The One Biotech Stock That Looks Like a Bargain These Days

Gilead Sciences, the largest biotech company, has a P/E ratio of only 11.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

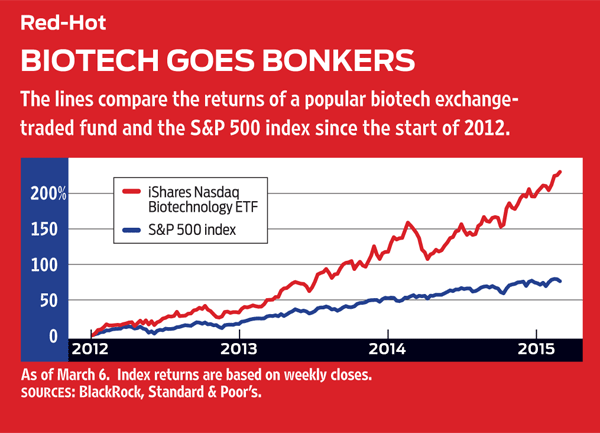

Over the course of this long bull market, biotech stocks have been very, very good for their owners. Perhaps too good. Investors have shown such rabid enthusiasm for biotechs—especially small, unproven companies that have yet to bring a drug to market—that some observers are using another b word to describe the high-flying sector: bubble.

Bubble or not, biotech investors have been having a blast. Over the past five years, iShares Nasdaq Biotechnology ETF (symbol IBB), an exchange-traded fund that tracks 150 Nasdaq-listed biotech stocks, earned an annualized 31.2%, more than double the return of Standard & Poor’s 500-stock index. In 2012, 2013 and 2014, the ETF earned 32%, 66% and 34%, respectively. It tacked on another 13% in the first nine weeks of 2015.

Short-term returns—and valuations—of individual stocks are stunning. Juno Therapeutics (JUNO), which is developing cancer drugs, went public in December at $24 per share. It rocketed to $62 and now trades at $53, giving the company, which has no sales, a market value of $4.8 billion. (Share prices and returns are as of March 6.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There are legitimate reasons for the fervor. Industry insiders say the pace of innovation has never been greater, and the Food and Drug Administration is approving more drugs more quickly than ever.

Finding success stories remains a challenge, however. Share prices of companies that win approval for their drugs or show enough promise to be acquired by one of the industry’s big players can double or triple in a flash. Companies, especially young ones, whose drugs flame out during testing often run out of money and leave their shareholders with massive losses. “To invest in individual names in this field, you need nerves of steel and confidence that you understand the science,” says Morningstar analyst Robert Goldsborough.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Milstead joined Kiplinger Personal Finance as senior associate editor in May 2025 after 15 years writing for Canada's Globe and Mail. He's been a business journalist since 1994 and previously worked at the Rocky Mountain News in Denver, the Wall Street Journal, and at publications in Ohio and his native South Carolina. He's a graduate of Oberlin College.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.