Do Not Expect the Stock Growth of Recent Years to Continue

What drove the incredible returns that stocks posted from the end of 2008 through September 2015? Nothing real.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one." ― Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds

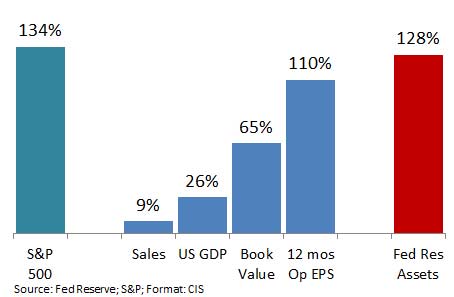

Since the end of 2008 through the third quarter of 2015, Standard & Poor's 500-stock index was up about 134%. Very impressive. Many will see this number and not inquire further. We see the number in the context of other numbers and wonder how in the world it did it. What drove the market up for six years? Was it earnings? Was it a great economy? Was it value?

Let's examine the economy, in terms of gross domestic product (GDP). According to the Federal Reserve, the GDP grew 26% since the beginning of 2009, an average of 3.36% annually. The stock market grew more than five times what the economy grew. Economic growth was hardly a catalyst for the market's performance.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Next let's look at earnings. We have heard great things about earnings for the past few years. The S&P 500's operating earnings grew 110% since 2008. However, that high jump is really just some balance sheet gymnastics; the starting point for that period of gains was when earnings were crushed due to the 2008 bear market. If you look at the index's performance from the previous market peak in June 2007 through September 2015, earnings are up only 13.85% total while the market is up 33.15%, almost 2.5 times the earnings growth. This gives a more realistic view of the long-term earnings growth. Earnings were up, but the market was up a lot more. Earnings weren't the catalyst.

Since earnings did grow, sales must have been up considerably, right? S&P data shows sales were up 9% total. Not annually, total—from the end of 2008 through the third quarter of 2015, there was only 9% sales growth. This meager sales figure gives further credence to the belief that much of the earnings over the past several years have been due to balance sheet and income statement manipulations rather than good old-fashioned business growth. Sales weren't the catalyst.

Was the market a great value in 2009? The cyclically adjusted price-earnings ratio, which is a measurement of value that was devised by Yale finance professor Robert Shiller as a way of normalizing earnings, hit a low of about 13.32. Also known as the Shiller P/E, its previous bottoms were in the single digits—for example, 6.64 in 1982, 5.57 in 1932 and 4.78 in 1921. Each bottom was less than half the 2009 low. So no, the 2009 low was no great bargain. And the Shiller P/E has doubled since 2009.

So what was the main catalyst of the market rally?

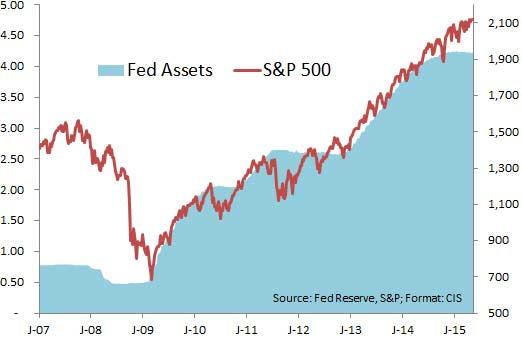

Our research shows that it was liquidity from the Fed. As the Fed pumped liquidity into the system, that liquidity found its way into stocks. The only number that comes close to having an impact on the value of stocks is the Fed's increasing its balance sheet by 128% since the beginning of 2009 (as shown in the chart below).

You can see just how much of an impact the Fed's buying binge had on the market. The chart below shows that when the Fed slowed its buying of assets, the market stalled, and when it started buying again, the market took off. Today the Fed has slowed its buying, and the market is going through some wild volatility.

(Some may retort, "But the markets made money for the past six years, so they did something right?!" To those people, I will point out that heroin dealers also make money, but it doesn't mean how they did it was right. The Fed has been acting more like a drug dealer for the past decade or more, and the markets have been its shady street corner. Investors are hooked on what the Fed is selling.)

What does this mean? Today's market is way out of whack with reality: sales growth, earnings growth and economic growth clearly do not track with the stock growth of recent years. Even with the latest correction, the market is still bloated. For it all to make sense, sales would need to catch up, showing that companies are focused on actually growing their businesses and creating better value, and the economy would need to suddenly accelerate. Otherwise, the market needs to become "real" again. This means stocks would have to fall back to where they belong, based on historical norms—to match the economic reality, that means the market could go 30% to 60% lower.

So what does an investor do? Realize that what we witnessed the past few years wasn't real, and do not expect it to continue. Carefully review your holdings and reduce risks. Eliminate the most overvalued holdings first. Don't forget to look at your mutual funds—they are made up of stocks and can be just as overvalued. Being in a mutual fund doesn't keep them from declining to normal levels.

Of course the Fed could step in and make an artificial market even more so. Could it come to the rescue again? Does it not see the damage they have already done to the markets? Does it not realize that pumping up its balance sheet only resulted in a meager increase in the economy and sales revenue, that its policy failed?

The Fed may very well be out of ammunition to prop up the economy and market. Those that are waiting for it to rescue the markets again could be sorely disappointed.

John Riley, registered Research Analyst and the Chief Investment Strategist at CIS, has been defending his clients from the surprises Wall Street misses since 1999.

Disclosure: Third party posts do not reflect the views of Cantella & Co Inc. or Cornerstone Investment Services, LLC. Any links to third party sites are believed to be reliable but have not been independently reviewed by Cantella & Co. Inc or Cornerstone Investment Services, LLC. Securities offered through Cantella & Co., Inc., Member FINRA/SIPC. Advisory Services offered through Cornerstone Investment Services, LLC's RIA. Please refer to my website for states in which I am registered.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

In 1999, John Riley established Cornerstone Investment Services to offer investors an alternative to Wall Street. He is unique among financial advisers for having passed the Series 86 and 87 exams to become a registered Research Analyst. Since breaking free of the crowd, John has been able to manage clients' money in a way that prepares them for the trends he sees in the markets and the surprises Wall Street misses.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.