What Keeps Me Awake Now

I still believe we will emerge from the slow growth in productivity. Nevertheless, it's crimping corporate profits.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In early 2011, I wrote a column titled “What Keeps Me Awake,” in which I outlined unfavorable events that could derail my bullish outlook for stocks. Now that the Dow Jones industrial average is more than 3,000 points higher, it’s time to revisit that question.

In 2011, fear of another debt crisis was a major concern for investors. The Lehman Brothers bankruptcy was still fresh in their minds, analyst Meredith Whitney was predicting a municipal bond collapse, and the European debt crisis was heating up. Just six months later, Standard & Poor’s downgraded the credit rating of the U.S., another move that shocked investors.

Fortunately, we have largely navigated through those troubled waters. With households and businesses paying down their debts, and prices for stocks and real estate on the rise, an imminent debt crisis is now unlikely. Despite Detroit’s bankruptcy, no other locality of that size has failed to pay its obligations.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The European debt situation has also improved substantially. And even though the ongoing European recession has been long and deep, there are some signs of recovery. Even the U.S. budget deficit has shown remarkable improvement, with the deficit for the fiscal year that ends September 30 projected to be $642 billion, down more than 50% from $1.3 trillion in fiscal 2011.

Nevertheless, there are real deficit problems down the road as retirement demands on Social Security and, especially, Medicare soar. But those problems will not affect today’s bull market.

Inflation trends. With the Federal Reserve and other central banks flooding the world with money, many people are concerned that inflation will threaten the U.S. economy. But the Federal Reserve can reduce its balance sheet and absorb the excess reserves it has created by requiring banks to hold higher reserves. I do think that inflation will trend a bit higher than the Fed’s official 2% target, but inflation in the range of 2% to 4% has not been bad for the stock market in the past.

One risk I did not note earlier was the country’s poor growth in productivity, which measures the output of the economy per hour worked and determines the standard of living. Productivity growth averaged only 0.6% in 2011 and 0.7% in 2012, with the first half of 2013 not much better. That’s considerably below the 2% average the economy has recorded since 1970.

The fall in U.S. educational achievement could be one cause, as well as the long periods of unemployment many Americans have experienced as a result of the recession. I still believe we will emerge from the slow growth in productivity. Nevertheless, it’s crimping corporate profits.

Two additional risks could strike the market at any time. I still worry about a terrorist attack, especially one involving nuclear material. A nuclear strike would be catastrophic not only because of the lives lost but also because of the costly security measures needed to prevent another one.

To terrorism I would add a new concern: a pandemic caused by a pathogen we cannot contain. We have had a number of fleeting epidemics in recent years, and even when the threat is not high, behavior can change radically. Yum Brands, which owns Kentucky Fried Chicken, says that fears of bird flu kept Chinese away from its restaurants in droves earlier this year, even though the disease could not be transmitted through cooked chicken.

I am hopeful that anti-terrorist surveillance as well as the creation of vaccines will mitigate these risks. They may temporarily deflect us from our upward path, but they will not change my forecast of increasing economic growth and higher stock prices.

Columnist Jeremy J. Siegel is a professor at the University of Pennsylvania’s Wharton School and the author of Stocks for the Long Run and The Future for Investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

A Preview of the Fed Under Trump

A Preview of the Fed Under TrumpEconomic Forecasts John Taylor, a former Treasury official in the Bush administration, is a top candidate to replace Fed chair Janet Yellen.

-

Investors, Don't Fear Higher Rates

Investors, Don't Fear Higher Ratesinvesting Although interest rates will rise modestly in coming months, that should not derail the bull market.

-

Why Investors Shouldn't Be Afraid of Inflation

Why Investors Shouldn't Be Afraid of InflationEconomic Forecasts An inflation rate of 2% to 3% is good for stocks because it gives companies the power to raise prices, which helps boost profits.

-

A Positive Outlook for U.S. Interest Rates

A Positive Outlook for U.S. Interest RatesEconomic Forecasts Instead of the threat of deflation from weak growth and falling prices, the U.S. is facing the opposite: accelerating inflation.

-

Can the Fed Save the Stock Market?

Can the Fed Save the Stock Market?Markets In retrospect, it was ill-timed for the Federal Reserve to start hiking short-term interest rates. But that can easily be fixed.

