Dine Out on Restaurant Stocks

Although these are flush times for eating out, success for restaurants can still be elusive. The tight labor market has hit them especially hard.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Forget the kitchen. We're eating out tonight. That is the message from the Census Bureau, which reports that Americans spent more this past June in "restaurants and other eating places" than they did in "supermarkets and other grocery stores." The National Restaurant Association expects sales for its industry to increase this year to $863 billion—more than double the 2000 figure. The average U.S. family now spends $6,700 a year eating out. With brick-and-mortar retailers under pressure from online merchants, restaurants are moving into empty storefronts. In Georgia, eating establishments make up 84% of planned new chain retail stores.

Although these are flush times for dining out, success for restaurants can still be elusive. The tight labor market has hit them especially hard. Some 40% of the industry's workers are between ages 16 and 24, a group that will shrink by 1.3 million over the next 10 years. Stricter immigration enforcement has also hurt employers. The New York Times recently reported that restaurants face a difficult choice: "Let go of trusted employees or risk criminal prosecution." Plus, the rising minimum wage in many cities and states has boosted costs. In Washington, D.C., for example, the base minimum for tipped restaurant workers will rise 29% in July 2020 compared with two years earlier.

Many seats, fewer butts. The biggest danger restaurants face, however, was expressed to me inelegantly by the founder of a firm that finances them: too many seats and not enough butts. With Wall Street's support, more and more restaurant groups have sprouted and grown, triggering severe competition. Many of these chains have unlikely names, niches and prospects. For example, Chanticleer Holdings (symbol BURG) owns eight Hooters restaurants, 18 Little Big Burger outlets and a few other scattered eateries. The stock traded at $35 as recently as 2015, but, after a string of losing years, you can buy a share now for 55 cents. Then there's Bagger Dave's Burger Tavern (BDVB), which went public in 2017 and trades at just 4 cents today, losing $800,000 on revenues of $5 million in the first half of 2019.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

