2015 Midyear Stock Outlook: How to Ride Out the Greek Crisis

We still see gains for the rest of the year, but more volatility, too. Here's how to cope.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As this bull market heads deeper into its seventh year—a remarkable feat accomplished only three other times in the past 85 years—investors have every right to reevaluate their strategy. Is it time to defend your portfolio against the long list of challenges that could finally best an aging bull? Or should we continue to bet on the resilience of a stock market that has time and again punished nonbelievers? In other words, what are we dealing with here? A super bull? Or one on its last legs?

In general, we favor stocks over bonds and see increasing opportunities overseas. By no means should you abandon U.S. stocks, but being more defensive—favoring large-capitalization stocks over smaller-cap fare, for example—might be in order. You may also want to focus on companies that will benefit from a stronger economy. (For more opportunities, see our interview with Russ Koesterich, global chief investment strategist for investment firm BlackRock.)

Having a plan helps when the going gets rough. The stock market was relatively placid in 2013 and for most of 2014, but increasing volatility has unnerved many investors. “Stocks are priced for perfection, with a margin of error that continues to narrow,” says Terry Sandven, chief stock strategist at U.S. Bank. “That explains the volatility.” He predicts that stocks will be buffeted by the economic statistic du jour, giving investors plenty of opportunities to buy on dips. Stocks have not seen a correction (generally defined as a decline of 10% to 20%) since 2011, although they usually occur an average of every two years. “Any weakness is a pause that refreshes and resets—not the start of a prolonged bear market,” Sandven says.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

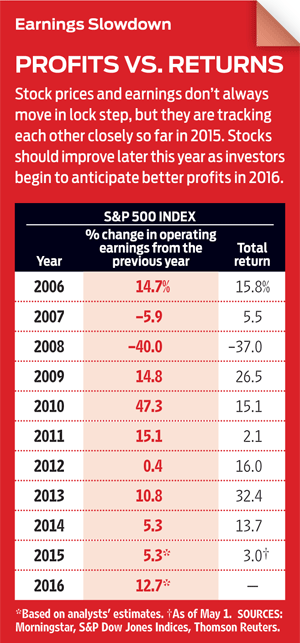

A key issue for stocks is whether corporate earnings can get back on track. Last fall, analysts were estimating double-digit-percentage profit growth for 2015. But following a collapse in oil prices and a surge in the dollar, they slashed their forecasts. Strategists at Bank of America Merrill Lynch, for example, expect profits for companies in the S&P 500 to decline by 1% this year, primarily because of the 45% drop in oil prices and the 20% increase in the value of the dollar since June 2014. If they’re right, the S&P 500 will log its first annual earnings decline since 2008. Excluding those two factors, BofA estimates that profits would be up 10% this year.

Analysts, who are often accused of wearing rose-colored glasses, may have overdone the gloom and doom this time. Two-thirds of S&P 500 companies beat analysts’ lowered expectations; 63% do so in a typical quarter. Plus, the dollar and oil prices have stabilized recently, and we believe the biggest moves are behind us. With companies having adjusted for the price swings already, earnings comparisons with year-ago periods will start looking up, and investors will begin to anticipate better earnings growth in 2016.

“Underlying revenue and earnings growth that’s pretty darn good is being temporarily obscured by the dollar,” says Matt Berler, CEO of Osterweis Capital Management. As for oil, he adds, if the first consequence of lower prices is a drop in energy profits, the second and more important effect is the boost that cheaper energy gives the global economy. “In the U.S., a quick hit to economic growth and earnings will translate into a positive as the consumer spends that energy dividend,” he says.[page break]

For now, though, stock market bulls must look past lackluster economic growth early in 2015. After generating 2.2% growth in the fourth quarter of 2014, the economy stalled in the first quarter of this year, performing far worse than expected. Blame much of the drag on dollar-induced trade woes and spending cuts in the oil patch. Making matters worse, labor strikes at West Coast ports worsened the trade deficit, and a brutal winter sent shoppers into hibernation. A build-up in inventories that contributed to growth in the first quarter will have to be worked down in future quarters, pressuring GDP.The economy should bounce back in the second half of the year, buoyed by a strengthening housing market and improving consumer spending. But the poor early showing will curtail U.S. growth for the full year. Kiplinger now expects real GDP growth of 2.5% in 2015, though the economy may surprise us with its vigor.

