This 5-Stock Portfolio Makes the Perfect Summer Gift

Giving stocks offers the potential for greater wealth over the long term and an invaluable lesson in investing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Summer is often the season for important milestones in many younger people's lives. To commemorate these events, such as graduations and weddings, too often we fall back on giving money, and your gift is distinguished from the next only by the dollar amount.

Instead, you might consider giving a gift of a five-stock portfolio held in dividend reinvestment plans (DRIPs). Your total cost to set up such a portfolio, depending on the price of the stock that you select, is somewhere around $500. In addition to the financial benefit, which is likely to compound to substantial wealth over the long-term (which I will demonstrate below), this gift will give the recipient a first-hand experience with a logical approach to investing.

By "saving" in the stock of the companies in a portfolio of DRIPs, your young investor has the opportunity to build wealth by participating in the growth of the economy in the easiest and most efficient manner possible. How much wealth? It could be millions of dollars!

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

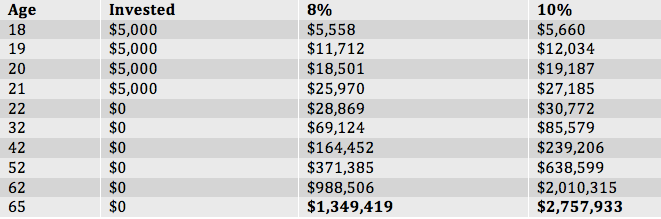

Let's assume that the graduate or the young couple (or you on their behalf) invests $5,000 a year for the next four years—spread evenly among the five-stock portfolio made up of high-quality, dividend-paying companies. Let's also say that no further investments are ever going to be made into those accounts. The results can be astounding.

What would your $20,000 turn into by retirement? The answer is more than $1 million, assuming an 8% average annual return over the 47 years until your high-school graduate reaches 65 years of age.

Is an 8% average annual rate of return realistic? Let's look at what occurred during the past 47 years. Even though the Dow Jones industrial average made no net progress between 1966 and 1982, it has grown 18 times over since then to the present level of around 18,000. So what can you expect from a portfolio of high-quality, dividend-paying stock over a 47-year period, especially if they are carefully selected and tend to increase their dividend payouts on a regular basis?

Might you obtain a higher rate of return, say, 10%? That's the long-term rate of return of the market in general as calculated since 1926 based on Ibbotson Research. Our portfolio may well provide above average returns compared with the market as a whole, but let's accept a 10% average annual rate of return. In that case, your $20,000 investment would provide more than $2.5 million.

Here's how the calculations look:

The reason for such a great benefit is that nothing is lost to investment fees. Once an investor is enrolled in a DRIP, subsequent investments can be made without going through a broker and without fees—and dividends can be automatically used to purchase more shares (and fractions of shares). That way, every penny is used to create a growing stake in the underlying company. What's more, the likelihood of the investment staying put over the long term is maximized when the assets are held in DRIP accounts. The "staying put" part of this equation is key.

The following are five companies we would include in a long-term portfolio. To qualify for inclusion, the company must have a long history of dividend increases. We kept total return in mind, looking for companies with excellent earning and dividend growth rates as well as sustainable business models. We limited our selections to companies that do not charge fees for investing through the plan, and we sought to diversify the companies in terms of industry.

Finally, we decided to limit the selection to five companies that are household names—stocks the gift recipients are likely to be familiar with and can relate to.

AFLAC (symbol AFL) is a leading insurer that's maintained after-tax operating margins of more than 10% since 2007. An extremely investor-friendly company, AFLAC has paid increasing dividends for 34 consecutive years, raising their dividend by 5.1% in 2015.

Johnson & Johnson (JNJ) has a market capitalization of about $280 billion, and its business is split between drugs, medical devices and products on one hand and consumer goods such as Band-Aids, Baby Shampoo and topical medicines on the other. The dividend has been increased for 53 consecutive years.

International Paper (IP) is the dominant company in the area of paper and packaging, both in the U.S. and abroad, with almost $23 billion in annual sales and a market capitalization of about $16.5 billion. With a yield of about 4%, it has raised its dividend for six straight years (and its latest increase was 10%).

General Mills (GIS) is a major food processor with products such as Yoplait and Pillsbury. The dividend has been increased for 12 straight years and has never been cut in the 114 years that the company has been paying them.

ExxonMobil (XOM) is the largest oil company that resulted in the breakup of the old Standard Oil conglomerate (at $333 billion market cap) and routinely logs the largest annual profits of any American company. Its dividend has been increased for 33 straight years.

Vita Nelson provides financial information centered around DRIP investing at www.drp.com and www.directinvesting.com. She is the editor and publisher of Moneypaper's Guide to Direct Investment Plans, Chairman of the Board of Temper of the Times Investor Service, Inc. (a DRIP enrollment service), and co-manager of the MP 63 Fund (DRIPX).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.