-

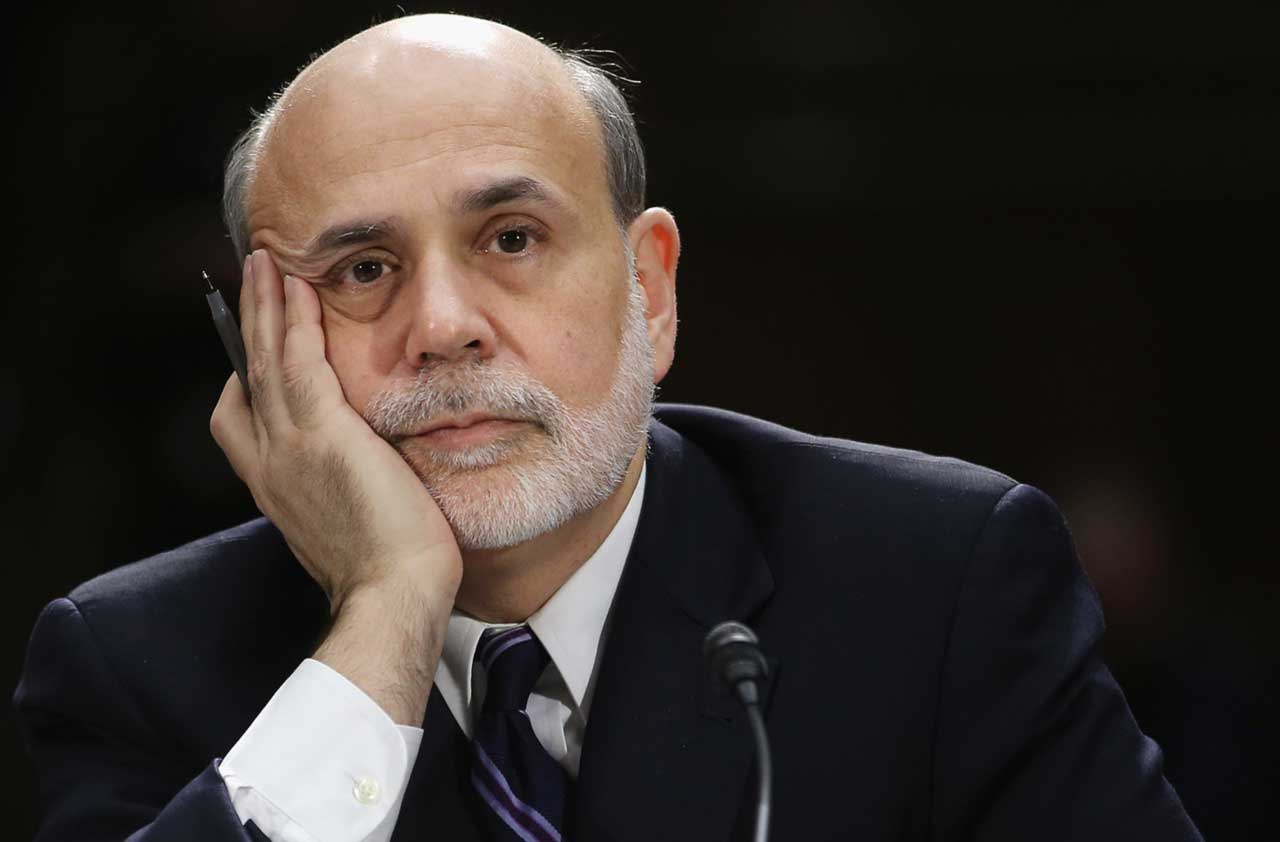

Bernanke's Ultimate Legacy

Bernanke's Ultimate Legacyinvesting The former Fed chairman's decisions in 2008 were an act of courage that averted an economic collapse far worse than we experienced.

-

Worries About China’s Economy Are Overblown

Worries About China’s Economy Are OverblownEconomic Forecasts Among the consequences of China's slowdown: lower commodity prices, which actually benefit the U.S.

-

Surviving the Greek Financial Crisis

Surviving the Greek Financial CrisisEconomic Forecasts Despite the recent friction, I believe the eurozone is stronger after putting down the Greek rebellion.