The Fed guessing game

The recent economic uncertainty has Federal Reserve watchers wondering about the timing of a long-awaited hike in short-term interest rates. Kiplinger expects the central bank to raise the federal funds rate—the rate that banks charge each other for overnight loans—by a quarter of a percentage point in September at the earliest. The rate is currently near zero. Look for the yield on the benchmark 10-year Treasury, which is set by investors in the bond market, to end the year at 2.4%, close to its 2.48% today. As long as rates stay low, yield-seeking investors will have to hunt for income. With nearly half of S&P 500 companies sporting yields greater than that of the 10-year Treasury, investing in dividend-paying stocks is a no-brainer. You’ll find dependable dividend growers in Kiplinger 25 member Vanguard Dividend Growth (symbol VDIGX), which has a defensive tilt that stands up well to volatile markets.

Or, says Osterweis’s Berler, go off the beaten track with Cone Midstream (CNNX, $18), a master limited partnership that builds and operates natural gas pipelines as well as compression and processing facilities in the Marcellus Shale region of Pennsylvania and West Virginia. Cone yields 4.7%. (Note: Familiarize yourself with MLP tax rules before you invest.) Despite Treasury bonds’ reputation for safety, ultralow yields make them risky now. At the first whiff of inflation, yields will almost surely rise and the prices of long-term bonds plummet, says money manager Martin Sass, of MD Sass Investments. “Buying government bonds now is like picking up nickels in front of a steam roller,” says Sass.

So far, inflation remains not only under control but also well under the Fed’s target growth rate. We think that the core rate of inflation, which excludes food and energy prices, will rise by about 1.7% in 2015, barely higher than last year’s 1.6% rate. The unemployment rate is likely to finish the year at 5.1%, down from 5.5% recently, ratcheting wage growth in 2015 to 2.5%, from 2% last year—not enough to spark inflation worries

For stock investors looking ahead to the Fed’s first rate hike since 2006, timing is less important than whether the central bank moves gradually and with a lot of warning. If that’s the case (and that is what most economists expect), investors will have plenty of time before the market peaks, says Burt White, chief investment officer at LPL Financial, a brokerage firm. “We’re in the second half of the bull market, but people think we’re closer to the end than we are,” says White. Looking at the past nine initial Fed rate hikes, he notes that, on average, bull markets generate nearly 40% of their gains after the first increase.

It goes without saying that this market is anything but average, considering the unprecedented expansion of the supply of money around the globe. Will investors one day pay for super-easy policies that have kept interest rates near zero and flooded the world with money, courtesy of massive bond purchases by central banks in the U.S., Europe and Japan? “Our long-term view is that the extraordinary amount of global monetary stimulus has led to an asset bubble in both stocks and bonds,” says Tony Roth, chief investment officer of Wilmington Trust. “We’re living off one stimulus announcement to the next. There could be a huge correction at some point when there’s no more juice in this lemon to squeeze.”

