5 Ways to Slice the S&P 500

What started as a plain-vanilla fund concept now comes in many flavors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

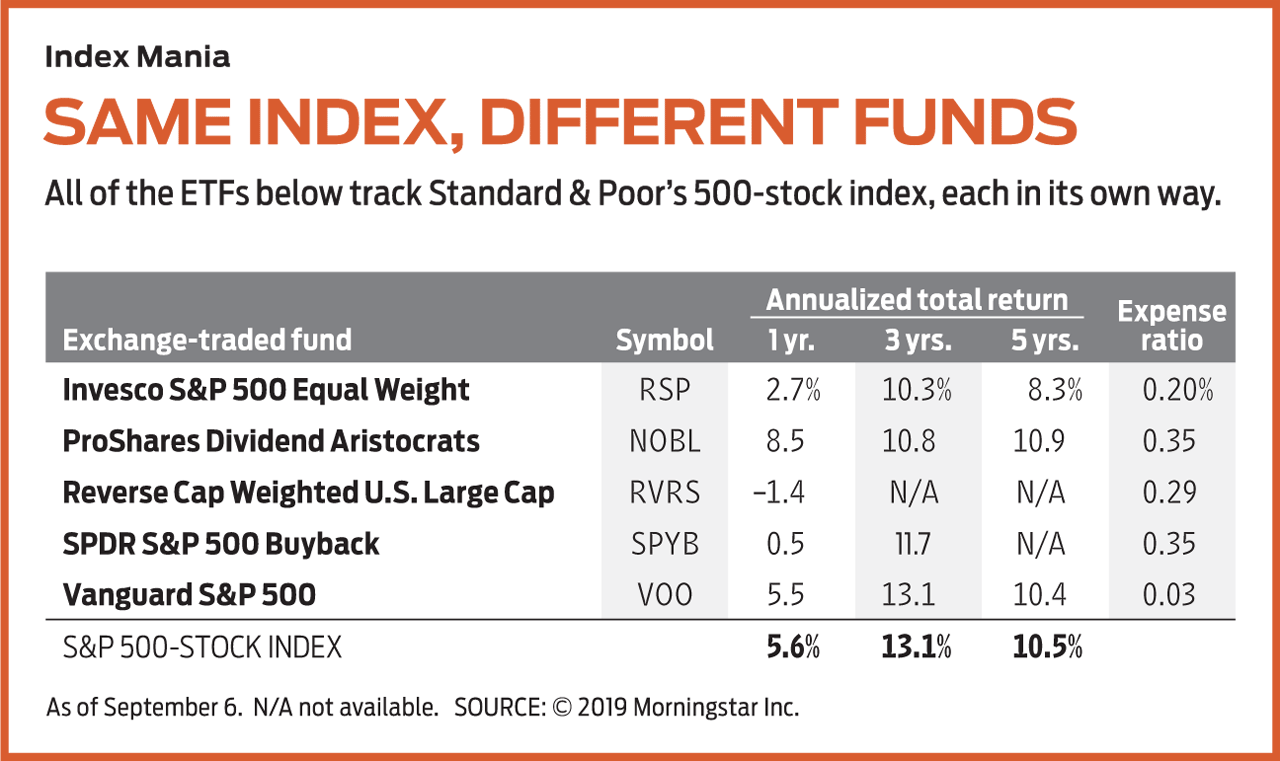

Not so long ago, S&P 500 index funds came in one flavor: They simply tracked Standard & Poor’s 500-stock index. Now, the fund industry offers almost as many types of S&P 500 index funds as Baskin Robbins does ice cream. You may be best off with the plain-vanilla version, but some other variations might be worth a taste test. Prices and returns are as of September 6.

Vanguard 500 Index (symbol VFIAX), the largest and oldest S&P 500 index fund, tracks the movement of the venerable stock index and weights each holding according to its market value, which is the number of shares outstanding multiplied by the share price. Using that methodology, the fund’s top holdings are Microsoft, Apple and Amazon.com. The 10 largest stocks in the fund account for 23% of the fund’s assets. The Vanguard fund simply weights its holdings the same way the index does. It follows the index’s returns closely, and for many people it’s a fine core holding. Exchange-traded-fund fans can consider the fund’s ETF clone (VOO, $274).

You can weight the S&P 500 index in different ways and get different returns as a result. Consider Invesco S&P 500 Equal Weight ETF (RSP, $108). As its name implies, this exchange-traded fund gives each stock in the index an equal weight, so that Nektar Therapeutics, with a market value of $3 billion, gets the same weight in the fund as $1.1 trillion Microsoft. The ETF is rebalanced every quarter.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What’s the advantage? Invesco S&P 500 Equal Weight ETF tends to beat the market-cap-weighted S&P 500 when small-company stocks are on a tear. In 2016, for example, the equal-weight ETF beat the S&P 500 by more than two percentage points. The past decade, however, has largely seen a large-company-stock rally, and the equal-weighted choice has lagged the S&P 500 by 0.16 percentage point annualized.

Investors who foresee a comeback for small- and mid-cap stocks can consider the Reverse Cap Weighted U.S. Large Cap ETF (RVRS, $16). The smallest stocks in the S&P 500 are the largest holdings in this fund, thereby turning the large-cap S&P 500 into a mid-cap index fund. The young fund, which has $9 million in assets, lagged the S&P 500 in 2018 and trails it so far this year. The fund has held up better against mid-cap yardsticks, losing 9.4% in 2018, compared with an 11.1% loss for the S&P MidCap 400, and essentially matching the mid-cap index’s return so far in 2019.

There are plenty of other ways to slice and dice the S&P 500. The ProShares Dividend Aristocrats ETF (NOBL, $71) uses only those S&P 500 companies that have raised their dividends every year for the past 25 years and weights each issue equally. The fund fares best in times when investors are worried about the stock market, because dividends can cushion downturns. The fund has lagged the S&P 500 by nearly two percentage points so far this year.

SPDR S&P 500 Buyback ETF (SPYB, $66) does for buybacks what the previous ETF does for dividends. It looks for companies that have actually reduced the number of shares available over the previous 12 months. All other things being equal, a lower number of shares should give a company’s stock a boost by dividing the corporate earnings pie among a smaller number of shares. The ETF has lagged the S&P 500 over the past year, but it has kept pace with an index tracking S&P 500 companies spending the most on buybacks in relation to their market value.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.