Picking Stocks: It’s Okay to Go With Your Gut

Investing in a Big Idea is more fun than other investing strategies, potentially more profitable and not necessarily more risky.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

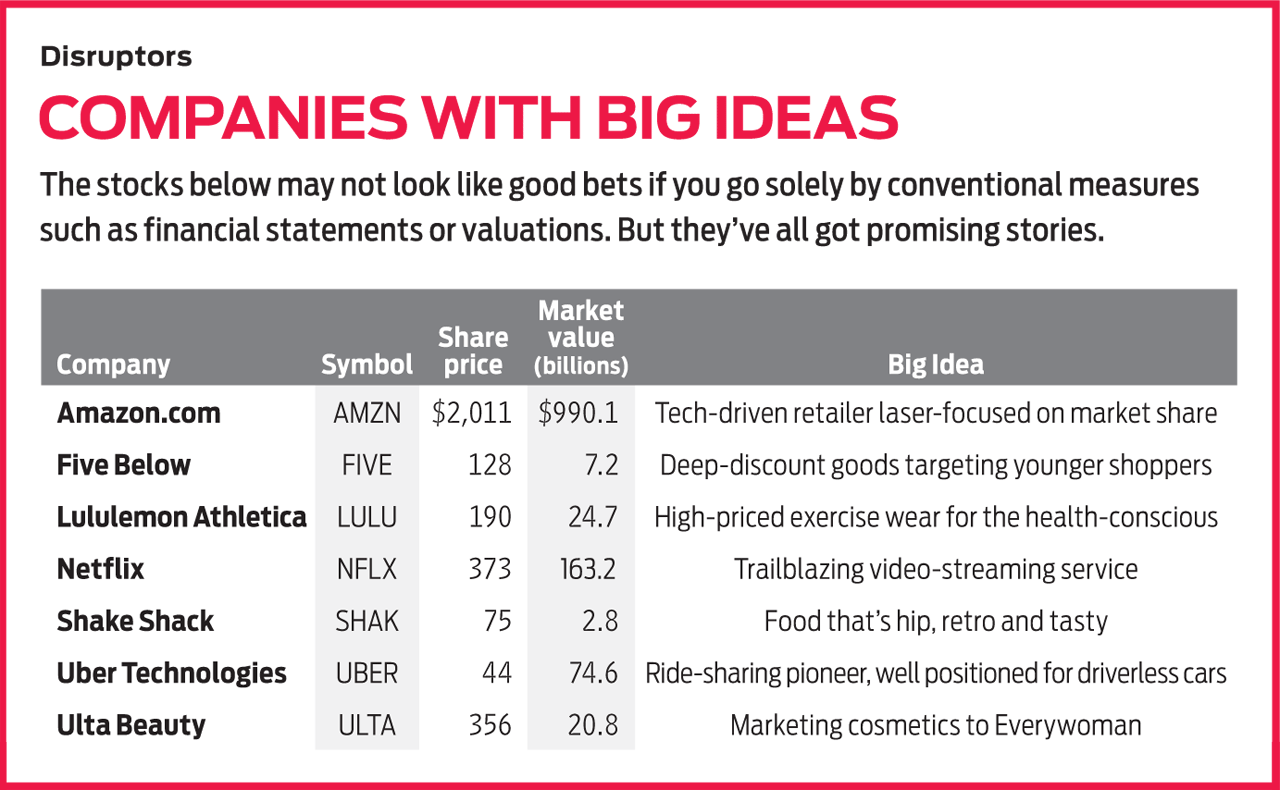

There are four ways to invest in stocks. You can buy a low-cost index fund, with holdings that reflect an entire market or a broad swath of one. You can buy a managed fund, hiring an expert to do the stock picking. You can conscientiously study data from individual companies and invest in their shares. Or you can buy stock in companies that appeal to you subjectively—that is, invest with your gut. You like what they’re doing. You trust the product, the management or, best of all, the idea behind the business.

