Private Equity Is a Plus

Academic research shows that private equity produces stronger and more-resilient companies.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Private equity. Carried interest. Leveraged buyouts. Venture capital. A once-obscure corner of the capital markets has exploded into the mainstream as Republican presidential candidate Mitt Romney defends the wealth he acquired in this most lucrative sector of the financial industry.

Private equity refers to a group of large investors, such as pension funds and endowments, that supply funds to general partners to use as venture capital (to incubate new companies) or to buy public companies, take them private and restructure them, sometimes by borrowing additional money (known as leveraged buyouts). Private-equity firms take an active role in monitoring, financing and reorganizing these companies with the goal of selling them back into the public market at prices that generate superior returns for both the general partners and investors.

Money has flowed into private-equity funds because they generate generally superior returns. For large public-pension funds, the median return on private equity was 6.6% annually over the five years ended in September 2011, according to Wilshire Associates. That’s far better than the return on stocks during the same period. Over the past ten years, the Cambridge Associates Private Equity index, which tracks more than 4,500 private partnerships, returned more than twice as much as popular U.S. stock averages.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But it is extremely difficult for ordinary investors to get a piece of this action. Investors must be “accredited” to become a limited partner (see Ahead). And even if you make the grade, some very successful funds favor established investors and have limited space for newcomers.

Does it help? On balance, academic research shows that private equity produces stronger and more-resilient companies. Although the employment growth generated by private equity is generally not as strong as Romney claims, most firms sold by private equity have lower default rates, invest capital more efficiently and turn in a better operating performance than comparable firms. That’s partly because private-equity firms can negotiate lower borrowing costs, and the equity partners are able to share their expertise with the firm’s management.

That doesn’t mean there are no abuses in the private-equity market. When the economy is booming and investors are all too willing to ignore risks, private-equity firms can easily find money to buy public companies, leverage them with debt, then sell them to the public at inflated prices.

One controversial issue in the presidential campaign is whether the compensation, or carried interest, that Mitt Romney and other general partners of private-equity firms receive should be taxed at a preferential rate. Here I must side 100% with the naysayers. Unlike ordinary investments, carried interest involves little or no capital at risk. Capital gains, on the other hand, are taxed at preferential rates because capital is at risk and there are restricted rules for deducting capital losses. But carried interest is no different from shares of stock, options and bonuses paid to employees, or even contingency fees paid to lawyers, all of which are taxed as ordinary income.

Being rich should not disqualify a candidate from the presidency, and Romney would be extremely wealthy whether his income from Bain Capital was taxed at 15% or 50%. To the extent that Romney mentored young firms and restructured old ones, that is exactly the right background for taking on the challenges of the presidency. Who disagrees that our government, with its trillions of dollars in unfunded future liabilities, needs to be restructured? But Romney must also admit that he benefited from too-favorable tax laws that need to be rewritten. In this election, it’s the candidate, and not private equity, who should be judged by the American public.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania’s Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

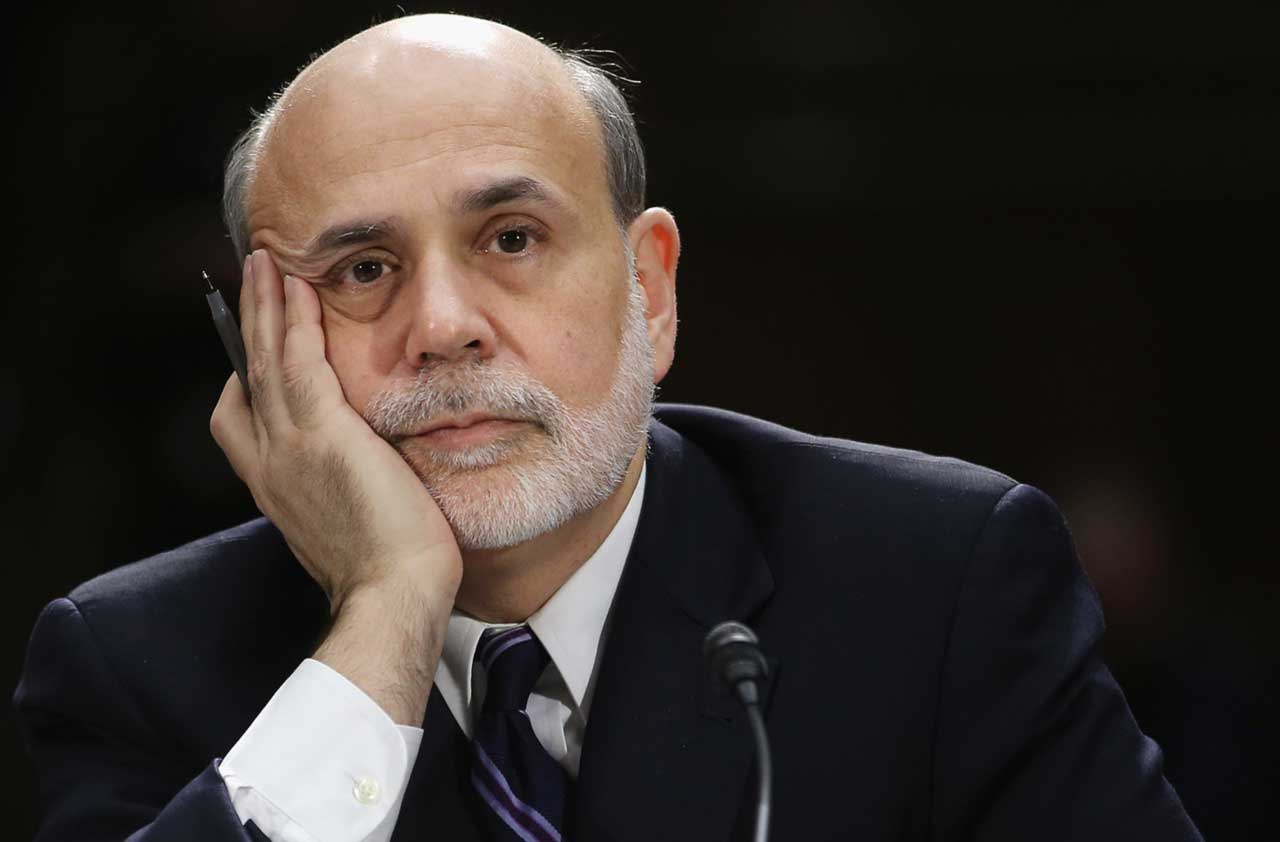

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.