7 Great Growth Stocks (and 4 Great Growth Funds)

Our eclectic picks share one common trait: Their profits are expanding faster than those of the overall market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Buying shares of a growth company early in its run to greatness is the holy grail of stock picking. The goal is to get in at a relatively cheap price, hang on as revenue and earnings rise sharply, and reap big returns as other investors hop aboard. But after the stock market’s phenomenal five-year bull run, finding undiscovered gems today is no easy feat.

That leaves growth-seeking investors with two options. One is to identify successful companies with strong growth prospects and figure out what you would like to pay—then hope for a market pullback that brings their prices into your range. With steep declines this year in many technology and biotechnology stocks, investors in those sectors suddenly have a lot of marked-down shares to sift through.

The second option is to look for growth companies that may keep flying high but whose share prices relative to expected earnings are still reasonable for a long-term investor. Like it or not, having a long time horizon is key at this stage of a bull market. Buying at today’s price levels may mean it will be five years or more before a stock realizes meaningful appreciation. So you have to ask yourself: How patient am I?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

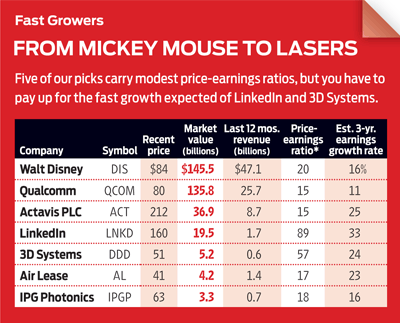

We went hunting for attractive growth companies and came up with seven. They cover a broad spectrum of sizes, industries and growth rates, but they all share one trait: In the view of Wall Street analysts, their earnings will rise significantly faster than the 10.2% average annual earnings growth predicted for Standard & Poor’s 500-stock index over the next three years. (The actual growth rate for the broad market will almost certainly be lower than what Wall Street expects.) We rank our picks by market value. Prices and related data are as of May 30. Price-earnings ratios are based on estimated year-ahead profits.

1. Walt Disney. Disney (DIS) is a Wall Street rarity: a growth story that spans generations. Disney was a phenomenal growth company in its early days. It stumbled in middle age, then came roaring back beginning in the mid 1980s. Today, the Burbank, Cal., company remains the premier U.S. entertainment franchise, with its film studios (latest hit: Frozen), TV networks (including ABC and ESPN), theme parks, resorts, home videos and consumer products.

With $45 billion in annual revenues, Disney can’t grow at the pace of smaller, up-and-coming businesses. But it offers investors the benefits of a blue-chip company that’s still capable of market-beating growth. Analysts estimate that Disney’s earnings will rise an annualized 16% over the next three years, well above the overall market’s growth rate. Even allowing for typical Wall Street over-optimism, there is good reason to believe that Disney’s growth rate will stay above the blue-chip average.

Key to the company’s success is its ESPN juggernaut. Led by the sports channels, Disney’s cable networks now generate 52% of the company’s total operating profit. But beyond cable, Disney’s ability to consistently find new ways to make money from its treasure trove of assets—from Mickey to Buzz Lightyear and Captain America—is unparalleled in the media industry, says Morningstar analyst Peter Wahlstrom. What’s more, in the boom-or-bust movie business, Disney’s 2012 acquisition of the rights to the Star Wars franchise heralded what FBR Capital Markets analysts say is a major shift by the studio unit. By focusing more on films with proven track records such as Star Wars (Episode VII is due out in late 2015), Disney aims for a “much more profitable, less risky” slate of future releases, FBR says. Nothing wrong with sticking with what works.

Data as of May 30. *Based on estimated earnings for the next four quarters.

2. Qualcomm. Like Disney, Qualcomm (QCOM) knows a thing or two about managing a growth business. The company has mushroomed over the past 30 years into a global leader in wireless technologies. That puts it at the heart of the continuing rush throughout the world to be connected—to anyone and, increasingly, to anything.

Qualcomm earns technology-licensing fees on nearly every 3G and 4G wireless phone sold. The San Diego company also produces the chips that help run many high-end smart phones and tablet computers. All told, Qualcomm earned $7.9 billion, or $4.51 per share, in the fiscal year that ended last September, representing a doubling of profits since 2010. That pace isn’t likely to continue, in part because Qualcomm faces rising competition in the smart-phone chip business from other tech titans, including Intel.

Still, the company’s size and technological know-how give it an advantage over rivals as consumers and businesses worldwide demand faster and more-intelligent wireless phones. Brian Modoff, an analyst at Deutsche Bank Securities, says that Qualcomm sees great possibilities in the development of the “Internet of things,” the connecting of everything from homes to cars to appliances via smart phones and other devices. He expects earnings to rise 17% in the current fiscal year and 15% in the year that ends in September 2015, and he adds that Qualcomm executives are committed to sharing profits with shareholders via dividends (now $1.68 per share annually). Investors looking to play the telecom industry can certainly find smaller, faster-growing companies. But if you want a marquee name at the forefront of wireless technology, Qualcomm fits the bill.