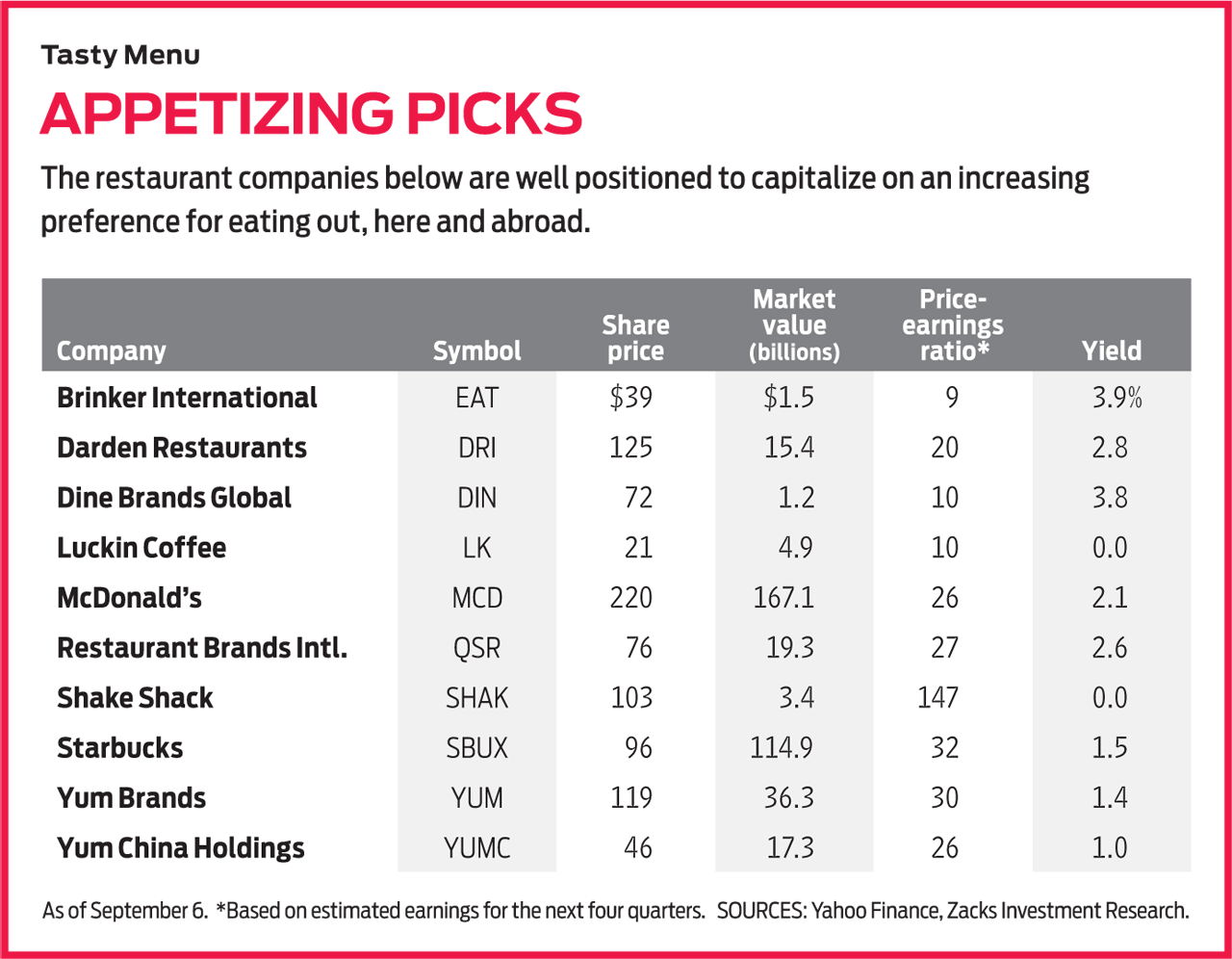

Investors fell in love with hamburgers in part because of Shake Shack (SHAK, $103), launched by New York celebrity chef Danny Meyer. The stock debuted in early 2015 at $21 a share. Today, more than 200 Shake Shacks, with what I consider mediocre hamburgers and fries but an undeniable mystique, operate around the world, with recently opened branches in Moscow and Kyoto. Profits are minimal but rising. With shares trading at a price-earnings ratio well over 100, based on earnings estimates for 2020, this is one best bought on dips. (Stocks I like are in bold; prices are as of September 6.)

The king of hamburgers remains McDonald's (MCD, $220), whose shares have doubled in the past four years. McDonald's has consistently proved it has the brand, the strategy, the flexibility and the management to dominate. There are few blue-chip companies of any sort that beat its combination of growth and stability. Global comparable-store sales rose 6.5% in the most recent quarter, and McDonald's carries a top rating from Value Line for financial strength.

A big reason for the success of McDonald's is its franchise structure. All but 3,000 of the approximately 38,000 restaurants that bear its name are owned by other people. McDonald's provides the brand and the standards, and it owns the real estate under the restaurants, charging a rental and service fee of about one-fifth of sales. At 26 times projected earnings for the 12 months ahead, the shares are not overpriced, and you get a 2.1% dividend yield in the bargain. (That's more than the yield on a 10-year Treasury bond.)

In this environment, with not just the restaurant sector but the U.S. economy itself showing signs of peaking, tried-and-true restaurants such as McDonald's are the place to be. Consider Starbucks (SBUX, $96), a longtime favorite of mine. Yes, the stock has doubled since June 2018, but earnings keep growing briskly, and there's room for even more expansion. The company still has far fewer outlets than McDonald's, for example, and (in my epicurean opinion) if it would only start offering better pastries and sandwiches, it could boost its revenues like crazy. According to a trade publication, Starbucks is one of the few restaurant chains that has "cracked the code on employee retention," with such perks as tuition reimbursement, health benefits and paid time off.

Multiple choices. The best choices among the established companies with multiple brands are Brinker International (EAT, $39), with Chili's and Maggiano's; Darden Restaurants (DRI, $125), with Red Lobster, Olive Garden and Eddie V's; and Restaurant Brands International (QSR, $76), with Popeye's, Burger King and Tim Hortons, the popular Canadian coffee-and-doughnut chain.

Brinker carries a P/E based on projected earnings of less than 10 and a dividend yield approaching 4%. It is riskier than the other two, with a debt-heavy balance sheet and revenues that barely budged in the last quarter. But the firm sees significant gains in 2020. Shares of Darden, which yields 2.8%, and Restaurant Brands, which yields 2.6%, have each roughly doubled in three years. They are well-run companies, built for the long haul.

In a class of its own is Yum Brands (YUM, $119), with a market cap of $36 billion. It has more than 48,000 KFC, Pizza Hut and Taco Bell restaurants in more than 140 countries. Yum recently invested $200 million in Grubhub (GRUB), the delivery service whose stock has tumbled from $146 in September 2018 to $59 in a super-competitive, so far profitless sector that I would avoid.

Yum Brands is, well, yummy, but I like Yum China Holdings (YUMC, $46), a sister company with 8,600 outlets in more than 1,000 Chinese cities, even more. The stock appears to have suffered unnecessarily from the trade scuffles of late between the U.S and China, presenting a buying opportunity. Another Chinese firm that bears consideration is Luckin Coffee (LK, $21), a chain of 3,000 small mainland coffee shops that mainly take online orders, a model that could go worldwide.

Appealing among smaller, more volatile stocks is Dine Brands Global (DIN, $72), owner of Applebee's and International House of Pancakes, which recently introduced a line of (you guessed it) hamburgers. Nearly all of the restaurants are franchised, and the stock is attractively priced at a P/E of 10 and a yield of 3.8%.

Finally, the hottest restaurant stock owns no restaurants. It's Beyond Meat (BYND), which went public in May at $25 and now trades at $155. Beyond Meat sells its vegan versions of meat in grocery stores and restaurants, including breakfast sausage for Dunkin' (DNKN), hamburgers for Carl's Jr. and chicken for KFC. Another company, Impossible Foods, which is not yet publicly traded, provides the non-meat burger for the Impossible Whopper, from Burger King.

Watch out for fads. Only 5% of Americans say they are vegetarian (a figure that has actually declined since 1999). Certainly, be on the lookout for the next great chain. But for now, invest in companies with strong track records and delicious dividends.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. He owns none of the stocks recommended in this column. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.