James K. Glassman's 10 Stock Picks for 2016

Here are nine good choices from investors I trust -- plus my own (repeat) pick.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

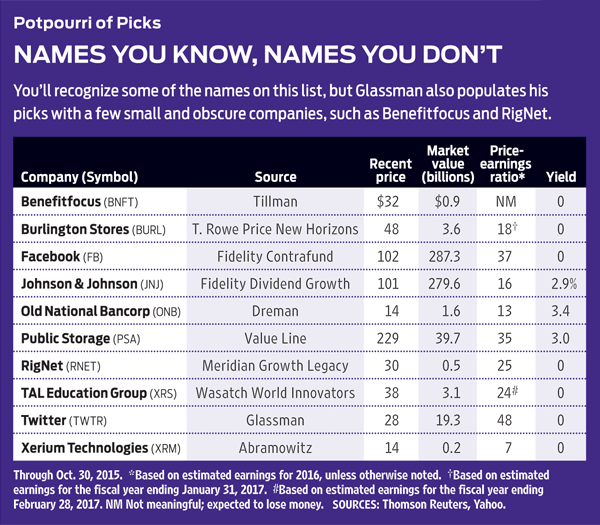

What a wild year! Every one of my 10 stock picks for 2015 registered a gain or loss of at least 17%, and three were down 31% or more. It was the most volatility I can remember in the 20 years I have been composing my annual list. In the end, I had six winners and managed to eke out a gain of 1.6%, compared with 5.2% for Standard & Poor’s 500-stock index (all figures include dividends). It was not a good showing, but there’s a lesson here: With a well-chosen 10-stock portfolio, you can often balance out big losers with impressive gainers.

Every January, I offer readers a list culled from selections of investment advisers I trust, with a stock I choose tossed in. Unfortunately, in 2015, my own pick, Twitter (symbol TWTR), performed miserably, declining by 31.4%. Conrad Industries (CNRD), which plunged 37.6%, was my worst pick, even though the suggestion came from Dan Abramowitz, whose choices in 2012, 2013 and 2014 each returned more than 40%. (Second lesson: No one gets it right every year.) Conrad builds and services boats for the offshore drilling industry and got caught in the oil-price downdraft.

But Abramowitz, who heads Hillson Financial Management, in Rockville, Md., is still my guy for micro-cap stocks, the smallest of the small. For the coming year, he likes Xerium Technologies (XRM), a manufacturer of products used in papermaking machines. Abramowitz calls the company “a turnaround story that is now at an inflection point.” Changes that a new management team put into effect in 2012 should start bearing fruit. The stock’s price-earnings ratio is a mere 7, based on the average of analysts’ earnings estimates for 2016. (Returns, share prices and related figures are as of October 30.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Wasatch World Innovators Fund (WAGTX) spreads its net across the globe, investing in fast-growing companies of all sizes. My pick from its portfolio a year ago, drugmaker Novo Nordisk (NVO), was one of my best picks in 2015. For 2016, the choice is TAL Education Group (XRS), a Beijing-based provider of K-12 after-school services that I recommended earlier this year and that has weathered the downturn in the Chinese stock market exceptionally well. (Third lesson: Look for resilient companies.)

It was a rough year for small-cap growth stocks, and that’s all the more reason to be buying them. A good place to hunt is in the portfolio of Meridian Growth Legacy (MERDX), an excellent fund in the category. One of its top holdings, a previous highflier that has stalled out because of the decline in energy prices, is RigNet (RNET), which provides digital-communications systems that link oil-and-gas operations around the world. Revenues and earnings are expected to be flat in 2016, but RigNet’s price has fallen by nearly half since July 2014, and it looks like a bargain.

Salesforce.com (CRM), with a gain of 21.4%, was one of my 2015 winners. The pick came from Terry Tillman, an analyst with Raymond James Associates who specializes in business software companies. I began using Tillman as a selector in 2012, and since then his four choices have averaged gains of 36%. For 2016, Tillman likes Benefitfocus (BNFT), which makes software that helps employees of large companies navigate the complex world of benefits, including health insurance. The company has been losing money, but Tillman sees revenues rising by 24% in the coming year.

My biggest winner for 2015 was Alphabet (GOOGL), the former Google, with a gain of 29.8%. It was the top holding of my all-time favorite large-cap mutual fund, Fidelity Contrafund (FCNTX). Lately, manager Will Danoff has been adding to his positions in Facebook (FB), which is now his top holding. Although the stock recently hit a new high, analysts estimate that both revenues and earnings will rise by about one-third in 2016. Given such rapid growth, I don’t consider Facebook to be overpriced, despite its seemingly high P/E of 37, based on profit forecasts for 2016.

