Why I'm Still Bullish on Bonds

If you buy funds that own high-quality debt, you'll get a bit of income and stand a good chance of getting some price appreciation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Against all odds, bonds issued by the U.S. government have lately proved to be a far, far better investment than stocks issued by U.S. corporations. While large-company stocks have returned an annualized 4% since 2000, long-term Treasuries have returned 9% a year. Over the past year, Standard & Poor’s 500-stock index returned a brisk 18.3%, but iShares 20+ Year Treasury Bond ETF (symbol TLT), an exchange-traded fund that tracks a long-term bond index, earned 26.3%.

It turns out that the safest investment in the world also puts the most money in your pocket, or at least it has recently and over the past 15 years. That seems to go against one of the basic tenets of investing. Typically, the less risk you take, the less you make. What gives?

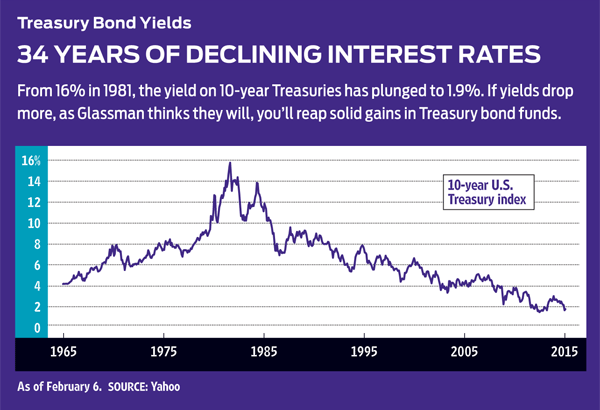

Microscopic yield. It’s true that Treasury bonds provide negligible income—that is, the interest they promise to pay you is minuscule as a proportion of the principal you put up. The yield on the benchmark 10-year Treasury note is now just 1.9%, down from 3% at the start of 2014 and 6.8% in 2000. The yield on the 30-year T-bond dropped to 2.2%, the lowest in history, before rebounding to 2.5%. (Unless otherwise stated, yields and returns are as of February 6.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It’s hard to believe that interest rates would fall so low. But that’s what has happened, and the payoff for guessing right has been big. That’s because as rates drop, the value of bonds purchased when rates were higher rises. Imagine, for example, that you bought a 10-year bond with a face value of $10,000 in mid 2010, when yields were about 4%. You have been receiving interest payments of $400 a year. A similar bond today pays annual interest of only about $190. As a result, on the open market, your previously purchased bond will become more attractive. Anyone who buys it on the open market will have to pay a good deal more than $10,000.

The rule is counterintuitive: When interest rates fall, the price of a bond rises, and vice versa. Also, the more time before a bond matures, the more volatile its price. That makes long-term bonds much riskier than short-term debt. The price of a 30-year bond will drop like a stone if interest rates move back to the historical average of 7.1%.

Key question. Mutual funds and ETFs hold shifting portfolios of bonds with different maturities, often from different issuers. Fund prices bounce up and down, either because rates in general fall or rise, or because perceptions of risk change and investors demand a higher yield as compensation. With Treasuries, we can forget about credit risk. The question is pretty simple: Will interest rates keep falling? If they do, then not only will you get paid a few percentage points in interest but you will also gain from increases in bond prices.

For years now, ever since the Federal Reserve slashed short-term rates during the 2007–09 recession, economists and Wall Street analysts have been predicting that rates would rise and bond prices, conversely, would fall. Instead, the opposite has happened. Rates have continued to decline, continuing the secular (that is, long-term) bull market for bonds that began in 1981. That year, the 30-year Treasury yielded 15%; in 1991, it was 8%; in 2001, 5%; today, it is half that.

My guess is that the trend will continue. Here’s why:

People are still frightened. The stock market’s catastrophic decline in 2008—the S&P 500 lost 37% that year—is still fresh in the minds of many investors. Economies in Europe and Japan are stagnant, and China’s growth is slowing. Currencies are in disarray. Terror attacks in Europe are increasing. Money is still flowing into government bonds issued by such sound borrowers as Germany, but the U.S. remains the haven of choice for investors seeking safety—not just Americans but people all over the world.

Inflation is nowhere on the horizon. The main reason long-term rates go up is that investors demand that borrowers pay them more to compensate for the loss in buying power caused by inflation. But consumer prices in the U.S. are barely rising at all; the consumer price index rose just 0.8% in 2014. Prices may rise by more this year, but not much more.

The Federal Reserve is not going to be a factor for a while. With low inflation and annual growth in gross domestic product still less than 3%, the Fed will not increase short-term rates aggressively. Even if it does raise the rates it controls, long-term rates—which are set by investors in the bond market—may not rise in lockstep because higher short-term rates would slow the economy.

The appetite for borrowing has been sated. On the federal and state level, deficits (which have to be financed with bonds) are under control, and corporations have generally taken on as much debt as they need. Consumers are also gun-shy about borrowing too much. In credit land, in other words, supply seems to exceed demand. That means interest rates will remain steady or fall, and prices will hold steady or rise.

Now, here’s what the continuing bull market in bonds means for you. If you buy funds that own high-quality debt—Treasuries and high-grade corporate and municipal bonds—you’ll get a bit of income and stand a good chance for getting some price appreciation, too. No guarantees, of course, but I like the odds. It is foolish in this sluggish economic environment, with so much geopolitical fear in the air, to reach for yield by purchasing high-yield, or junk, corporate bonds or the debt of shakier economies, such as Brazil, Greece or Puerto Rico. It’s also too risky to bet on questionable European debtors whose bonds pay surprisingly little. The 10-year bonds of Portugal, for example, yield only 2.4%; those of Italy, just 1.6%.

If you firmly believe that rates will continue to fall, then buy funds that own bonds with maturities far into the future. An example is Vanguard Extended Duration Treasury ETF (EDV), with an effective average duration of 25 years. Duration is a technical term that measures the sensitivity of the price of a bond or a bond fund to changes in interest rates. In this case, if bond yields fall by one percentage point, you can expect the fund’s price to rise by about 25%. Because of the leverage provided by its extended duration, the Vanguard fund jumped 45.1% last year. But in 2013, when rates rose, the fund fell 19.9%. A conventional mutual fund that takes a similar approach is Wasatch-Hoisington U.S. Treasury (WHOSX), with an average duration of 20.5 years.

An alternative that doesn’t make such a big bet on the direction of rates is Fidelity Government Income (FGOVX), with a duration of just 4.7 years. It returned only 4.9% over the past year, but it was far less risky than the other two funds. The iShares 20+ Year ETF splits the difference with a duration of 18.1 years. My preference is to go with funds with longer durations. (You can find durations at Morningstar.com and on fund sponsors’ Web sites.)

How low will bond yields go? I think the 30-year Treasury will drop below 2% and the 10-year below 1%. The bonds of Germany, Japan, Switzerland, Sweden, Denmark and several other countries are already at those levels. If I’m right, buyers of long-term bond funds will profit.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.

-

An Urgent Need for Cybersecurity Stocks

An Urgent Need for Cybersecurity Stocksstocks Many cybersecurity stocks are still unprofitable, but what they're selling is an absolute necessity going forward.

-

Why Bonds Belong in Your Portfolio

Why Bonds Belong in Your Portfoliobonds Intermediate rates will probably rise another two or three points in the next few years, making bond yields more attractive.

-

140 Companies That Have Pulled Out of Russia

140 Companies That Have Pulled Out of Russiastocks The list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

-

How to Win With Game Stocks

How to Win With Game Stocksstocks Game stocks are the backbone of the metaverse, the "next big thing" in consumer technology.