James Glassman's 10 Stock Picks for 2017

Having beaten the market in 2016, I'm banking on these 10 stocks to outperform in the year ahead — and beyond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

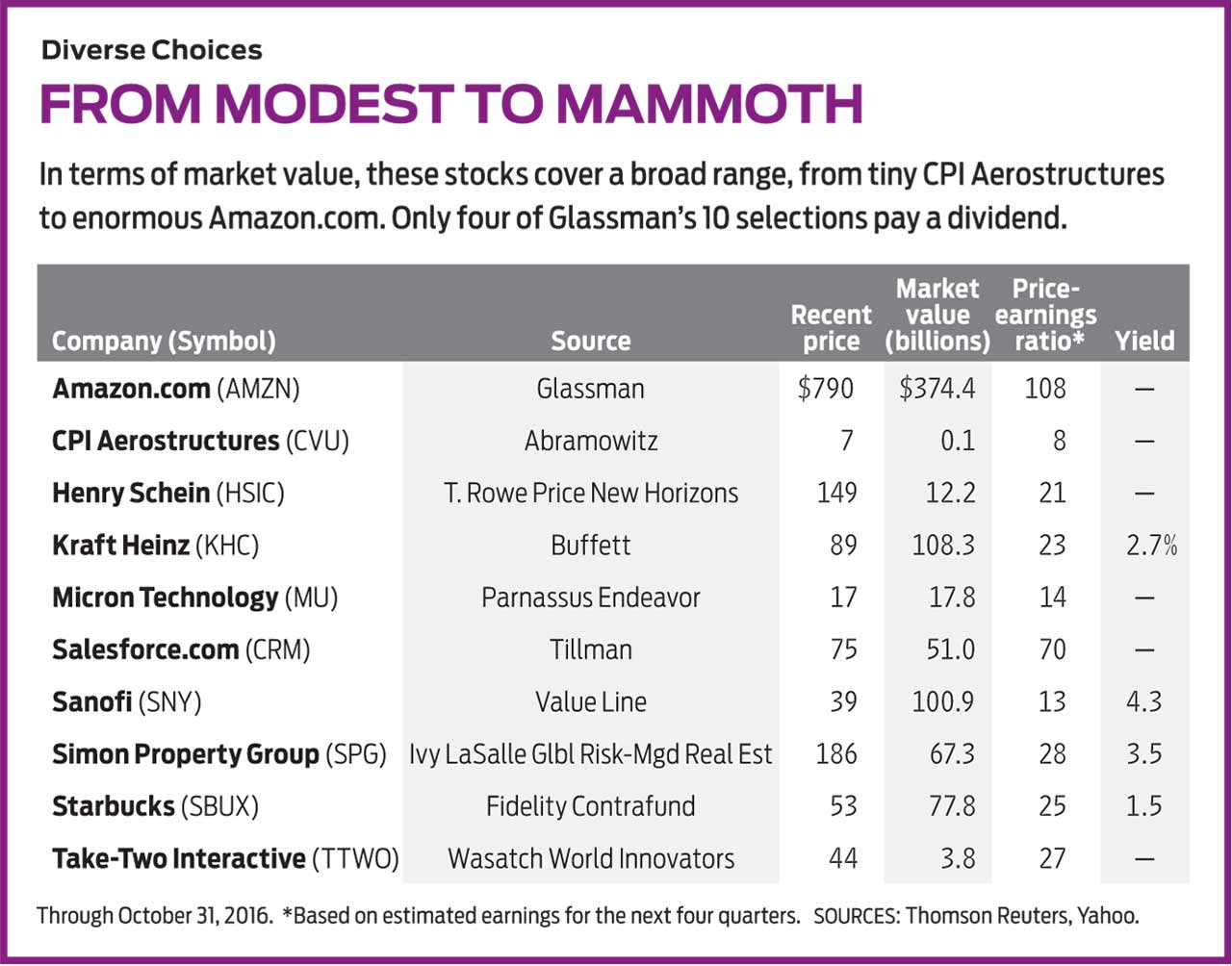

I’m baaack! After my annual stock picks trailed Standard & Poor’s 500-stock index in both 2014 and 2015, my choices from a year ago returned 8.0% over the past 12 months, beating the index by 3.4 percentage points. The past 10 lists have topped the index by an average of one percentage point per year. That’s not much, but, like many of you, I enjoy picking stocks and don’t want to put all of my money into index funds.

For two decades, I have been offering a list culled from selections of experts I trust, with a stock I choose tossed in. The 2016 list produced six winners, four losers and a lot of volatility. The top gainer was TAL Education Group (symbol XRS), which offers after-school tutoring in China. The stock, which was held by Wasatch World Innovators Fund (WAGTX), soared 112% over the past year. The biggest loser was Xerium Technologies (XRM), a maker of parts for paper-making machines. Xerium was supposed to be a turnaround story, but it hasn’t quite turned around yet. The choice of Dan Abramowitz, my small-cap maven, the stock lost 54%. (Prices and returns are as of October 31.)

As top scorer in 2016, World Innovators gets the honor of leading off this year. The aggressive growth fund invests in companies based all over the world, but today nearly half of its assets are in U.S.-based firms—including its largest holding, Take-Two Interactive Software (TTWO). The company makes video games, such as Grand Theft Auto. Take-Two’s revenues and profits have been bouncing up and down lately with the popularity of its products, but analysts see brisk earnings gains for the year ahead. Flush with cash, the firm could be a takeover target. With a market capitalization of $3.8 billion, Take-Two has about $1.5 billion in cash and short-term investments and just $500 million in debt.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

For the second year in a row, T. Rowe Price New Horizons (PRNHX), a hot venue for small- and midsize-company growth stocks since 1960, was the source of the second-best performer on my list. For this year, I like Henry Schein (HSIC), which New Horizons first purchased in 1996. Schein is an 84-year-old company that distributes health supplies to physicians, dentists and veterinarians. A mid-cap stock, Schein is not a superfast grower, but it has a rock-solid niche, with earnings expected to rise at a good clip.