3. Actavis PLC. It seemed a slam-dunk in the late 1990s to bet that the giant U.S. drug companies would make a lot of money off an aging population. But stocks such as Merck and Pfizer were terrible performers in the first decade of the new century as the companies lost patent protection for key products and makers of generic drugs swooped in. Now comes generic firm Actavis (ACT) with a reverse strategy: It is buying up brand-name drug makers to boost its long-term prospects by lessening its dependence on the cutthroat generic business.

Actavis, the third-largest U.S. generic drug firm, spent $8.5 billion last year to buy Ireland’s Warner Chilcott, a maker of brand-name drugs to treat women’s-health, gastroenterological and dermatological issues. (Actavis is headquartered in Dublin, although its executive offices are in Parsippany, N.J.) In February, Actavis announced another blockbuster acquisition: a $25 billion deal to buy Forest Laboratories, which is known for drugs that are used to treat depression, high blood pressure, fibromyalgia and other diseases.

With the mergers, Actavis’s annual revenues should reach $15 billion, up from just $3.6 billion in 2010. Analysts on average expect earnings of $13.67 per share this year, rising 22%, to $16.61 per share, in 2015. Profits will be helped in part by the low tax rate Actavis now enjoys after changing its registration to Ireland. Wall Street clearly likes Actavis’s strategy: The stock soared from $100 in the spring of 2013 to $230 by early 2014, before pulling back a bit. Ken Cacciatore, an analyst at Cowen & Co., says the stock’s leap shows that investors are “exceedingly comfortable” with the company’s finances in the near term (even with a much higher debt load). He thinks Actavis will continue to build up its brand-name drug portfolio via acquisitions, boosting the company’s ability to generate cash for shareholders in the next few years. As the market focuses on that longer-term payoff, Cacciatore says, the stock could be worth as much as $255 within 12 months.

[page break]

4. LinkedIn. Love it or hate it, social media is here to stay. For investors, the question is which social-media companies are here to stay—and which are likely to flame out, like so many Internet-based firms before them. That concern has deepened this year as many of the tech stocks that soared in 2013 have plummeted.

High on the list of this year’s losers is professional-networking leader LinkedIn (LNKD). After peaking at $258 last fall, LinkedIn’s shares have slid to $160. Besides being caught in the general rout of tech stocks, LinkedIn has spooked some investors by showing signs that its red-hot growth of the past few years is slowing. First-quarter revenues climbed 46%, to $473 million, from the same period a year earlier, but that was down from full-year growth of 57% in 2013. And after posting mostly modest quarterly profits since 2010, the Mountain View, Cal., company fell back into the red in the first quarter, losing $13 million as it spent heavily on expansion.

Wall Street analysts still think LinkedIn has spectacular growth potential. On average, they’re projecting annualized earnings gains of 33% over the next three years. Why bet they’re right? One reason is the 300 million people worldwide who have joined LinkedIn—in theory, at least, to enhance their career prospects. If the future of business networking and recruiting is increasingly online, Linked-In is in a sweet spot to sell more services to both workers and employers.

Critics say that only a small percentage of Linked-In members are active on the site. But that also means more opportunity for the company to engage them. What’s more, LinkedIn is just beginning to ramp up its presence in China. All in all, the company has “a clear path for long-term growth,” says analyst Kerry Rice, of Needham & Co. The question suggested by this year’s stock-price swoon: What price for that growth?

5. 3D Systems. Some investors may view 3D printing like flying cars: futuristic technology that will never really get here. In fact, the technology is already widely in use in manufacturing. And one of the oldest names in 3D printers, 3D Systems (DDD), has been making money since 2009. Sales have jumped from $113 million that year to $513 million in 2013.

But as so often happens, exciting new technology triggers stock manias. Shares of 3D Systems and its rivals rocketed in 2012 and 2013, with 3D Systems soaring from $10 at the start of 2012 to a peak of $97 last January. Since then, as high-flying stocks in general have crashed, 3D Systems has tumbled as well, to $51. It didn’t help that rising research costs and other expenses drove the Rock Hill, S.C., company’s operating earnings lower in the first quarter, despite a 45% year-over-year jump in revenues.

For growth-hunting investors who can handle high risk, however, the sinking stock price could be a gift. Though the consumer market for 3D printing remains small, many manufacturers have embraced it—not yet for mass production but for smaller tasks, such as creating prototypes and producing replacement parts for older machinery. 3D printing uses digital imagery of an object to replicate it in metal, plastic or other materials. For 3D Systems and other printer makers, long-term growth will hinge not just on printer sales but also on revenue from material refills and servicing, as with conventional printers. Hendi Susanto, an analyst at money manager Gabelli & Co., thinks demand will drive 3D Systems’ revenues to $1 billion by 2016 and operating earnings to $1.45 per share. The risks, of course, are many, particularly from increased competition. But 3D Systems is a leader in this business, not a novice.