My second-best 2015 pick, with a return of 28.3%, was Restoration Hardware Holdings (RH), from the portfolio of T. Rowe Price New Horizons (PRNHX), the place to go for hot small and mid-cap stocks since 1960. Manager Henry Ellenbogen made a large addition to his position in Burlington Stores (BURL) in the third quarter of 2015, a move that I endorse. The apparel chain, with 546 stores and a robust Internet presence, is growing briskly, with profits expected to rise 18% in the fiscal year that ends in January 2017.

Of the more than 2,000 stocks ranked by the Value Line Investment Survey (the best one-stop research shop, in my view), only nine are ranked in the top category (“1”) for both timeliness and safety. And of those nine, my favorite is a large real estate investment trust called Public Storage (PSA), which owns and operates self-storage facilities. As a customer, I know just how good a business this is. Rental rates keep rising, and it’s a pain to shop around and move your stuff. (Fourth lesson: Invest in companies you know.) Earnings are rising robustly, and the stock currently yields 3.0%.

Stocks that pay consistently rising dividends tend to provide ballast for a portfolio, delivering regular, though unspectacular gains. That’s why I chose Lockheed Martin (LMT) in 2015. It performed well, with a return of 18.5%. For the coming year, using Fidelity Dividend Growth fund (FDGFX) as my source, I’m choosing Johnson & Johnson (JNJ), which has increased its payout for 53 consecutive years. Shares of the health care giant have been largely treading water for two years, and it’s time for them to catch up with the rest of the health care sector.

Veteran investment adviser David Dreman, author of the classic 1980 book Contrarian Investment Strategy, is a hunter of extreme value. His philosophy: “We believe that the markets are not perfectly efficient.” Some stocks, in other words, are judged by the market to be cheaper than their actual worth. Lately, Dreman has been buying shares of Old National Bancorp (ONB), a 181-year-old financial institution with 195 branches, mainly in the Midwest. The stock, which is still down by about one-third from its prerecession high, trades at just 13 times projected 2016 earnings and yields an attractive 3.4%. (Fifth lesson: Go for the trusty dividend.) If interest rates ever rise, the bank should benefit from a widening spread between its cost of funds and the interest rates borrowers pay.

My own pick this year is Twitter—again. In my January 2015 column, I quoted venture capitalist Peter Thiel as saying, “It’s a horribly managed company.” I agreed with the sentiment but believed that Twitter, now with more than 300 million active users per month and revenues rising at more than 40% annually, “will eventually find a way.” Clearly, Twitter didn’t in 2015, but with Jack Dorsey back as CEO, I think it will in 2016 and beyond.

Please remember my annual warnings: Although I expect these stocks will beat the market in the coming year, I don’t believe in short-term investing (holding a stock for less than five years), so consider them long-term holdings. Also, these are just suggestions. Ultimately, the decisions are yours.

James K. Glassman, visiting fellow at the American Enterprise Institute, is the author, most recently, of Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks mentioned, he owns Twitter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Stock Market Today: Stock Rally Continues; Twitter Soars on Musk U-Turn

Stock Market Today: Stock Rally Continues; Twitter Soars on Musk U-TurnThe Tesla CEO said he now wants to buy Twitter at his original offer price.

-

Stock Market Today: Stocks Bounce as Oil Prices Crumble

Stock Market Today: Stocks Bounce as Oil Prices CrumbleStock Market Today U.S. crude futures finished at their lowest level since mid-January amid concerns over slowing global economic growth.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

Stock Market Today: Stocks' Momentum Stalls After Shocking Snap Earnings

Stock Market Today: Stocks' Momentum Stalls After Shocking Snap EarningsStock Market Today The Snapchat parent posted its slowest quarterly revenue growth on record and said it plans to cut back on hiring.

-

Twitter Earnings on Tap, But All Eyes on Musk Court Battle

Twitter Earnings on Tap, But All Eyes on Musk Court Battlestocks Our preview of the upcoming week's earnings reports includes Twitter (TWTR), Netflix (NFLX) and Johnson & Johnson (JNJ).

-

Stock Market Today: Nasdaq Snaps Win Streak as Twitter Drags on Tech

Stock Market Today: Nasdaq Snaps Win Streak as Twitter Drags on TechStock Market Today Twitter stock sold off on news Elon Musk no longer wants to buy the social media platform.

-

Stock Market Today: Stocks Finish Mixed After Boffo Jobs Report

Stock Market Today: Stocks Finish Mixed After Boffo Jobs ReportStock Market Today A far-better-than-expected June employment situation might tamp down recessionary fears, but it also might clear the Fed for more aggressive rate-hiking.