Although Abramowitz, of Hillson Financial Management, in Rockville, Md., picked what turned out to be a clunker for 2016, his choices have done well in the past, so I asked him back for 2017. His pick: CPI Aerostructures (CVU), which makes structural parts, such as wing assemblies and fuel panels, for commercial and military aircraft. The firm recorded a huge loss in 2014, but it has recovered and, Abramowitz tells me, “has a large and growing backlog” of orders. The stock’s price-earnings ratio is just 8, based on Abramowitz’s forecast that CPI will earn about 90 cents per share for 2017. With a market cap of $58 million, CPI is the smallest company I’ve ever recommended here, so expect a wild ride. The potential reward looks like it’s worth the risk.

Terry Tillman, a technology analyst with Raymond James, extended his winning streak to five years in a row with another good pick. Over the period, his stocks have delivered an average yearly gain of 28%. For 2017, he’s gone back to the stock he chose in both 2014 and 2015: Salesforce.com (CRM), a rapidly expanding company that sells web-based software that helps companies manage relationships with their customers. (Salesforce broke my heart by not purchasing Twitter, as described below.) Tillman sees revenues rising by 25% in the fiscal year that ends January 31, 2017, and by 21% for the following year. He was correct to avoid recommending Salesforce here a year ago because the stock fell 4% over the subsequent 12 months, but he thinks the time is right to recommend it again. (For more on Salesforce, see 10 Great Stocks for the Next 10 Years.)

Parnassus Endeavor (PARWX) has been one of the top-performing large-company funds over the past five years, with an annualized return of 17.1%. Jerome Dodson, a leading practitioner of socially responsible investing, has been managing funds for 32 years, and with Endeavor he emphasizes “low turnover and high conviction.” Micron Technology (MU), an Idaho-based semiconductor maker, is the fund’s top holding and one of the few stocks added to Endeavor’s portfolio in 2016. Micron has been struggling, but some analysts see profits rising sharply over the next year or two. It’s a contrarian play, but my money is on Dodson.

What’s a top-10 list without a selection from Fidelity Contrafund (FCNTX), run by Will Danoff for a quarter-century? Last year’s pick, Facebook (FB), the fund’s top holding, advanced 29%. This year, I’m moving down to number 14 in the portfolio: Starbucks (SBUX), the coffee-shop chain. The stock has suffered lately, sinking 14% over the past year, and that makes it even more attractive, especially with no serious competitors on the horizon, a gorgeous balance sheet, and earnings that Value Line predicts will rise 16% annually over the next five years.

Warren Buffett, who turned 86 in August, is still America’s greatest living investor. He frequently buys entire companies for Berkshire Hathaway (BRK.B), the company he runs. A few years ago, he purchased about one-fourth of Kraft Heinz (KHC), the world’s fifth-largest food company, with such venerable brands as Jell-O, Oscar Mayer and Velveeta. On a P/E basis, the stock isn’t cheap. It is unlikely to soar, but it offers a 2.7% dividend yield and should add ballast to any portfolio.

It has been a while since I’ve had a real estate investment trust on my list, so here’s the corrective: Simon Property Group (SPG), owner of regional malls and outlet shopping centers around the world. Simon’s stock has been flat since the start of 2015 as enthusiasm for REITs has waned. But that’s what I like to see when buying a stock. Simon, the largest REIT by market cap and the top holding of Ivy LaSalle Global Risk-Managed Real Estate (IVRAX), an excellent REIT fund, yields an attractive 3.5%.

Few companies receive top rankings for both timeliness and safety from the Value Line Investment Survey (my favorite single source of research). Promoted to that exalted position in late October was Sanofi (SNY), the Paris-based maker of pharmaceuticals, with an emphasis on diabetes medicines. Sanofi’s stock yields a hefty 4.3%, an indication that it may be undervalued.

My own pick last year was a dud. Twitter (TWTR) was nearly acquired by Salesforce, but the deal fell through, and the stock dropped by almost one-third. This year, I am recommending what I think is the best-run company in the world, Amazon.com (AMZN). The stock, which I own, took a hit in October because of disappointing earnings, but CEO Jeff Bezos has his eyes on the long term. The company dominates online retailing, has a strong position in cloud computing, and is moving aggressively into video content and artificial intelligence. Value Line sees revenues rising 19.5% annually over the next five years.

Here are my annual warnings: I expect these stocks to beat the market in the year ahead, but I don’t believe in holding a stock for less than five years, so think of these companies for the longer term. Also, this is merely a list of suggestions. The choices are yours.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Look Out for These Gold Bar Scams as Prices Surge

Look Out for These Gold Bar Scams as Prices SurgeFraudsters impersonating government agents are convincing victims to convert savings into gold — and handing it over in courier scams costing Americans millions.

-

How to Turn Your 401(k) Into A Real Estate Empire

How to Turn Your 401(k) Into A Real Estate EmpireTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

My First $1 Million: Retired Nuclear Plant Supervisor, 68

My First $1 Million: Retired Nuclear Plant Supervisor, 68Ever wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.