Investors, It's Time to Bet on Banks

The big banks have different personalities. JPMorgan Chase is strong and steady. Wells Fargo is seen as the best managed and most innovative.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

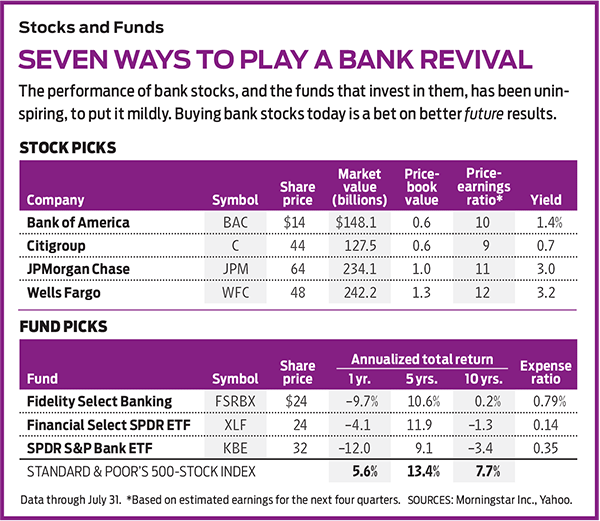

UPDATE: In the column below that appeared in the October 2016 issue of Kiplinger’s Personal Finance, I recommended all four of the largest U.S. banks. One of those was Wells Fargo. Since then, Wells has been embroiled in what can only be called a disgusting scandal. The bank fired 5,300 employees for opening about 2 million fake accounts, going back to 2011, and has announced that CEO John Stumpf will forfeit about $45 million in compensation as a sort of punishment.

Wells shares have dropped from $48 to $45 since I recommended them. Do I continue to recommend the stock? Absolutely not. Mistakes and individual misbehavior, I can tolerate, but systemic fraud, I can’t. It’s rarely an isolated event. Why own this tainted company when there are so many good ones out there?

In normal times, banking is a nice business—not hugely profitable, but consistently so. Banks borrow money, mainly by taking deposits, and pay interest for the privilege. Then they turn around and lend that money to businesses, governments and individuals at a higher rate of interest. The difference between those two rates (after accounting for expenses such as rent and salaries) is a bank’s profit. For the past 30 years, that difference for U.S. banks has bounced between three and five percentage points. That might not sound like much, but with billions of dollars in deposits, serious money is involved.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For banks, the cost of borrowing money has been extremely low lately, as anyone with a savings account knows. But the price that banks get for lending money has been extremely low as well. A recent study by the Federal Reserve Bank of St. Louis found that the average net interest margin (NIM)—that is, the difference between the rate at which banks lend and borrow—for U.S. banks is about three percentage points, which is near a historical low. In 2008, the NIM was 3.3 percentage points, and in the early 1990s it was nearly five points. For the big banks, which compete vigorously for large corporate customers, today’s interest margin is even lower. At the end of June, JPMorgan Chase (symbol JPM), the nation’s largest bank, reported an NIM of just 2.25 points.

A small rise in NIM goes a long way. With about $800 billion in loans, Chase would boost its after-tax profit by $8 billion—or by more than one-fourth of its 2015 earnings—if its NIM were to climb by one percentage point.

Unfortunately for banks, they have little control over the rates at which they borrow; those are set by the Federal Reserve and the market as a whole. The Fed has been reluctant to raise rates in an economy that remains sluggish nearly eight years after the end of the Great Recession. Banks traditionally do have some influence over the rates they charge borrowers, but the primary way they can boost rates is by taking on riskier loans. Because of concerns about repeating the mistakes of the past, both banks and their regulators have become highly averse to assuming credit risk.

Cream of the crop. Still, some banks have performed well in recent years. The best of them, such as JPMorgan Chase, have boosted the bottom line by increasing the size of their loan portfolio and by cutting expenses. Chase’s lending was up 16% for the 12-month period that ended June 30, and, although revenues actually declined between 2011 and 2015, profits rose by one-third, thanks to lower costs.

Chase’s shareholders have been rewarded. The stock has more than quadrupled since the dark days of 2009, and over the past five years it returned 12.0% annualized. That’s 1.4 percentage points per year lower than Standard & Poor’s 500-stock index, but it’s not bad for a highly regulated business. A good chunk of that return has come from a steadily rising dividend. In 2009, Chase slashed its dividend rate from $1.52 per share annually to just 20 cents. Its annual payout, after a 10% increase over the summer, now stands at a record $1.92 per share, and the stock, at today’s price of $64, yields a brisk 3.0%. (All returns and prices are as of July 31.)

