How to Buy Your Stock Picks on Sale

Dollar-cost averaging with DRIPs ensures that you’ll buy shares even when prices are falling.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Doubtless, you've heard that you should "buy low and sell high." That's a great strategy, but how do you do it without a crystal ball?

Well, there is a way to very effectively do it although it's not widely known. That way involves using dividend reinvestment plans, also known as direct investment plans, or DRIPs.

DRIPs make it feasible for you to invest small amounts of money on a regular basis. (I say feasible because, by investing through no-fee DRIPs, your investments are not compromised by transaction costs. A small investor attempting to implement this strategy through a brokerage account is likely to spend more on fees than on shares.) Through a no-fee DRIP, it's efficient (from a transaction cost point-of-view) to make regular investments over a period of time instead of buying shares at one time for one fee.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

With that said, now you can consider the advantages of investing regularly to build up holdings as compared with investing a lump sum at one time.

For one thing, you reduce your risk of buying at exactly the wrong time. By investing the same amount regularly, you will be buying shares at lots of different price points. But the fact is, you will be doing even better than that—as I will explain in a minute.

Investing in this manner is called dollar-cost averaging. With this strategy, you don't need to be glued to the screen watching price movements. You can relax with the knowledge that you are following a simple, time-tested strategy to build substantial wealth.

Revered by billionaire investor, Warren Buffett, as well as a broad range of financial experts, dollar-cost averaging is one of the most successful long-term investing strategies.

No-fee DRIPs make this strategy accessible to even small investors. Otherwise, to follow a dollar-cost averaging strategy, you'd run into lots of problems. You wouldn't want to routinely pay a commission to buy small amounts of stock in the same company. And even if you did, you can't call your broker and say you want a $100 worth of stock (or, for that matter, $500, $1,000, or $10,000 worth of stock). That's because, with a broker, you designate shares to buy and with DRIPs, it's the other way around. You designate the dollars and get shares (or fractions of shares), depending on the share price. That's an important difference.

Why so important? It's important because otherwise it would be hard to invest the same amount routinely. When the stock price is high, you'd end up paying more for the same number of shares. When you invest dollar amounts, you buy fewer shares for the same amount of money.

Why is this strategy so appealing? It virtually forces you to buy low. Your regular investment amount results in more shares for you when prices are low and fewer shares when they are high. The result is that the cost of the shares you acquire will be even less than the average price during the investing period. That's because you automatically bought more shares when the price was relatively cheap and fewer when it was selling high.

What's more, dollar-cost averaging helps you withstand the impulse to buy or sell with the crowd—which is what most investors do—and which is why most investors lose money in the stock market.

Dollar-cost averaging boosts results

Take a look at the illustration below to see how investing at a variety of price points will actually cause you to buy more at low prices than you will at higher prices. But keep in mind that these advantages are reserved for those who invest through a no-fee DRIP. Of the nearly 1,300 companies that allow direct investing through the company-sponsored DRIP, about 700 offer a no-fee DRIP.

We do not recommend that you follow a dollar-cost averaging strategy if the company does not offer a DRIP or if you intend to invest small amounts and the DRIP charges fees. Otherwise, the fees you pay on your routine investments will end up enriching the company transfer agent (usually a big bank) or your stockbroker. That's not the use you want to make of the money that could be used to build holdings in your account.

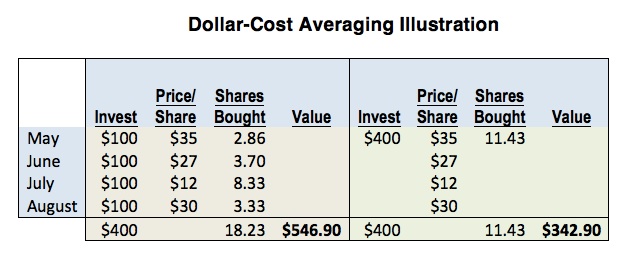

This illustration assumes you invest $100 each month, which will buy however many shares you are entitled to based on the market price of the stock. In our example, the share price fluctuates between $12 and $35.

That means that the average price per share for the four investments was $26. Your average cost will be less. That's because your four $100 investments bought more shares when the price was low. Your average cost per share turns out to be only $21.94.

If you were unlucky enough to buy all your shares at the wrong time (which is when they were selling for $35) your average cost would be $35 of course. Assuming a value of $30 per share, the difference is remarkable—as you can see above.

With this strategy you are guaranteed to buy more shares when the price is low and fewer shares when it is selling at the high prices. Isn't that exactly what you want to do?

It's like getting your shares on sale… and it's easy to take advantage of dollar-cost averaging with any DRIP.

For your convenience, here's a complete list of no-fee direct investing plans (DRIPs) that do not charge fees for investing, or reinvesting dividends.

Ms. Vita Nelson is one of the earliest proponents of dividend reinvestment plans (DRIPs) and a knowledgeable authority on the operations of these plans. She provides financial information centered around DRIP investing at www.drp.com and www.directinvesting.com. She is the Editor and Publisher of Moneypaper's Guide to Direct Investment Plans, Chairman of the Board of Temper of the Times Investor Service, Inc. (a DRIP enrollment service) and co-manager of the MP 63 Fund (DRIPX).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.