6. Air Lease. Travel is a growth industry worldwide, but it has been tough to make money in the notoriously fickle airline industry. Since 1980, more than three dozen U.S. carriers, including most of the biggest names, have filed for bankruptcy at least once. Air Lease (AL)offers a different way to bet on travel: It buys jets and leases them to major airlines worldwide, a profitable middleman role that gives carriers greater financial and business flexibility. The Los Angeles firm also manages jet fleets owned and leased out by investor groups.

Jet leasing is a tricky business because it requires financial savvy as well as the ability to ride out inevitable airline-industry turbulence. But Air Lease’s chief executive, Steven Udvar-Házy, 68, has been doing this for a long time: He ran International Lease Finance Corp. from 1973 to 2010, when he left to launch Air Lease as a competitor. The new company’s revenues rose from $337 million in 2011 to $859 million in 2013. Per-share earnings reached $1.80 last year, up from 59 cents in 2011. Analysts on average predict 23% annualized profit growth over the next few years.

Air Lease reached a milestone in May when it bought its 200th aircraft. The company expects to ride surging global air traffic, particularly in emerging economies. The total annual passenger count is projected to reach 3.9 billion by 2017, up from 3 billion in 2012, says the International Air Transport Association. Analysts at Morgan Stanley say Air Lease has a number of advantages over its rivals, including the youngest fleet of high-quality jets and a “relatively conservative balance sheet,” which will allow the company to take on more debt. The key risks: a major economic slump or another credit crunch. But Udvar-Házy has seen those before.

7. IPG Photonics. IPG Photonics (IPGP) isn’t a household name, but it’s a big one in the business of lasers. After four years of rapid growth, the company appears to have hit a soft patch in sales. If this setback is just a hiccup, it could be a great opportunity for long-term investors, with the stock down 20% from its 2013 high.

IPG says it’s the world’s leading producer of high-performance lasers used in manufacturing, telecommunications, health care and other applications. The majority of sales are to manufacturers for use in materials processing—for example, cutting, drilling and welding metals or other materials. Using a term favored by Silicon Valley, IPG sees itself in the role of a “disruptor,” as its lasers replace older technologies in manufacturing. IPG’s revenues jumped from $186 million in the recession year of 2009 to $648 million in 2013; earnings per share rocketed from 12 cents to $2.97 in the same period.

[page break]

Although revenues in the first quarter of 2014 rose a solid 20% from the same period a year earlier, IPG projected weaker-than-expected sales in the second quarter. The company said the slowdown was partially due to some customers delaying orders that it still expected to arrive later on and that orders overall remained “very strong.” But the forecast spooked some investors, at a time when some IPG executives were trimming their personal stock holdings and when the company faced competition from China in lower-end lasers. Analysts at Stifel, Nicolaus are cautious in the near term, but they still see double-digit-percentage earnings gains, to $3.38 a share this year and $3.75 in 2015. The longer-term view is that IPG has a host of new markets to conquer with its laser technology—exactly what the firm has been doing for the past decade. And with $481 million in cash on its balance sheet and little debt, it has the wherewithal to power ahead.

Try a Fund Instead

If you'd rather buy growth stocks through a fund, start by checking out two members of the Kiplinger 25. At Fidelity New Millennium (symbol FMILX), manager John Roth invests in a diverse mix of companies, including emerging growers and out-of-favor firms. Stocks of large companies account for 55% of the fund's assets; midsize and small outfits make up the rest. Despite its name, Baron Small Cap (BSCFX) has slightly more of its assets invested in midsize firms than in small-capitalization issues. Manager Cliff Greenberg, who favors undervalued growth companies, has mostly stayed away from high-flying social-media and biotech stocks.

Also worthy of consideration is Primecap Odyssey Growth (POGRX), a team-run fund managed by low-profile Primecap Management. The fund's performance has been plenty high-profile: From 2005, Odyssey Growth's first full year, through 2013, it landed in the top third of the large-cap growth category six times. Annual expenses are 0.65%, unusually low for an actively managed fund.

If you prefer an exchange-traded fund, look no further than PowerShares QQQ (QQQ). One of the oldest ETFs, QQQ tracks the Nasdaq 100 index and holds many tech giants, including Apple, Google and Facebook. Annual fees are 0.20%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

Dow Dives 797 Points as Government Opens: Stock Market Today

Dow Dives 797 Points as Government Opens: Stock Market TodayThe process of pricing and re-pricing realities old and new never stops, and next week promises to be at least as exciting as this week.