Medtronic is expected to post sales of $29 billion in the fiscal year that ends next April and earn $6.3 billion, or $4.37 per share. The cash-rich company has demonstrated a commitment to sharing its profits via dividends, having increased its payout by 25% in July. Brokerage BTIG calls Medtronic “one of the most structurally sound” medical tech companies and says the stock offers “compelling” potential reward relative to the risk.

But before investing in Medtronic, make sure you don’t have any objection to “corporate inversions.” After consummating the merger with Covidien last January, Medtronic officially moved its headquarters to Ireland to qualify for that country’s low tax rate, even though the top brass will continue to run the firm from Minnesota. Such maneuvers have drawn political ire, though the companies argue that the tactic is just good business sense.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.