You can create a good stock portfolio by deploying all four of these methods. But it is the fourth, which I’ll call Big Idea investing, that is frequently overlooked or even derided. Big Idea investing is more fun than the other strategies, potentially more profitable and not necessarily riskier.

If markets are efficient—and I believe that they are the vast majority of the time—then today’s price for a stock reflects all known information. It is rational and fair. But the market may not recognize the power of a Big Idea because it is hard to quantify using conventional tools. That means you as an investor, listening to your gut, may have an edge on the professionals.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Gut instinct. Big Idea investing is an act of faith. Though you may lack evidence today that a company will become an outrageous success, you believe it will, even if you are not sure how.

Average investors run across great prospects all the time just by keeping their eyes open and their imaginations vivid.

Probably the most famous practitioner of Big Idea investing was Peter Lynch, who, before he retired at age 46, was the most successful mutual fund manager of his day, producing average annual returns of 29% for Fidelity Magellan over 13 years. His book, One Up on Wall Street, published 30 years ago, makes the case that average investors run across great prospects all the time just by keeping their eyes open and their imaginations vivid. The way to score huge gains is to understand those prospects before they are reflected in the numbers. As Lynch wrote, “Remember, things are never clear until it’s too late.”

Lynch tells how he made a large and profitable investment in Hanes, a small company later bought by Sara Lee (now private) and then spun off as a separate firm, today called Hanesbrands. Lynch bought the stock after his wife told him about the unique egg-shaped packaging that made the pantyhose easy to recognize in grocery stores.

I bought Netflix (NFLX, $373) right after its 2002 initial public offering mainly because I thought the company had a Big Idea: letting you order movie discs online, mailing them to you immediately and letting you keep them as long as you wanted. Netflix killed the video store, but I also had an inkling that, if films could someday be downloaded swiftly from the internet, Netflix would be well positioned. Okay, I sold Netflix after it had tripled—a “three-bagger,” in Lynch’s parlance—and missed out as the stock became a 300-bagger. (Stocks I like are in bold; prices are as of July 12.)

When I bought Netflix, it had almost no revenues and no earnings—really nothing for an investor to count on but the idea. Today, Netflix has about 150 million subscribers. For the second quarter, the company reported weaker-than-expected subscriber numbers, and the stock plunged. I have seen such episodes before, and they don’t worry me. The strategy and brand are strong.

Do not be afraid to invest in companies without profits. Jeff Bezos launched Amazon.com (AMZN, $2,011), the online retailer, in 1994. Five years later, it had annual sales of $1.6 billion but was losing $720 million, or nearly 50 cents on every dollar of sales. The firm did not eke out a profit until 2003. In the first quarter of 2019, Amazon more than doubled its earnings compared with the same period a year earlier, to $3.6 billion, or $7.09 a share. Profits still represent only 6% of sales.

Even today, Amazon remains a Big Idea company, and the idea is being a technology-driven retailer that cares about market share and satisfying the customer, no matter what it costs in the short run. In his experimentation with new businesses, such as cloud computing, Bezos has developed a Big Idea corollary. As he put it in a 2017 letter to shareholders, “Experiment patiently, accept failures, plant seeds, protect saplings, and double down when you see customer delight.”

What about Uber (UBER, $44)? The financial figures for the ride-sharing phenom are discouraging. In the first quarter of 2019, just before the company’s IPO, Uber’s operating loss more than doubled compared with the same period a year earlier. Revenues rose 20%, but selling, general and administrative expenses rose 28%. Not a formula for success. Still, my interest in Uber is the Big Idea, not the numbers. Ride-sharing is revolutionary, and, just like Netflix, Uber is positioned for the future—in this case, with driverless vehicles and any other business its leadership can devise to serve the people who take 14 million rides a day.