All the big banks have shored up their balance sheets since the financial meltdown, and government regulators have kept them on a tight leash, discouraging the kinds of loans and trading activity that were routine in the past. There’s little room for the kind of risk-taking or bold investing that mark sectors such as technology.

Chase’s “common equity tier 1” ratio, the key measure of the buffer against another disaster, has risen from 7% in 2007 to 11.9% as of June 30. That’s an achievement, but it hasn’t changed the status of Chase and the other too-big-to-fail banks as practically wards of the state. “Banks cannot be utilities,” Jamie Dimon, Chase’s CEO, wrote in the company’s 2015 annual report. Because of the understandable fears of government officials and the public, however, that’s just what the giant banks have become.

Chase is the largest of the four banks that dominate commercial banking. The others are Bank of America (BAC), Citigroup (C) and Wells Fargo (WFC), each with about $2 trillion in assets. Besides lending, they all advise on mergers and acquisitions (M&A), manage mutual funds, underwrite bond issues, and trade currencies and other investments for their own accounts. My list excludes Goldman Sachs (GS) and Morgan Stanley (MS), which perform many of the same functions as the others but are mainly investment banks, focusing on such activities as M&A and underwriting rather than collecting deposits and making small loans.

The banks have different personalities. Chase is strong and steady. Wells, whose largest shareholder is Warren Buffett’s Berkshire Hathaway, is seen as the best managed and most innovative. Its stock has been the top performer over the past five years, with an annualized return of 14.0%.

BofA and Citigroup suffered more during the financial crisis and still haven’t fully recovered. Neither has been profitable enough to raise its dividend to anywhere near pre-financial-crisis levels. (Citi’s stock yields just 0.7%; BofA’s, 1.4%.) Once a proud and powerful global bank, Citi has drastically reduced its footprint. It now has retail bank offices in 21 countries, down from 50 in 2007; over the same period, it cut the number of U.S. branches from 936 to 780. A large portfolio of mortgage-backed securities still burdens BofA. Low interest rates encourage borrowers to refinance, which can be particularly problematic for holders of mortgage securities. The bank’s second-quarter earnings fell 18% from the same quarter in 2015, and its return on equity (a measure of profitability) is the lowest of the four.

A key measure of how investors view banks is the relationship between their share prices and book value, or net worth on the balance sheet. The figure reflects investors’ take on the real value of a bank’s loans and other assets. Both Citi and BofA stocks trade for about 40% less than their book values. Chase trades almost precisely at book value, and Wells trades at a one-third premium to book value.

Of course, these valuations are measures of how the market assesses the banks today. As an investor, your concern is what will happen tomorrow. I like the future of all four big-bank stocks. Higher interest rates, waiting in the wings, will be the catalyst that drives up their share prices. Higher rates will likely lead to wider net interest margins and thus higher profits. Banks can continue to cut costs by closing branches and deploying new technologies. And although I am generally averse to heavy regulation, the constraints on banks have been largely beneficial.

Banks below the top tier also look like good buys now. My favorite way to invest in the sector is through Fidelity Select Banking (FSRBX), an actively managed mutual fund in which the big four banks, led by Wells, at 10.2% of assets, are among the top six holdings. Another good choice is SPDR S&P Bank ETF (KBE), an exchange-traded fund with a portfolio comprising about 60 large banks, none accounting for more than 3% of assets. I also like Financial Select Sector SPDR (XLF), a more diversified ETF that, in addition to bank stocks, holds insurers, asset managers and even real estate investment trusts.

Or you can skip the funds and simply put the same amount of money into each of the big four banks. It looks like the time is right.

James K. Glassman, a visiting fellow at the American Enterprise Institute, is the author, most recently, of Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. He owns none of the stocks mentioned.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

Visa Stamps the Dow's 398-Point Slide: Stock Market Today

Visa Stamps the Dow's 398-Point Slide: Stock Market TodayIt's as clear as ever that President Donald Trump and his administration can't (or won't) keep their hands off financial markets.

-

Stocks Climb Wall of Worry to Hit New Highs: Stock Market Today

Stocks Climb Wall of Worry to Hit New Highs: Stock Market TodayThe Trump administration's threats to Fed independence and bank profitability did little to stop the bulls on Monday.

-

Dow Hits a Record High After December Jobs Report: Stock Market Today

Dow Hits a Record High After December Jobs Report: Stock Market TodayThe S&P 500 also closed the week at its highest level on record, thanks to strong gains for Intel and Vistra.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.

-

JPMorgan's Drop Drags on the Dow: Stock Market Today

JPMorgan's Drop Drags on the Dow: Stock Market TodaySmall-cap stocks outperformed Tuesday on expectations that the Fed will cut interest rates on Wednesday.