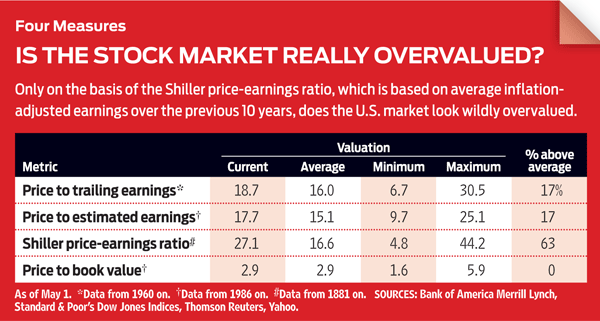

Even Fed chairman Janet Yellen has expressed concern about stock prices, which she recently deemed “quite high.” But by many measures, the market has room to run. True, stocks in the S&P 500 are trading at 18 times estimated earnings for the coming four quarters, above the historical average of 15. But they’re not dramatically overpriced based on other yardsticks, such as price to book value. The S&P is up 33% from its peak before the devastating 2007–09 bear market, well below average peak-to-peak gains going back to 1957, says BofA. Since its pre-recession peak, the economy has grown by less than 9%; with one exception, peak-to-peak growth going back to 1957 has ranged from 11% to 50%. Nor have the number of mergers, acquisitions and initial public offerings reached their past highs. And perhaps most important, “compared with other alternatives, stocks still look attractive,” says Edward Jones strategist Kate Warne.

But you need to be choosy. This year, investors have flocked to small-company stocks, because they are more likely than big firms to derive most of their sales domestically, and that makes them less susceptible to the risks of a strong dollar. But large-cap stocks have advantages in a market in which economic growth is uncertain and global concerns are elevated—such as the escalating worries about whether Greece will default on its debt and leave the euro zone and whether the crisis will be contained. Blue chips are easily traded, their earnings prospects are easier to predict, and they usually offer the cushion of a dividend yield.

[page break]

If you can look past the volatility, consider holding more foreign stocks—particularly those in developed markets—than you’d normally own. “We still have an overwhelming bias toward the U.S., but we’re at the highest weighting for Europe and Japan in seven years,” says U.S. Trust’s Hyzy. Jason Pride, director of Investment Strategy at Glenmede Investment and Wealth Management says European banks are far better equipped to handle a “Grexit” than they were a few years ago, and that economic growth throughout Europe overall is encouraging. “Despite the uncertainty surrounding Greece, euro zone economies are gaining healthy momentum,” he says. Economies in Europe and Japan are benefiting from extensive monetary stimulus from their respective central banks, lower oil prices (both are big importers) and lower currency values relative to the dollar, which boosts exports.

A broad-based international fund is a good way to branch out overseas. Artisan International (ARTIX), a member of the Kiplinger 25, had 44% of its assets in Europe’s developed economies at last report and 12% in Japan. Manager Mark Yockey says European companies, exemplified by Nestlé (NSRGY, $74.61), the Swiss food giant, know how to build brands. Nestlé owns more than 20 brands that each generate at least $1 billion in annual sales, Yockey says. In Japan, he likes Toyota Motor (TM, $135.46). (Both stocks trade in the U.S. as American depositary receipts.)

Any further rise in the dollar is likely to be modest and gradual. If you don’t want to worry about a rising dollar eroding investment profits, consider FMI International (FMIJX), another Kip 25 fund. This fund, which hedges against currency swings, has 28% of its assets in developed Europe and 10% in Japan. Or try Deutsche X-trackers MSCI EAFE Hedged Equity (DBEF), an exchange-traded fund broadly diversified across developed foreign markets.

In the U.S., focus on defensive sectors, such as health care, and those that could prosper as the economy rebounds in the second half of 2015. Vanguard Health Care (VGHCX) has delivered impressive returns at low cost and with a relatively smooth ride considering its focus on a single sector. Technology companies such as Intel (INTC, $31.02) and Microsoft (MSFT, $45.26) should get a boost from a stronger labor market, as companies upgrade their systems to accommodate new employees. Retailers, restaurants and other firms that offer nonessential consumer goods or services will benefit from a long-awaited loosening of purse strings. Dick’s Sporting Goods (DKS, $52.93) sells an attractive mix of high-performance gear and sports apparel. Cash in on housing gains with SPDR S&P Homebuilders ETF (XHB), which provides exposure not only to builders but also to makers of appliances and building products, as well as home-furnishing and home-improvement retailers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.