Ignore the P/E. Because most of us aren’t experts in software, energy exploration or high finance, our Big Idea stocks will be those of consumer companies we encounter every day. A good example is Five Below (FIVE, $128), a retailer that makes shopping an exciting experience for kids roughly 8 to 14 years old, selling candy, simple beauty products, scarves, lamps, sports gear and electronics at low prices. It’s sort of a Dollar Tree store for children, with a great website. Unlike Uber, Five Below has good numbers: For the first quarter of fiscal 2019, sales rose 23% and earnings rose 18%. Five Below has 789 stores, but it is still small, with a market capitalization (share price times shares outstanding) of $7.2 billion. Keep in mind that with fast-growing, high-potential Big Idea companies, price-earnings ratios are nearly meaningless. Five Below’s P/E for the coming four quarters is more than 40, and P/Es for other Big Idea stocks are even higher.

Another favorite Big Idea stock, Lululemon Athletica (LULU, $190), has been public for 12 years but is still youthful. The company created an aura around its exercise clothing, connecting it to the healthful mysticism of yoga and unabashedly pricing its products high. Lululemon stock still carries a modest market cap of $24.7 billion.

Ulta Beauty (ULTA, $356), a cosmetics retailer with stores in every state, has a Big Idea that’s reflected in the best TV commercial I have seen in years, depicting a glorious diversity of women with Alessia Cara singing “Scars to Your Beautiful” in the background. Buying a stock because of an ad may sound absurd, but I wish I had. The shares are up more than 40% this year. The marketing is part of the approach that CEO Mary Dillon, a veteran of McDonald’s and Gatorade, brought to the company in 2013.

I should have bought Shake Shack (SHAK, $75) when I first saw the long lines in front of celebrity chef Danny Meyer’s little burger stand in Madison Square Park in New York. The Big Idea here is food that is hip, retro and tasty. Shake Shack went public in 2015, but it is still young, with only about 200 stores and a market cap of $2.8 billion.

Big Idea investing is hardly foolproof. Selling pet supplies over the internet was a Big Idea when Pets.com went public in 2000, but the company was bankrupt less than a year later. Still, even the most hyper-analyzed stock can go broke. Look at Enron.

Keep an eye out for Airbnb, whose IPO could come later this year. Home-sharing has to be one of the biggest Big Ideas ever. There are many more out there for investors with imagination and a bit of courage.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. His most recent book is Safety Net: The Strategy for De-Risking Your Investments in a Time of Turbulence. Of the stocks mentioned in this column, he owns Amazon.com and Lululemon Athletica.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.

-

Stocks Slip to Start Fed Week: Stock Market Today

Stocks Slip to Start Fed Week: Stock Market TodayWhile a rate cut is widely expected this week, uncertainty is building around the Fed's future plans for monetary policy.

-

Stocks Keep Climbing as Fed Meeting Nears: Stock Market Today

Stocks Keep Climbing as Fed Meeting Nears: Stock Market TodayA stale inflation report and improving consumer sentiment did little to shift expectations for a rate cut next week.

-

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market Today

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market TodayAmazon lifted its spending forecast as its artificial intelligence (AI) initiatives create "a massive opportunity."

-

What Netflix Stock's 10-for-1 Split Means for Investors

What Netflix Stock's 10-for-1 Split Means for InvestorsNetflix stock started trading on a split-adjusted basis in mid-November.

-

What Tariffs Mean for Your Sector Exposure

What Tariffs Mean for Your Sector ExposureNew, higher and changing tariffs will ripple through the economy and into share prices for many quarters to come.

-

The Dollar Index Is Sliding. Is Your Portfolio Prepared?

The Dollar Index Is Sliding. Is Your Portfolio Prepared?The dollar's fall has been troubling because inflation appears to be constrained and the economy has been strong. Here's what it means for investors.

-

Stock Market Today: Stocks Step Back From New Highs

Stock Market Today: Stocks Step Back From New HighsInvestors, traders and speculators continue the low-volume summer grind against now-familiar uncertainties.